The recent recovery of the US dollar did not prevent the GBP/USD currency pair from maintaining its gains steady around the 1.3745 resistance level, after it retreated to the 1.3609 support amid a natural correction. In general, the pound enjoys the momentum of optimism from Britain's progress in its vaccination campaign. Bulls are eyeing the 1.4000 psychological resistance.

Recently, the better-than-expected jobs report for the month of November put the British pound on solid foundations, enabling it to rise alongside some equity markets and other risk assets, although the global market picture was mixed. According to official data, the UK unemployment rate reached 5% in November, up from 4.9% in October but less than expectations of 5.1%.

Also, the pound's performance may be supported by strong demand for a 30-year UK government bond supply after the Office of Debt Management sold £1.7 billion worth of notes maturing in 2050 and paid a coupon of 0.84%, nearly the middle of the 30-year yield range since March 2020. The DMO also sold £2.9 billion worth of bonds due in 2035, paying out a coupon of 0.64%, which was covered 2.6 times. Bonds like this and lesser maturities have often seen strong demand since the coronavirus first began shutting down economies last year, and global central banks have slashed benchmark interest rates to or near zero levels.

All in all, interest in UK government debt has increased since the start of the crisis and may go a long way toward assuaging UK Treasury concerns about declining demand and rising borrowing costs - partly due to potential investor concerns about the UK’s large deficit. Accordingly, Jordan Rochester, a strategist at Nomura, said: “In our view, as long as the Bank of England (BoE) avoids lowering interest rates (as we expect) and continues its QE purchases, it is unlikely that the UK double deficit problem will affect the outlook.” The GBP/USD sales increased but did not approach the selling pressure seen in the past, during Brexit uncertainty. So despite the recent performance of the GBP/USD, it is likely to hold back further gains.

Chancellor of the Exchequer Rishi Sunak has reportedly been manipulating tax hikes due to what has been described as concern about the cost of the coronavirus, although strong demand for new bond issues has a downward impact on yields, reflecting financing costs in nearly real time. Government borrowing rose to 34.1 billion pounds in December, the third highest monthly figure ever, which brought total borrowing for the first nine months of this fiscal year to 270.8 billion pounds. Meanwhile, total net debt rose to 2.13 trillion pounds by the end of the year, equivalent to 100.5% of GDP in the pre-pandemic period. The increases reflect the cost of vacation and income support programs for the self-employed, among other things, although these costs are expected to decrease in the coming months as the UK vaccination launch paves the way for a return to normal life.

In general, the UK is benefiting from a domestic vaccine (Oxford/AstraZeneca) and prior approval of a Pfizer vaccine that is likely to secure supplies in contrast to the hurdles that global economies face in obtaining adequate quantities of vaccines. 10% of the UK population has already received its first dose of the vaccine, and Nomura expects that the GBP/USD pair will reach a peak of 1.4200 by the end of next March.

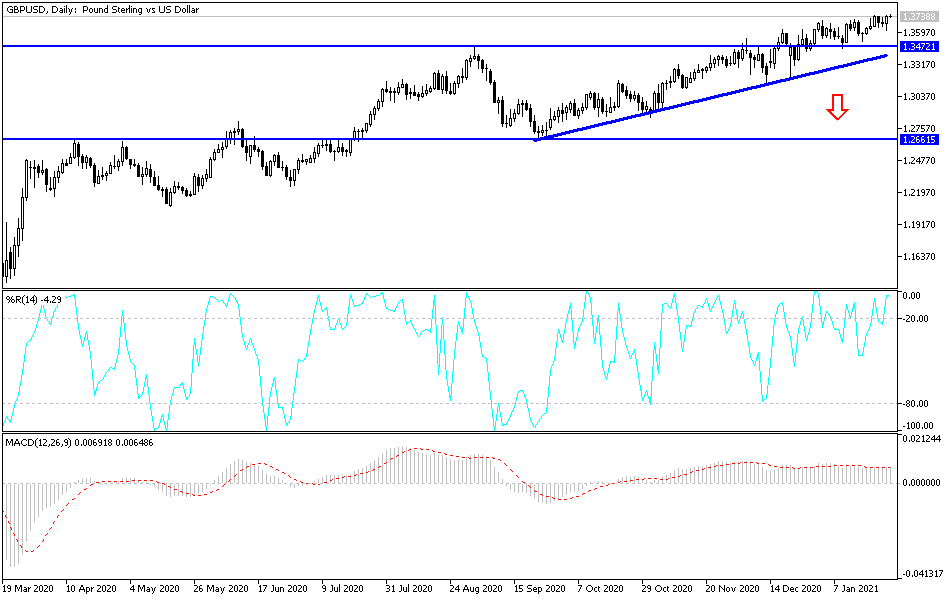

Technical analysis of the pair:

The GBP/USD is still showing a strong bullish performance, and stability above the 1.3700 resistance will push technical indicators to strong overbought areas. Continuing to ignore this will enable a higher move to the psychological resistance level at 1.4000. There will not be a trend reversal without first breaching the 1.3430 support.

The pair will be affected by progress in vaccinations, investor sentiment, as well as the US Federal Reserve’s announcement and Governor Jerome Powell’s statements today.