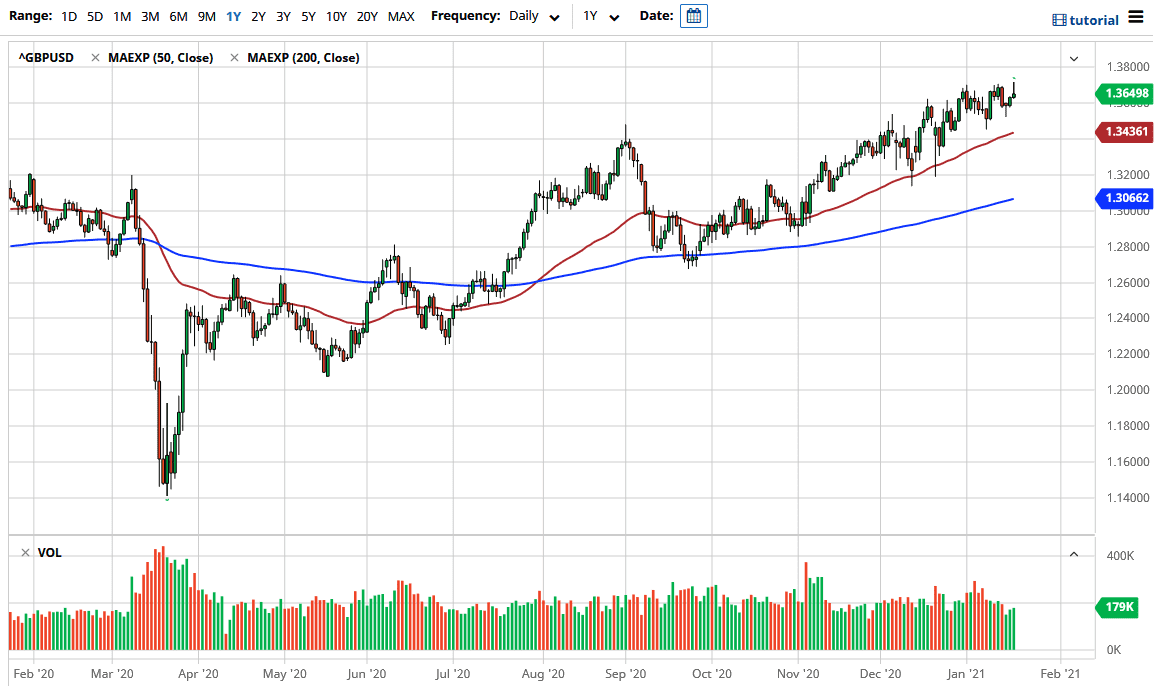

The British pound initially tried to rally during the trading session on Wednesday but gave up gains above the 1.37 level as it continues to be massive resistance. There is a significant amount of previous resistance at roughly 1.3750, so it does make sense that the British pound is struggling to bit here. That being said, I do think that the British pound may have gotten a bit ahead of itself and therefore I think a correction is looking more and more likely.

This is not to say that you should be shorting the British pound, simply that you may get an opportunity to buy it on a pullback. The 50 day EMA underneath is particularly interesting to me, just as the 1.35 level is, which is just above it. I think given enough time it is likely that we will see buyers show up sooner or later, but the next couple of days could be a simple matter of grinding back and forth with a slight downward tilt as the US dollar has been oversold for quite some time.

Yes, I realize that there is a lot of talk about stimulus out there but at the end of the day the stimulus package is not going to be as much of a “slam dunk” as initially thought. The US government is about as fractured as I remember it being in my lifetime. I suspect that a lot of pressure is going to be placed upon blue dog Democrats who have to walk the fine line between walking the party line and voting in a way that their constituents will not vote them out at the next election. In other words, there will be stimulus, but it is not going to be $1.9 trillion. This in and of itself could provide a little bit of a lift for the greenback.

Beyond that, although financial markets have been pricing in a recovery, the recovery that they are pricing in has been a little bit misplaced. It is not as if vaccines are going to be rolled out and then would suddenly go back to where we were before. Because of this, I think that also could provide a little bit of a lift for the greenback. This pair might be just a bit of an outlier though, because historically speaking the British pound of course is cheap and then the whole influence of unwinding the Brexit talks continues to have a little bit of a knock on effect. Buying on dips should continue to be the way forward.