After six bearish trading sessions, the GBP/USD pair corrected to the upside from the 1.3450 support level to the 1.3670 resistance level at the beginning of Wednesday's trading. The pound's gains came despite comments by Bank of England Governor Andrew Bailey that the third national lockdown to contain the spread of the coronavirus will delay Britain's economic recovery. In an online speech to the Scottish Chambers of Commerce, Bailey stated that the second wave "will likely delay the path" of the recovery.

He also indicated that although the unemployment rate is officially at 4.9%, the rate is likely to actually be around 6.5%. Regarding negative interest rates, he reportedly said that there is absolutely nothing stopping that, but that there are serious concerns in implementing them.

Deputy Governor of the Bank of England Ben Broadbent, said that the coronavirus pandemic has less than expected pressure on inflation. "The consequences of medium-term cost pressures - and thus on monetary policy - may be limited," he stated. "But this difference in demand may help explain why, at least in terms of its impact, it is reducing the epidemic to inflation by a little less than we and others expected when it started."

The monetary policy official concluded that the bank’s Monetary Policy Committee would need conclusive evidence of a significant contraction in excess capacity, and a sustainable return to inflation to the 2% target, before considering pulling any of that stimulus. Moreover, he said, it is likely that the GDP has declined in the last quarter of 2020 and that this will happen again in the first quarter of 2021. This will undoubtedly spark headlines about the "double recession".

Broadbent noted that the unemployment rate is the best single measure of economic stagnation. Unemployment is expected to rise once the holiday schemes cease.

The Bank of England interest rate has been at 0.10% since March 2020, although pricing in the overnight index swap (OIS) this year indicates that investors are expecting to reduce borrowing costs to at least zero before the summer. Market expectations for BoE policy are among the "doves" of the G10 world.

Technical analysis of the pair:

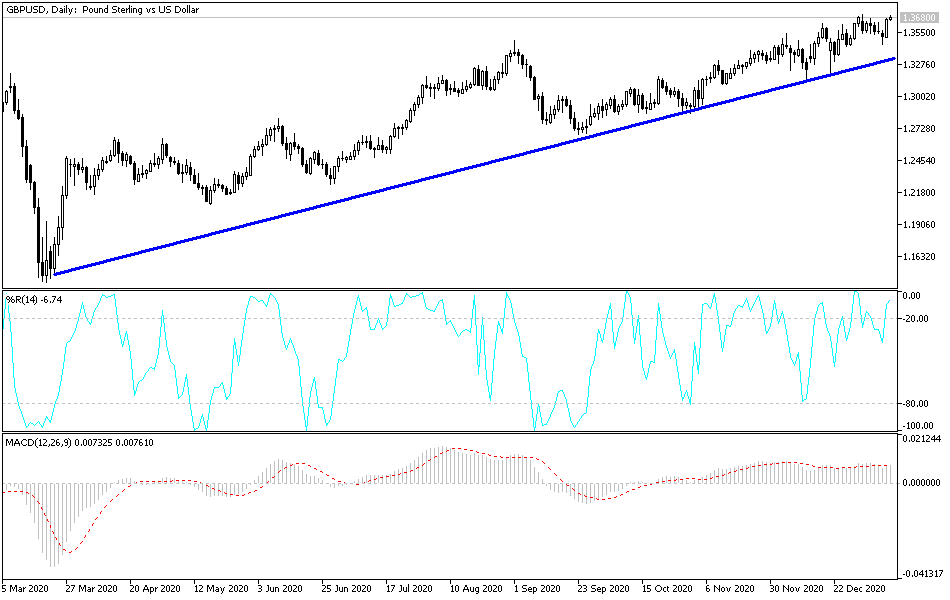

According to the performance on the daily chart, the GBP/USD pair is still in the range of its bearish channel, and the recent sell-offs did not succeed in breaking that trend. To continue the trend, the pair will need to move towards the support levels of 1.3430 and 1.3300. To the upside, stability above the 1.3600 resistance continues to confirm that the currency pair is ready to test higher peaks. The recent gains moved the technical indicators into overbought areas. Therefore, with concerns about British lockdowns, the pound will witness selling at any time.

Today's economic calendar:

There are no important British economic releases. From the United States, there will be statements by monetary policy officials at the Federal Reserve, in addition to the announcement of US inflation figures.