Long trade ideas

Buy the GBP/USD because of the bullish momentum.

Target the psychological level at 1.3750.

Add a stop loss at 1.3628, which is the highest level on December 17.

Short trade ideas

Short the GBP/USD if it moves at 1.3628.

Target the important support at 1.3600.

Add a stop loss at 1.3700.

The GBP/USD continued rallying in early trading due to the relatively weaker dollar and optimism about a post-Brexit Britain. It is trading at 1.3695, which is the highest it has been since April 2018. It has also risen for the past four consecutive weeks.

Post-Brexit Britain

The United Kingdom completely left the European Union on Friday, ending a controversial transition period after the 2016 Brexit vote. The country left the EU after the two sides reached a Brexit deal before Christmas.

The agreement helped to ensure that the two sides will continue trading as they did before. There will be no hard border and they will not impose tariffs on each other. Also, the two sides will continue collaborating on key issues like security and climate change.

A no-deal Brexit would have had a negative impact on the UK economy. Earlier estimates showed that the country would have lost thousands of jobs while the economy would have shrunk by about 2% this year.

Key Risks Remain

The GBP/USD pair is rallying even as key risks remain. For one, the UK and the EU did not reach final decisions on key issues. In particular, they did not reach an agreement on the vital financial sector. Instead, they committed to continue their deliberations through March this year.

Also, there is a major risk of the rising number of coronavirus cases in the United Kingdom. During the weekend, the number of new cases and hospitalisations continued to rise, driven by the new variant of the virus.

Further, there is uncertainty about who will win tomorrow’s runoff election in Georgia. If Republicans win one of the two seats, it will lead to gridlock in Washington, which will be a good thing. That’s because they will be able to block most of Joe Biden’s agenda, including high taxes.

On the other hand, if Democrats win the two seats, it will be a sign of higher taxes and more stimulus.

Later today, the GBP/USD will react to the UK and US Manufacturing PMI data. It will also react to the UK mortgage numbers that will be released by the Bank of England.

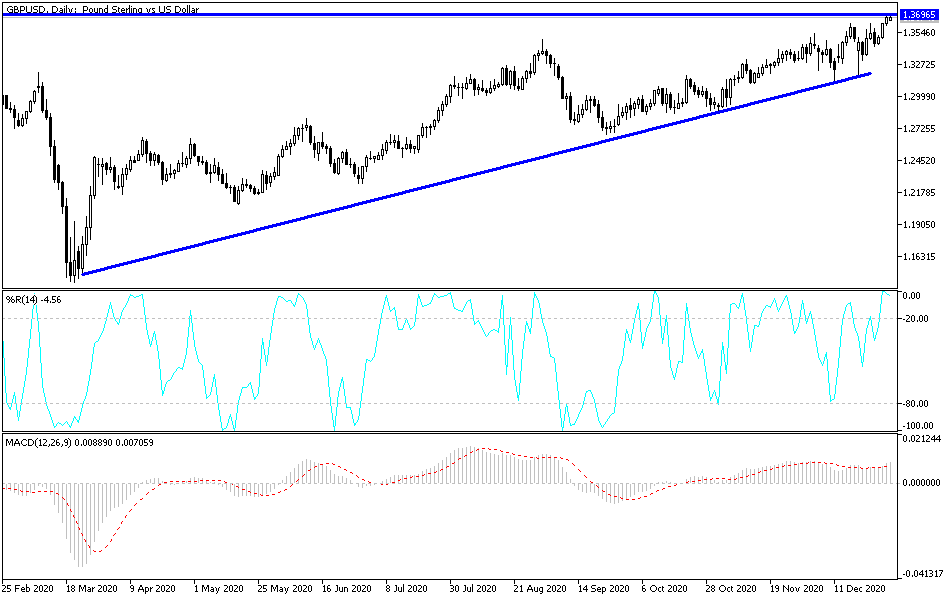

GBP/USD Technical Outlook

On the 4H chart, the GBP/USD continued rallying, pushing the price above the 28-period and 14-period EMAs. Similarly, the Relative Strength Index (RSI) and momentum have continued to rally.

Therefore, the pair will possibly continue rising since bulls have the momentum. Subsequently, the next target will be 1.3750. This prediction will be invalidated if the price moves below the support at 1.3628.