The Bank of England's comments about adopting negative interest rates helped push the GBP/USD pair to the periphery of the 1.3700 resistance level, settling around 1.3630 as of this writing. Concerns about interest rates, compounded with economic lockdowns in Britain, were pressure factors on the pound against the rest of the other major currencies. Bank of England Governor Bailey recently told the Scottish Chambers of Commerce on Tuesday that there are “a lot of problems” in using negative interest rates as a policy tool.

This was after Silvana Tenryou, an external member of the Monetary Policy Committee at the Bank of England and a professor at the London School of Economics, said in an online presentation on Monday that it is "not too late" to implement it and could "theoretically" cut the bank interest rate below -0.75%. Bailey's comments dispelled the cloud of gloom that hung over the pound in the early days of the New Year 2021, when a renewed national lockdown led to speculation in some parts about a possible subsequent decision to push the Bank of England's index of borrowing costs below zero.

Central banks have traditionally used interest rates to influence the level of lending in the economy in response to rising and downward inflation pressures. Many banks, including the Bank of England, struggle to raise borrowing costs from the bottom line of the coronavirus crisis that followed the financial crisis of the past decade. With benchmarks like the bank rate, which was lowered to a new low of 0.1% in March 2020, after stabilizing near zero for years, some global central banks have become increasingly reliant on other instruments in order to stimulate the faster economic growth thought necessary in order to achieve their inflation targets.

As a result, quantitative easing, which promotes the transmission of lower benchmarks by forcing government bond yields to be collected at all rates imposed on the economy, has become increasingly popular, but this particular tool may approach its limits at the Bank of England and other central banks.

Bond yields have been close to zero for years as well, thanks to a combination of lower bank interest rates and a greater volume of quantitative easing, but the Bank of England has relied on policy enough now that it is an owner of nearly half of the UK government debt.

When the nine-member Bank of England Monetary Policy Committee voted to lower the bank interest rate to 0.1% last year, it also agreed to raise the Bank of England's quantitative easing target from £435 billion to £645 billion, but this target has since been increased to an amount of £895 billion, equivalent to about half of the UK's projected GDP for 2020. But shortly after the rate cut in March, BoE officials began work on analyses of how negative interest rate policy was actually implemented, and have since asked lenders to prepare for such a possibility.

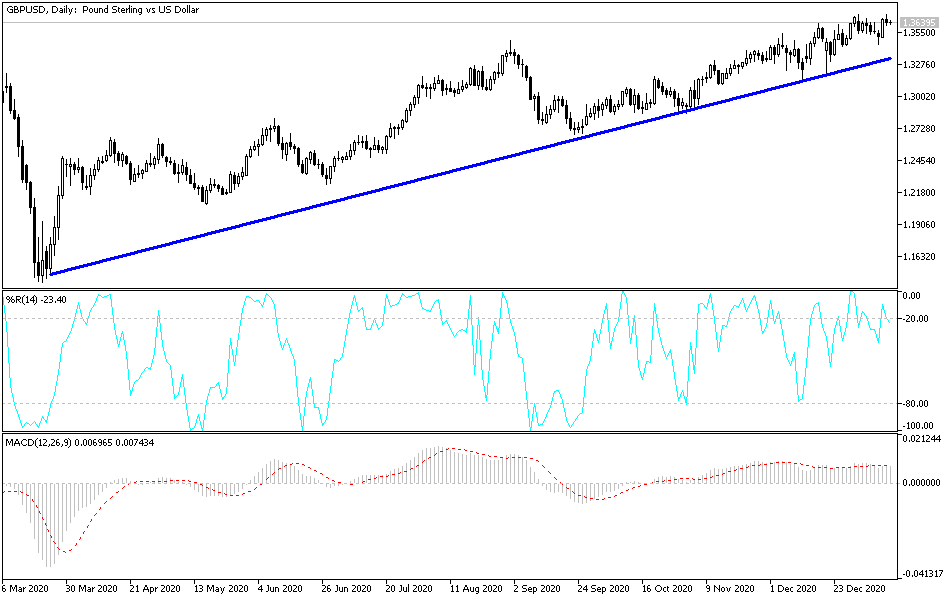

Technical analysis of the pair:

The stability of the GBP/USD pair above the 1.3700 resistance is still pushing the technical indicators to strong overbought areas, so profit-taking sales are expected at any time. On the downside, according to the performance on the daily chart, a bearish reversal will occur if the pair moves to the support levels a 1.3410 and 1.3345.

Today's economic calendar:

There are no important British economic data today. From the United States, we expect the number of weekly unemployment claims, followed by the upcoming statements of Federal Reserve Chair Jerome Powell.