The GBP/USD pair has been making steady, upward movements despite the US dollar’s attempts to recoup its recent losses. The currency pair closed last week’s transactions by stabilizing around the 1.3682 level, and its gains during the week reached the 1.3746 resistance level, the highest for the pair since May of 2018. The sell-off in the British pound accelerated ahead of last weekend after the release of data showing that the British economy suffered from a larger than expected decline in January. A survey of companies in the UK showed that the impact of the third major nationwide lockdown was more severe than markets and economists had anticipated, as the all-important UK service sector suffered a particularly large recession.

The IHS Markit Services PMI survey came in at 38.8, versus an expected reading of 45.0. The drop to 38.8 comes after the December reading of 49.4, confirming the severity of the measures introduced on January 3rd. According to the index data, a reading below the 50 level indicates a decline. Accordingly, IHS Markit says: "The services economy was hit hard by restrictions on trade and lower consumer spending at the start of the year, with business activity declining at the fastest pace for an eight-month period."

However, the Manufacturing PMI was less affected, providing in December a reading of 52.9, versus the previous month with a reading of 57.5 and the expected reading of 54.0. But the services sector accounts for more than 80% of economic activity in the UK, and to get a clearer picture of how the broader economy is performing, IHS Markit has a Composite PMI - bringing manufacturing and services together - that weighs the two surveys accordingly. This reading was at 40.6 versus 50.4 in December, which was significantly lower than expectations for a reading of 45.5.

Despite the recession, expectations for a rebound in business activity are high. IHS Markit asks about the future prospects of companies when taking a PMI survey, and there is some positive news. According to the IHS Markit statement, “Despite a rapid return to downturn in business activity at the start of the year, the latest data indicated that UK private sector firms remain optimistic about their long-term prospects. The index, which measures business expectations for the next 12 months, has increased slightly since December and was the highest since May 2014."

The survey respondents attributed their positive commercial expectations to the successful launch of the vaccine in 2021. The launch of the vaccine in the United Kingdom is according to plan, with the goal of having the most vulnerable vaccinated by February.

However, British Prime Minister Boris Johnson said last week that restrictions may not be lifted until early summer, hinting at a possible government policy to eliminate the virus completely before opening up.

If this is the case, then companies' forward-looking expectations may be disappointed and the negative impact of the shutdowns could have a more permanent and lasting effect on the economy as many firms will not survive. Conversely, the government's failure to support small businesses that are not eligible for any grants or government support other than loans is something that business representative bodies raise as a particularly acute problem.

Overall, the pound turned lower ahead of the weekend amid a broader decline in global investor sentiment, which saw sell-offs in global stock markets over the weekend. The developments confirm the pound's new link with global market sentiment and trends now that the Brexit negotiations are in the past. It appears that the UK “beta” of the markets has rallied over the past two weeks, as it rose along with the equity market rally, but falls when it dips.

Parallel to this relationship, the pound is sympathetic to the decline in European stock markets, which includes a 1.0% drop for the German DAX Index and a 0.75% decline for the British FTSE 100 Index. According to analysts, the decline in the equity markets is not being driven by any major developments, which leads to assumptions that a technical correction is in progress and that the broader trend to the upside remains.

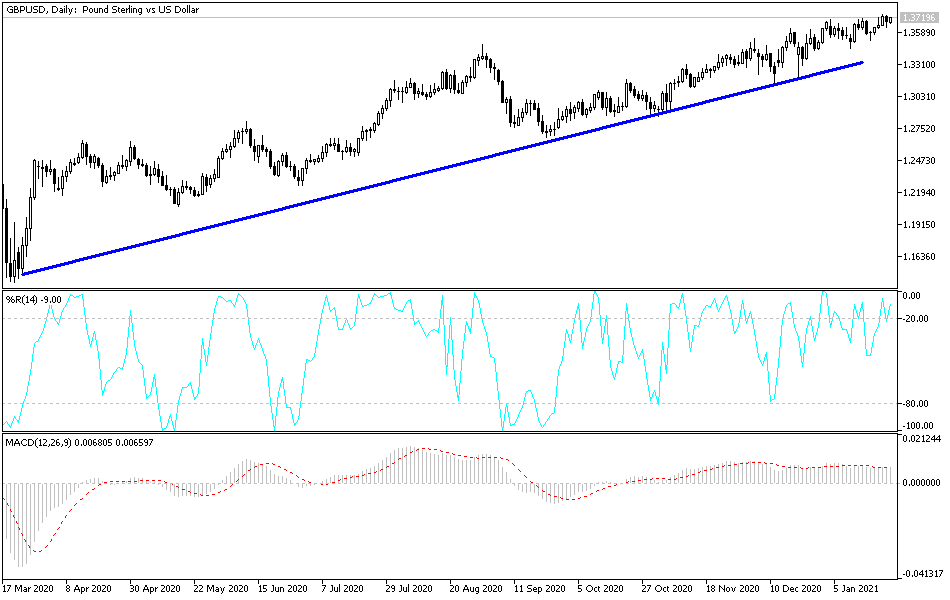

Technical analysis of the pair:

The bullish trend of the GBP/USD still holds. At the same time, according to the performance on the daily chart, stability above the resistance 1.3700 pushes the technical indicators to strong overbought areas and would therefore usher in profit-taking, especially if the risk appetite of investors weakens. I see opportunities to sell from the resistance levels at 1.3735, 1.3820 and 1.3900. On the downside, the bears will gain control over the performance in case the currency pair moves below the support level of 1.3430.

The currency pair does not expect any important economic data, whether from Britain or the United States of America.