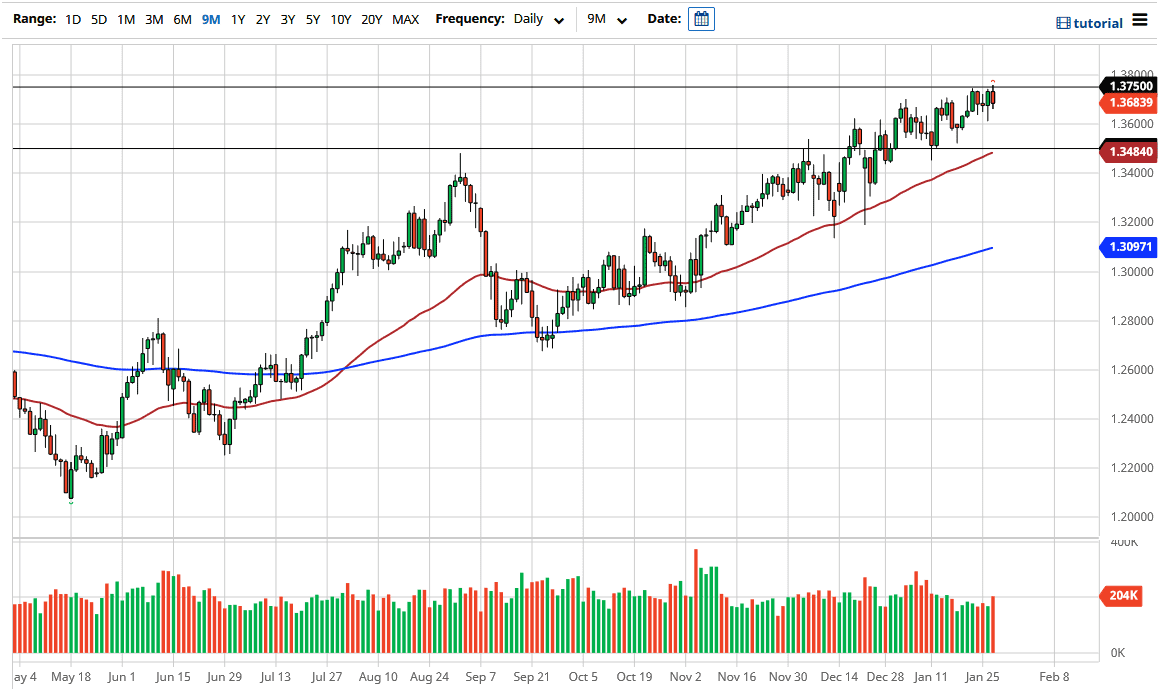

The British pound initially tried to rally during the trading session on Wednesday but has taken a bit of a beating as the US dollar strengthened. Looking at this chart, the 1.3750 level has offered significant resistance, and therefore I think it does make a certain amount of sense that we would pull back a bit at this point. Ultimately, I think this is simply a market that you are looking to buy on dips, with the 50 day EMA near the 1.35 level, I think that should offer a bit of a short-term floor in the market.

It is not necessarily that I like the British economy and want to buy the currency due to the potential outlook in the short term, but longer-term it looks like we are going to continue to see more of a recovery due to the Brexit being in the rearview mirror. We have coronavirus related lockdowns currently, but I think a lot of traders are looking at this as a scenario where we could see the British Pound go back to more or less a more historic norm.

Because we are cheap, the market is likely to continue looking at dips as buying opportunities. At this point in time, I do not think that the market breaks down below the 1.35 handle, but if we were to do so then it could open up a bigger move towards the 1.32 level. The 200 day EMA would come into play at that point in time, so therefore you should be paying close attention to that as potential support. To the upside, if we were to break above the 1.3750 level on a daily close, then I think the market is likely to go looking towards the 1.40 level above. That of course is a large, round, psychologically significant figure that will attract a significant amount of attention, and I think yet a significant amount of profit-taking. If we can break above there, then the next move would be to the 1.4250 level after that. I do believe that it is going to be very noisy between now and that level, so you need to be cautious and do not over lever the entire situation. I do not believe that the US dollar suddenly going to turn around, because no matter what happens it seems like people are looking to short it.