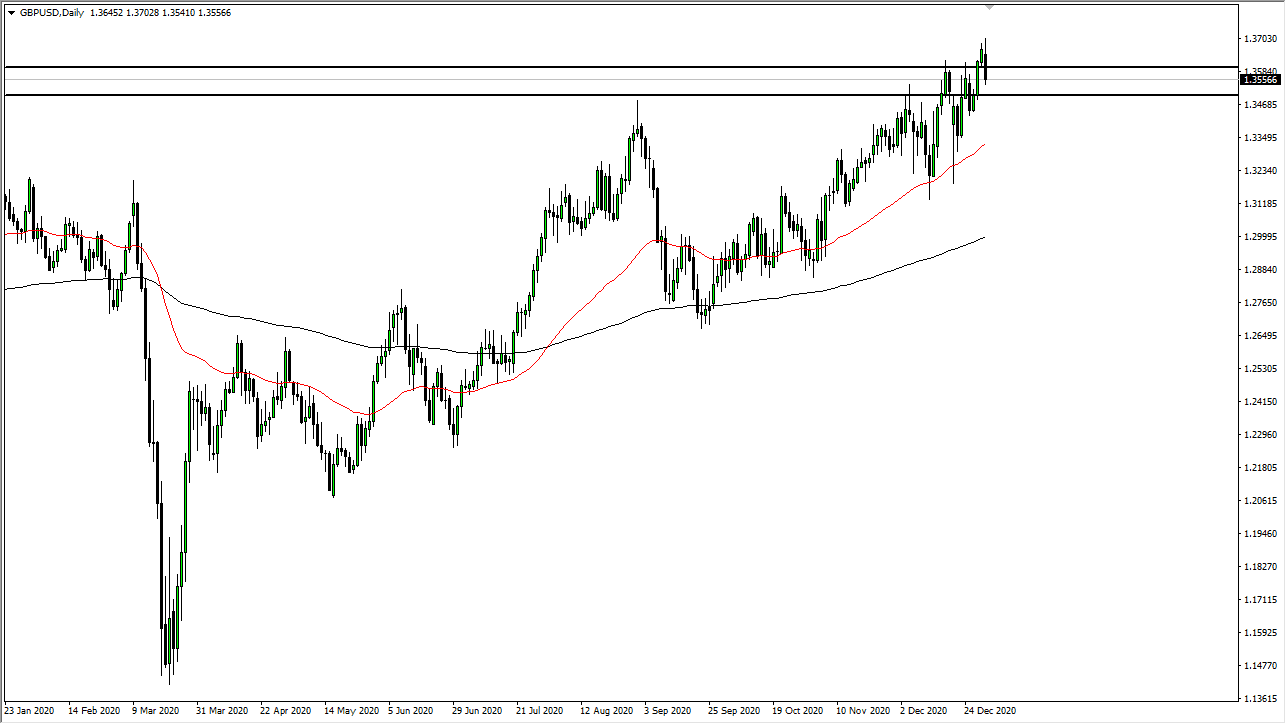

The British pound initially tried to rally during the trading session on Monday, and even broke a bit higher during the day as it peaked above the 1.37 handle. However, we have seen this market break down significantly since then, as Boris Johnson is set to announce more lockdowns in the United Kingdom, doing even further damage to the economy. At this point, the only thing that seems to be holding up the British pound is the fact that there is so much in the way of stimulus coming out the United States.

The question now is whether or not traders will choose to look past the virus situation now that we have vaccines out there. I suspect that they will come buy, and that does not necessarily mean that the British pound will have an easy path higher. After all, there are a whole host of other currencies out there that you can use to trade against the US dollar that do not have the various issues that the United Kingdom has post-Brexit. However, I do not subscribe to the Apocalypse Theory when it comes to United Kingdom either. The British pound is historically cheap, and once the dust settles, it will go back towards where it typically spends most of its time, somewhere around the 1.55 area or so.

Currently, I look at the 1.35 level as an area of interest, and I certainly would be interested in the British pound down near the 50-day EMA as well. I need to see a daily candlestick that shows signs of support, but we are still very much in an uptrend and upward channel, and I do not think that is going to change in the short term. However, if you are looking to sell the US dollar, you could probably get more mileage in a much shorter amount of time against other higher beta currencies such as the New Zealand dollar or the Australian dollar. It is not that the British pound will go higher, it is just that it may lack some of its peers due to the fact that it has extra baggage that comes with it. As far as selling is concerned, I do not really have any interest in doing so quite yet; but if we broke down below the 200-day EMA, something that is far away from where we are right now, then I would have to reconsider things.