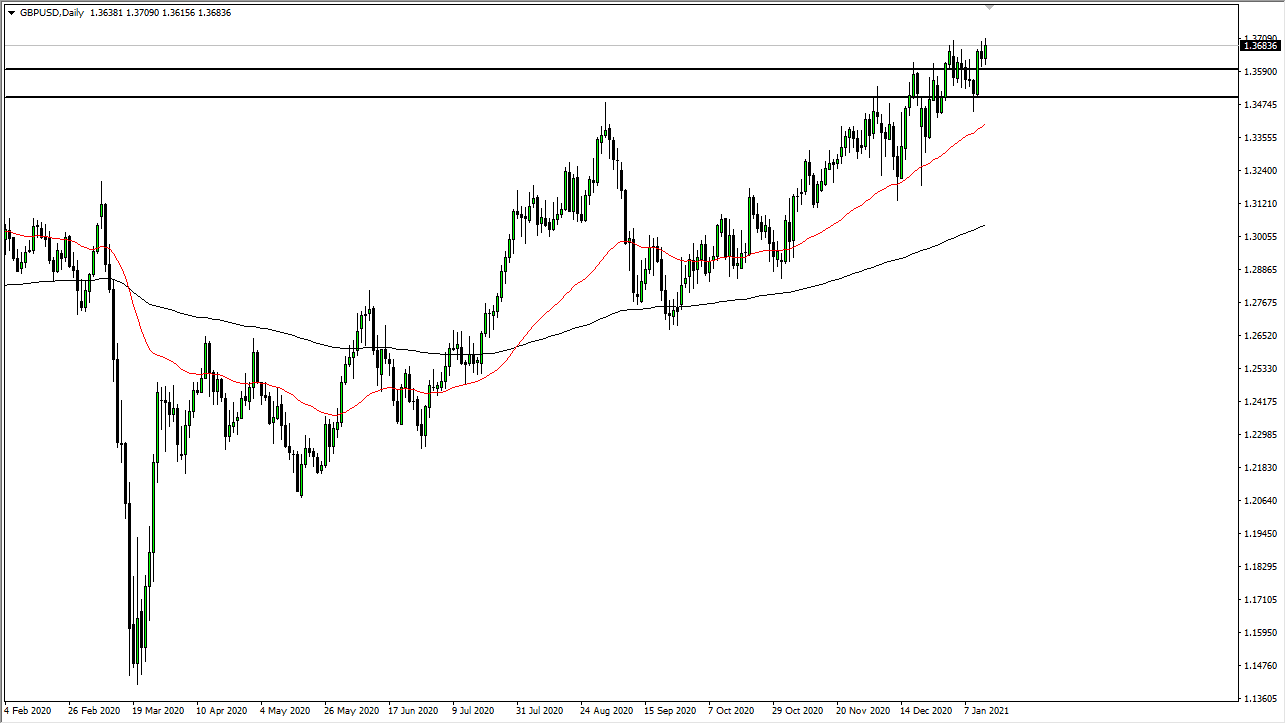

The British pound has rallied significantly during the trading session on Thursday to reach towards the 1.37 handle. That of course is a large, round, psychologically significant figure, and an area where we have seen resistance as well. Ultimately, I think that this market will break above there and continue to go to the upside. Looking at this chart, I think it is can further to go to the upside and will eventually try to rip through the 1.3750 level to go looking towards 1.40 level after that. After all, we have been in a nice uptrend for some time, and that of course is more than likely going to be the way this market continues to behave.

To the downside, the 1.35 level underneath is massive support, as it has been massive resistance previously. The 50 day EMA is starting to reach there, so that also could offer a bit of support as well. The British pound has been freed of the specter of Brexit, even though there are still a lot of things that concern traders going forward, the reality is that a lot of the uncertainty of that negotiation nonsense is behind us. All things being equal, think that dips continue to be bought, and eventually the British pound takes off. The British pound is historically cheap, and I think a lot of people will continue to look at it as such. Furthermore, the US dollar has been weakening over quite some time, so it is possible that could be a main driver of the market going higher as well.

I expect more volatility going forward, and of course people will be somewhat concerned about the lockdowns in the United Kingdom due to the coronavirus. However, it seems as if most traders are looking beyond that and trying to price in the idea of life after the vaccine gets distributed. However, the distribution of the vaccine has been slower than anticipated, so that will probably continue to make this very noisy. I have no interest in shorting this pair anytime soon, but I would like to see some type of pullback in order to buy it, as we need to find a certain amount of value in what has been a very relentless grind to the upside for several months now.