A new wave of restrictions implemented in the UK to combat COVID-19 prompted the GBP/USD pair to give up more of its gains in early trading this week. The pair retreated from the 1.3703 resistance level, its highest in 31 months, to the support level at 1.3541, before settling around the 1.3560 level at the beginning of Tuesday's trading. Prior to that, the value of the pound strengthened in response to a post-Brexit trade deal, while the US dollar declined further. Accordingly, Reuters Market Analyst Andrew Spencer says: “It appears that the broader bearish trend for the US dollar will extend at the beginning as flexible risk sentiment reduces the dollar's appeal as a safe haven, providing strong fundamental support for the GBP/USD pair.”

Global stock markets opened 2021 trading with a positive performance, as investors begin to look toward a time when vaccines herald a return to normal life. The dollar has come under particular pressure against Asian currencies, as Asian economies outperformed their Western counterparts in containing COVID-19. Commenting on the performance, Lee Hardman, Forex Analyst at MUFG says, “The weakening of the US dollar continued at the start of the new year with more pronounced weakness against Asian currencies. The Indonesian rupiah and Chinese renminbi were the highest performers. The weak trend of the US dollar against Asian currencies has been harsh since then, and in the middle of last year there are few signs that this is expected to reverse anytime soon. Asian currencies continue to partially benefit from the relative cyclical performance of Asian economies during the COVID crisis. The spread of COVID is still more contained within Asia, which allows local economies to grow more without restrictions and fears of the impact on activity compared to Europe and America.”

The British pound appreciated by 3.0% against the US dollar in 2020. However, this pales in comparison to most of the other major currencies that have posted larger gains, indicating a possible depreciation of the pound. Accordingly, Elias Haddad, a senior currency strategist at CBA, said: “The GBP/USD pair could trade near the 1.4000 psychological peak during the next few months after the Trade and Cooperation Agreement between the European Union and the United Kingdom...The GBP/USD is undervalued. Real differences in real interest rates.”

Politics will return to the fore in relation to the US dollar this week as two re-elections for the Senate are taking place in Georgia, and the outcome will determine which party wins control of the Senate. "If the Democrats win in both rounds, the resulting 50/50 split in the Senate will allow Vice President-elect Kamala Harris to cast the tie-break vote, handing over the Democrats' control," says Michael Brown, Chief Market Analyst at CaxtonFX. "Basically, this will be a postponed version, so the scenario for the "blue wave" elections will bear fruit."

The general rule in the markets was that a "blue wave" would be positive for stocks and commodities and negative for the US dollar as the increase in stimulus measures is positive for short-term economic growth.

British Prime Minister Boris Johnson announced a new national lockdown for England until at least mid-February to combat a new rapidly spreading strain of coronavirus, even as Britain intensifies the vaccination program by becoming the first country to start using the vaccine frrom the University of Oxford and the pharmaceutical company AstraZeneca. Accordingly, Johnson said that people should stay home again, as they were ordered to do so in the first wave of the epidemic in March, because the new virus variant is spreading in a "frustrating and disturbing" way. "As I speak to you tonight, our hospitals are under more pressure from COVID than at any time since the start of the epidemic," he said.

Under the new lockdown rules, which took effect immediately, primary and secondary schools and colleges will be closed for face-to-face learning except for children of key workers and vulnerable students. University students will not return until mid-February at least. Accordingly, all non-essential stores and personal care services such as hairdressers will be closed, and restaurants can only operate take-out services.

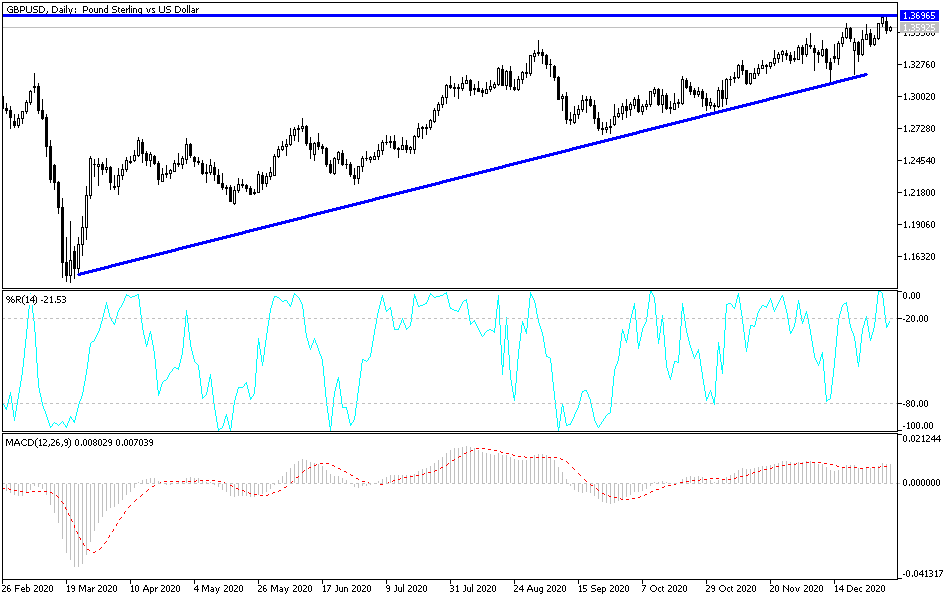

Technical analysis of the pair:

According to the performance on the daily chart, the GBP/USD remains within its ascending channel, and there will be no first stage for a downward correction without the bears moving to the support levels of 1.3488 and 1.3270, respectively. The markets are preparing for the USD becoming strong as a safe-haven currency due to COVID-19 fears. Whenever there are global restrictions on economic activity, the strength of the US dollar will increase. On the upside, strong bullish breakouts may occur in case the currency pair moves above the resistance 1.3755.