The GBP/USD has been subjected to downward pressure that pushed it towards the 1.3660 support level, stabilizing around 1.3685 at the start of Thursday's session. The bearish moves came after the Federal Reserve announced its monetary policy to keep interest rates around their historically low level for a longer period, as were market expectations. After a Brexit deal was reached, sterling faced negative factors, such as the British economic performance and economic restrictions t to contain the outbreak of new strains of coronavirus, but the progress in the pace of vaccination in the country supported the sterling in the face of these risks.

The British labor market performed better than economists had expected. Despite tight closures and restrictions, according to the Office for National Statistics (ONS), the number of workers in the UK decreased by 88,000 to 32.5 million in the three months ending in November. The forecast was at 100,000. However, when compared on an annual basis, the UK labor market is still down by 398,000. The unemployment rate came in at 5% in November, up slightly from 4.9% in October. The market had expected an unemployment rate of 5.1%. Average wages, including and excluding bonuses, rose 3.6% in November, up from 2.8% the previous month.

Meanwhile, the CBI survey of retail sales fell to -50 in January, down from -3 in December. Since the COVID-19 crisis, the survey has only climbed into positive territory twice: July and September. The only subsectors that have remained stable or recorded growth have been grocery and furniture retailers, and even e-commerce sales have declined slightly.

Next week will be crucial for the British economy as the Bank of England (BoE) will hold its policy meeting in February, announcing its decision on interest rates and quantitative easing.

Coronavirus cases in Britain finally declined this month, with an average of seven days dropping from 49,112 on New Year's Day to 33,738 on Monday. In total, the United Kingdom has reported 3.67 million cases, but the deaths have crossed the 100,000 mark. Yesterday, British Prime Minister Boris Johnson indicated that the lockdown of the coronavirus in England will remain in effect until at least March 8, ruling out any imminent return to school for most students.

In a statement to lawmakers, Johnson also confirmed new restrictions on travelers arriving in England from countries where the government believes there is a risk of contracting known variants of the coronavirus. He also said that the UK remains in a "precarious situation" with more than 37,000 patients hospitalized with COVID-19, nearly double the number during the country's previous peak in April. While hopes were frustrated to return to classrooms after a school holiday in mid-February, Johnson warned that the March 8 goal was an ambition dependent on progress on the vaccination front and continued reductions in the spread of the virus in society. He said that a "road map" for the "gradual and phased" easing of the closure would be unveiled in the week beginning on February 22.

Johnson also tightened border rules to reduce the chances of new types of coronavirus emerging in England. He confirmed plans for a 10-day quarantine in hotels or other accommodations provided by the government to anyone arriving from 22 endemic countries, including South Africa and Portugal, all of them in South America. Since travel bans are already in place in these countries, quarantine measures will largely apply to British residents, who will also have to pay for their hotel stay.

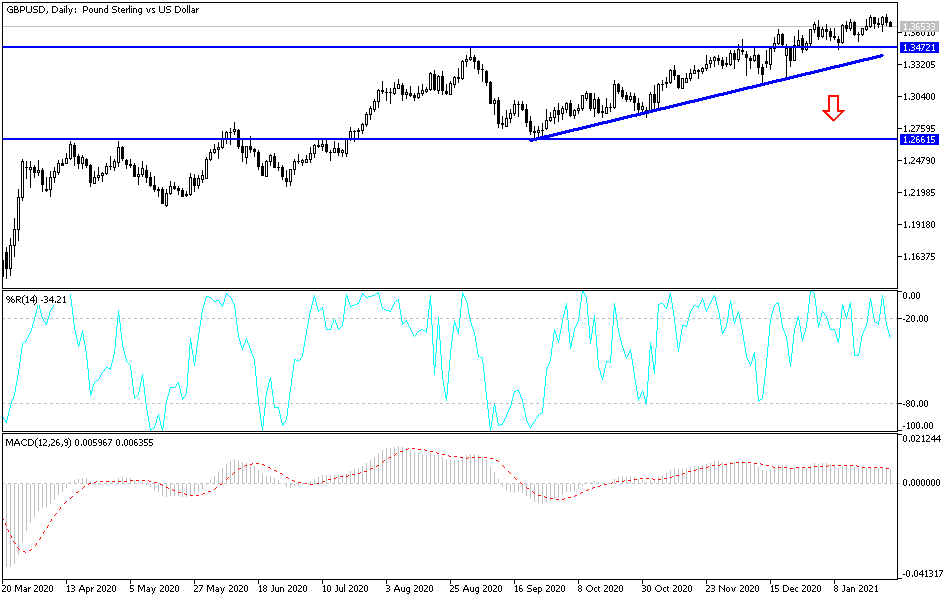

Technical analysis of the pair:

Despite the recent decline, the GBP/USD is still within a bullish trend, and there will be no bearish reversal unless the pair moves below the 1.3435 support level. Despite the optimistic outlook, stability above the resistance 1.3700 pushes the technical indicators to strong oversold areas. Therefore, any pressure on the pound will directly lead to quick profit-taking sales. I recommend selling the currency pair from the resistance levels of 1.3765, 1.3845 and 1.3930.

Today's economic calendar:

All focus is on the announcement of the growth rate of the US economy for Q4 2020, the number of weekly unemployment claims and new US home sales.