After being sold off for four trading sessions in a row, the GBP/USD pair reached the support level of 1.3532 after its recent gains had pushed it towards the resistance level at 1.3703. Last week's trading closed flat around 1.3560. The losses of the currency pair were due to recovery of the US dollar and lockdowns in Britain. Before the start of trading this week, British officials said that thousands of people aged 80 years or over had begun receiving invitations to obtain a coronavirus vaccine in England. Britain is stepping up its national vaccination program in an attempt to achieve its goal of vaccinating about 15 million people by mid-February.

More than 600,000 invitations are due to arrive at doorsteps across England this week, asking the elderly to visit the new mass vaccination centers near them. The government has given the first dose of the vaccine to more than 1.2 million people so far. The seven new, large-scale vaccination centers join about 1,000 other sites across the country, including hospitals, general practitioners' clinics, and some pharmacies.

Officials hope that the launch of a rapid mass vaccination will help get Britain out of the third national lockdown, which was ordered this month to curb the alarming rise in infections and deaths caused by the coronavirus. Britain has seen 81,000 deaths in the epidemic, according to a tally from Johns Hopkins University. The UK is the epicenter of the COVID-19 outbreak in Europe again, and so the Conservative government headed by Boris Johnson faces questions and anger as people demand to know how the country ended up here - again.

Many countries are experiencing new waves of the virus, but Britain is among the worst. More than 3 million people in the UK have tested positive for the COVID-19 virus and 81,000 have died, with 30,000 in just the last 30 days. The British economy contracted by 8%, with more than 800,000 jobs lost and hundreds of thousands of registered workers in limbo.

Even with the new lockdown, London Mayor Sadiq Khan said on Friday that the situation in the capital was "critical", with one in 30 people infected. "The stark reality is that we will run out of beds for patients in the next two weeks unless the spread of the virus slows dramatically," he stated.

The US non-farm payrolls data for the month of December came in weaker than expectations of 71,000 jobs, with 140,000 job losses. The change (year-on-year) in the average hourly wage beat expectations by 4.4% with a change of 5.1%. On the other hand, the unemployment rate exceeded the rate estimated at 6.8% after remaining unchanged from November at 6.7%. Prior to that, the US ISM Service PMI for December was announced to have beaten expectations of 54.6, with a reading of 57.2. The ISM New Orders Index beat expectations by 54.9, with a reading of 58.5. On the other hand, both the ISM Paid Services Price Index and the Services Employment Index beat expectations by 65.2 and 50.7, with 64.8 and 48.2, respectively.

In the UK, house prices from Halifax for December missed expectations (monthly) of 0.5% with a change of 0.2%. The Markit Construction PMI for December also came below expectations of 55 with a change of 54.6, while the Markit Service PMI narrowly missed 49.9 with a score of 49.4, and Markit's Manufacturing PMI exceeded expectations of 57.3 with a change of 57.5.

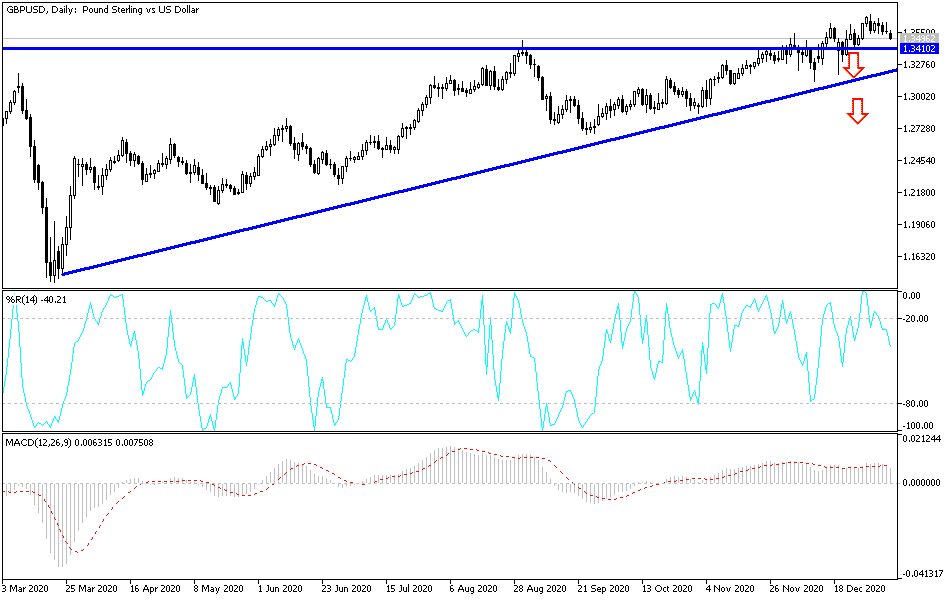

Technical analysis of the pair:

In the near term, and according to the performance on the hourly chart, it appears that the GBP/USD pair is trading within an ascending wedge formation, which indicates a short-term bullish bias in market sentiment. Therefore, the bulls will look to extend the current uptrend towards 1.3599, or higher to 1.3634. On the other hand, the bears will be looking for profits around 1.3531, or lower at 1.3492.

In the long term, and based on the performance on the daily chart, it appears that the GBP/USD is trading within an ascending triangle formation. This indicates a significant long-term bullish bias in market sentiment. Accordingly, the bulls will look to ride the current bullish wave by targeting profits around 1.3674, or higher at 1.3813. On the other hand, the bears will target reversals around 1.3428, or lower at 1.3277.