The year 2020 was one of extreme volatility for the GBP/USD pair. From January 2020, the official announcement of Brexit was made, and the looming prospect of a no-deal Brexit could have resulted in strong collapses of economies and currencies. At the last moment, trade relations between the two sides were agreed upon, beginning January 1, 2021. Throughout 2020, the GBP/USD suffered many setbacks, due to Brexit and COVID-19 concerns. The collapse of currencies against the safe-haven US dollar pushed the pair towards the support level of 1.1410, an historically low price for the GBP/USD. In the last trading session of 2020, the pair jumped to the 1.3686 resistance level, its highest since April of 2018.

However, we still see that the pound's gains faces emerging new strains of the coronavirus, Britain being most affected by those strains. The United Kingdom recorded a record 57,725 cases of coronavirus daily. Government figures show that the UK has posted five consecutive daily highs, all above 50,000, and nearly double the levels they were two weeks ago. Hospitals in Britain have also started receiving batches of the coronavirus vaccine developed by the University of Oxford and AstraZeneca, which British regulators approved this week.

About 530,000 doses of the vaccine will be available to circulate across the country as of Monday. Nursing home residents and their caregivers and hospital staff received the first doses. Princess Royal Hospital in Haywards Heath, part of the NHS Fund of University Hospital of Brighton and Sussex in southern England, was among the first to receive the vaccine. Commenting on this, Dr. George Findlay, the Fund's chief medical officer, says the Oxford-AstraZeneca vaccine is "much easier" than administering Pfizer-BioNTech, which needs to be stored in extremely cold temperatures.

The second doses of both vaccines will occur within 12 weeks instead of the 21 days initially planned, to increase the number of people who get the first vaccine. More than one million people in the UK received their first dose of the Pfizer vaccine.

Britain has seen 74,682 virus-related deaths in the epidemic, the second-highest total in Europe after Italy.

In Britain, seasonally adjusted nationwide housing prices for December rose over expectations (monthly) of 0.4%, with a change of 0.8%. Prices (year-on-year) were higher than expectations of 6.7%, with a change of 7.3%. Meanwhile, British Parliament approved the post-Brexit trade deal.

In the United States of America, US unemployment claims for the week ending December 25 were lower than expectations of 833,000, with the number of claims registered at 787,000. Continuing claims for the week ending December 18 also were lower than expectations of 5.39 million, with a total of 5.219 million. November pending home sales missed the expected change (monthly) of 0.0%, with a change of -2.6%. The Chicago PMI for December beat expectations of 57 with a rate of 59.5.

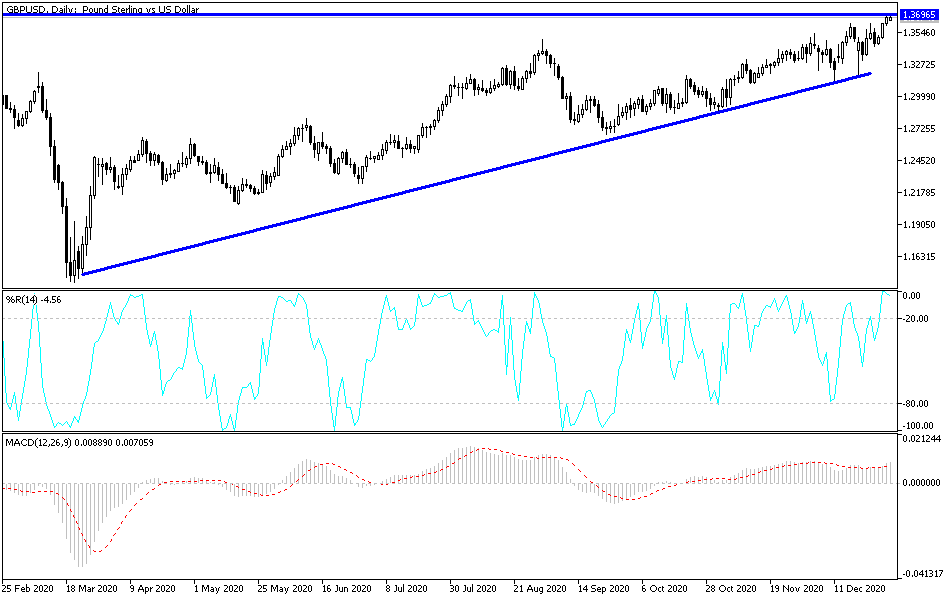

Technical analysis of the pair:

In the near term, and according to the performance on the hourly chart, it appears that the GBP/USD pair is trading within an ascending wedge formation. The currency pair has now risen near overbought levels in the 14-hour RSI. This indicates a short-term bullish bias in market sentiment. Accordingly, the bulls will look to extend the current short-term gains towards 1.3703, or higher to 1.3761. On the other hand, the bears will be looking to pounce on pullbacks around 1.3607 or below at 1.3543.

In the long term, and based on the performance on the daily chart, it appears that the GBP/USD is trading within a sharply ascending triangle formation. The pair has now risen near overbought levels in the 14-day RSI. It is fixed at several levels above the 100-day and 200-day simple moving averages. Accordingly, the bulls will look to extend the current long-term gains towards 1.3839 or higher to 1.4121. On the other hand, the bears will be looking for profits around 1.3456 or lower at 1.3187.

Today's economic calendar:

Regarding the GBP, the Industrial Purchasing Managers' Index, money supply and net lending to individuals will be announced. Regarding the USD, the rate of construction spending will be announced.