Investors have regained an appetite for safe havens amid prolonged European lockdowns, especially in Britain. The British pound weakened against the US dollar, as it plunged to the 1.3520 support level at the beginning of this week’s trading before settling around 1.3586 at the beginning of Tuesday's session. By the end of last week’s trading, the GBP/USD had witnessed its worst decline in months, as it retreated from the 1.3697 resistance level to the support level at 1.3572, as risk aversion led to the strengthening of the dollar against many major competing currencies. However, we may see a faster pace of COVID-19 vaccinations over the coming days, which would improve the economic outlook and return the British pound to test the 1.37 resistance. The pressure on the pound increased after the UK's decision to close international borders in response to the spread of new strains of the emerging coronavirus.

Despite its resilience so far, the British pound could be vulnerable to further weakness this week if the fourth quarter GDP figures from China are positive. Commenting on the future performance of the GBP/USD, Chris Turner, Head of Global Markets and Regional Director of Research at ING says, “We believe that the dollar's bearish trend needs some strengthening.” His colleagues say that the GBP/USD pair should find support at 1.3420 in the coming days, and it may be a base for a launch again, to reach the resistance level at 1.38 later this week.

Analysts at Goldman Sachs expect the price of the GBP/USD to reach 1.42 by the end of March and 1.45 by the end of the year. At the moment, they cling to optimistic forecasts of global growth and still anticipate a broad weakening of the dollar in 2021; they recommend buying the Canadian dollar and the Australian dollar against the US dollar.

This week, investor and market focus is likely to rapidly shift to US bond yields and the inauguration of US President-elect Joe Biden on Wednesday, whose anticipated speech may contain clues about when the administration expects to make vaccines more widely available and how this might happen, as well as the extent of support for the US economy. By the end of last week’s trading, global markets fell widely as investors were concerned about whether the proposed US $1.9 trillion aid package would pass through Congress, which offset the impact of Fed Chairman Jerome Powell’s recent speech.

The Telegraph reported last weekend that all people over the age of 18 would have the opportunity to be vaccinated by the end of June, more than a week after British Prime Minister Boris Johnson announced that 15 million people would be vaccinated by February 15. Three million people have already tested positive for the virus, and the government will make sure that more than a quarter of the population has been vaccinated or diagnosed before March.

Yesterday, the head of the World Health Organization criticized the profits of pharmaceutical companies and the inequality in the distribution of vaccines, saying that it is “not correct” that younger and healthier adults in rich countries are vaccinated against the coronavirus before the elderly or healthcare workers in poor countries. Director-General Tedros Adhanom Ghebreyesus kicked off the week-long WHO executive board meeting by claiming that a poor country had received only 25 vaccine doses while more than 39 million doses were given in about 50 of the richest countries.

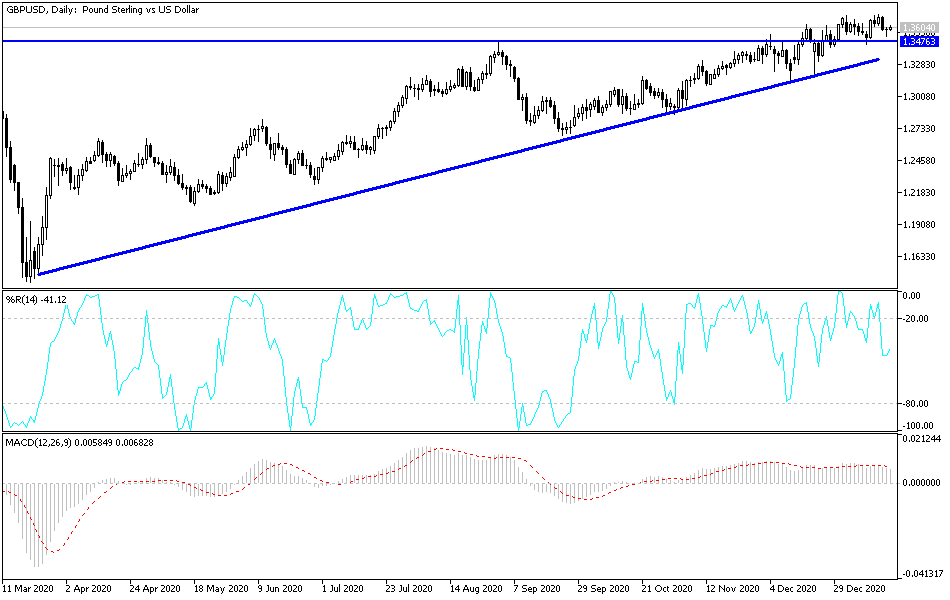

Technical analysis of the pair:

Despite the recent performance, the GBP/USD is still in the range of its ascending channel, and there will be no real bearish reversal of the trend without the currency pair breaking the support levels of 1.3440 and 1.3300. On the upside, the breaking through the resistance level of 1.3700 may give bulls the momentum to move to the psychological resistance 1.4000. The currency pair will interact with Britain's plans to contain the new strains of the coronavirus and global efforts to stimulate the global economy in the face of the effects of the pandemic and clarity regarding the new US administration's policies.

Today's economic calendar:

The currency pair is not waiting for any significant US or British economic releases today.