Gold markets have been relatively quiet during the trading session as we await the FOMC results, and perhaps more importantly, the press conference that Jerome Powell will be giving afterwards. In other words, the gold markets will probably be relatively quiet between now and roughly 2:30 PM in New York, so I anticipate that we should be sideways between now and those comments.

The question and answer portion of the press conference will probably be the most important, and if Chairman Powell suggests that they are going to be even more extraordinarily loose with monetary policy, that should be like rocket fuel for the gold market. I would expect that gold should continue to go higher because, longer term, we have loose monetary policy coming out of both the United States and the European Union, two of the biggest drivers of the gold market. Beyond that, there are multiple other central banks getting involved as well, so I think it all kind of ties into higher prices currently.

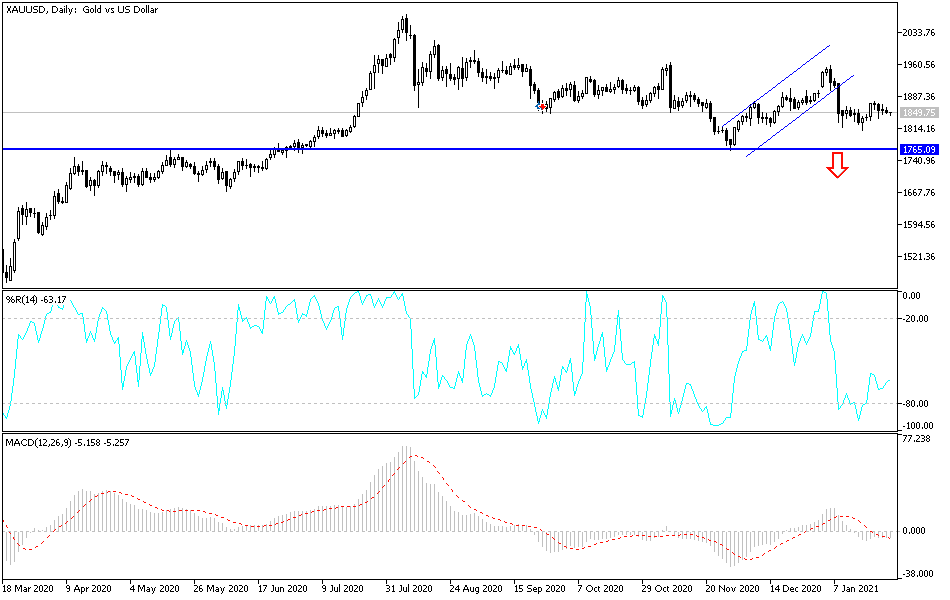

To the downside, I see the 200-day EMA at the $1822 level offered support, just as I see the $1800 level and then the $1750 level. In other words, I see plenty of areas underneath that will attract value hunters. On the upside, the 50-day EMA at the $1870 level should cause a significant amount of resistance, but if we can break above there then we will go looking towards the $1900 level, possibly even the $1960 level after that. Longer term, not only do I think we will get to the $1960 level, but I also think that we will go back to the $2100 level. Gold is going to continue to be strong over the longer term, though we do have some uncertainty in the near term that could cause quite a bit of choppy volatility. Nonetheless, it should be noted that the 200-day EMA has held so far, which is a relatively strong sign for an uptrend. If for some reason we did break down below the $1750 level, I would have to reassess the entire situation; but as things stand right now, I have no interest in shorting anytime soon. If you are patient and reasonable with your position size, buyers should eventually make out fairly well.