Despite the recovery of the USD, the GBP/USD pair stabilized around the 1.3650 level during Thursday's session, after the previous session's gains from the 1.3718 resistance level. The pound benefited a lot from Bank of England Governor Bailey’s comments, in which he confirmed not to make a decision on negative interest rates. He said the Bank of England had not discussed whether or not to introduce negative interest rates. But he said the BoE should have the negative rates option as a tool. The challenge remains to hit target inflation.

Data from the UK's Office for National Statistics showed that consumer price inflation in the UK doubled in December due to rising transportation and entertainment costs. Inflation accelerated to 0.6% from 0.3% in November. The rate was higher than economists' expectations of 0.5%. On a monthly basis, consumer prices rose 0.3%, reversing a 0.1% decline in November and faster than the expected 0.2%. Excluding energy, food, alcohol and tobacco, core inflation rose to 1.4% from 1.1% in November. The core inflation rate was 1.3%.

At a monetary policy meeting in December, policymakers told the Bank of England that inflation would rise sharply toward target in the spring, as the value-added tax cut and significant lower energy prices declined earlier in 2020 than the annual comparison. Commenting on the results, Thomas Pugh, an economist at Capital Economics, said that UK inflation is likely to rise to nearly 2.5% in late 2021. However, the recession will prevent inflation from spending too much time above its 2% target in 2022.

Another report from the Office for National Statistics showed that output prices fell for the tenth consecutive month in December. However, the pace of decline was the slowest since March 2020. Output prices fell 0.4% year-on-year, after a 0.6% decline a month ago. On a monthly basis, output price inflation was stable at 0.3%. Economists had expected output prices to drop 0.6% year-on-year, but would rise 0.2% on a monthly basis in December. Meanwhile, input price inflation has turned positive for the first time since August 2019. Input prices rose 0.2% from a year ago, reversing a 0.3% decline in November. But the rate was below economists' expectations of +1%.

On a monthly basis, input prices rose 0.8%, faster than the 0.4% increase in November and the 0.7% expected.

For the second day in a row, Britain recorded another record increase in coronavirus-related deaths. The British government said that 1,820 people died in 28 days after testing for the coronavirus. This brings the total confirmed number to 93,290, the highest in Europe and the fifth highest in the world.

The lockdown restrictions across the UK have helped reduce the number of people infected with the virus, although the UK still records high levels of infections compared to other countries in Europe, such as France or Germany. On Wednesday, the United Kingdom recorded another 38,905 new cases. This was higher than 33,355 a day earlier. However, it is below the seven-day average of close to 60,000 earlier this month.

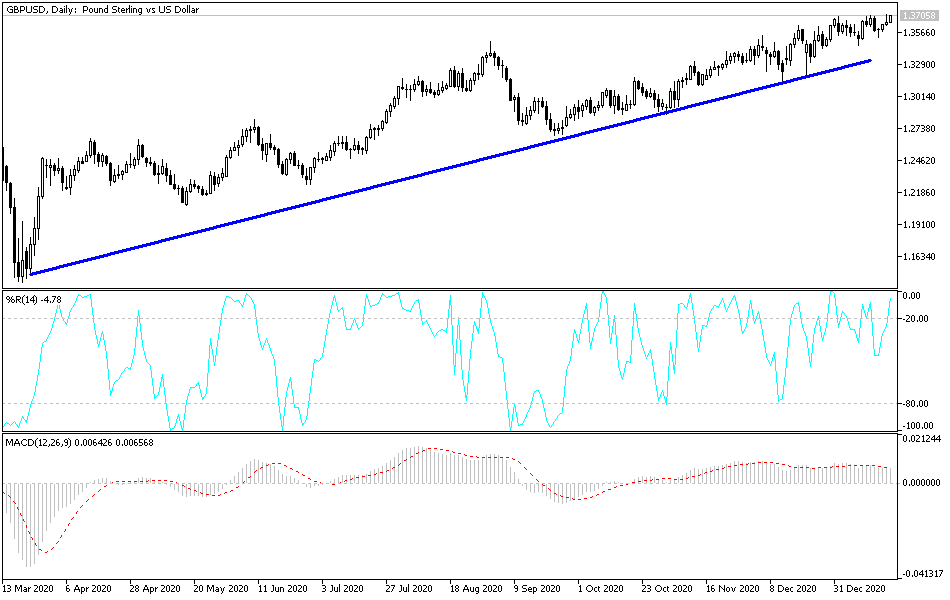

Technical analysis of the pair:

The GBP/USD pair is still bullish, and breaching the 1.3700 resistance level again may prevent the movement of technical indicators to overbought areas. The market is preparing to move towards the next psychological resistance at 1.4000, due to factors that may cause further gains. Britain is in a good position to vaccinate against COVID-19, economic data are yielding good results, negative interest imposition has been ruled out, and the pace of investor appetite for better risk and long-term buying deals for the pound is increasing. On the downside, there will be no reversal of the trend without breaching the support at 1.3430, according to the performance on the daily chart.

Today's economic calendar:

Focus will be on the results of US economic data, as the number of weekly unemployment claims will be announced, and there may be a strong reaction if it is more than one million claims. This is in addition to the Philadelphia Industrial Index reading, building permits and of US housing numbers.