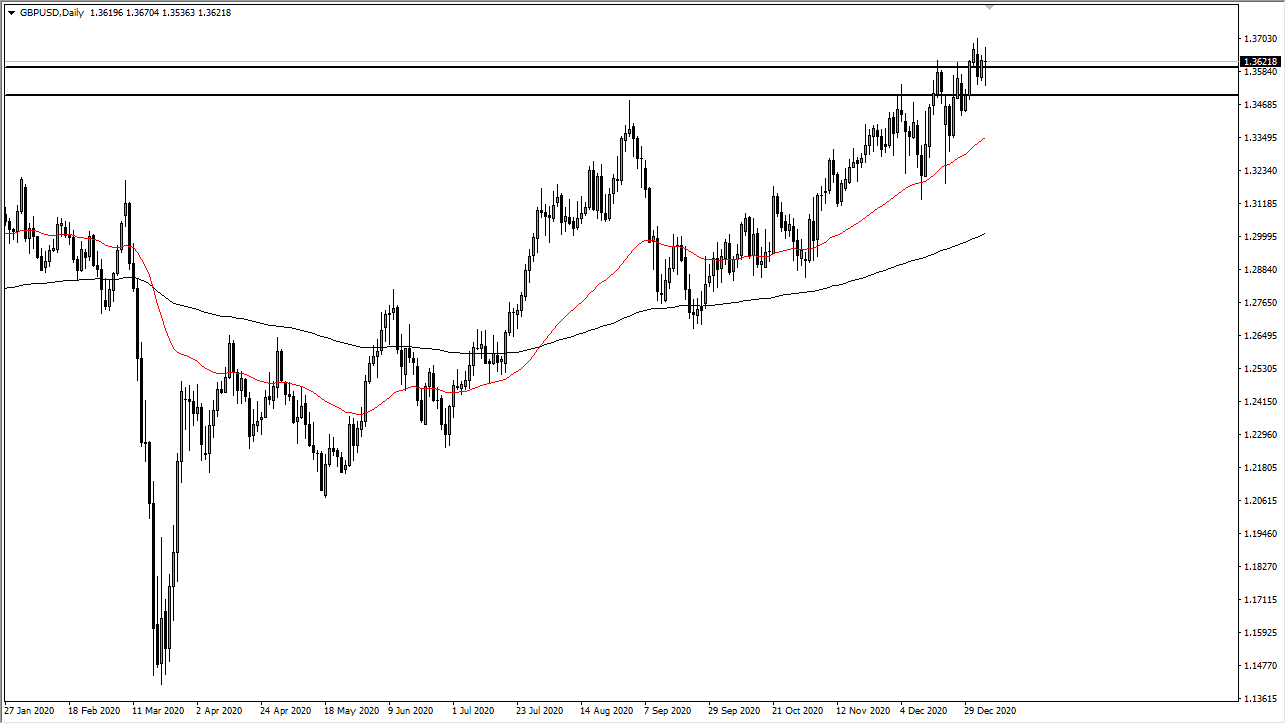

The British pound fluctuated during the trading session on Wednesday as we look at the 1.36 level as a bit of an anchor for price. The British pound is moving based upon coronavirus figures and the lockdown in the United Kingdom, but also in reaction to the U.S. Senate flipping to the Democrats, which means that spending in America might be much more significant than originally thought. This is a market that I think will continue to go higher, but we also have to worry about Great Britain itself.

On any given day, the British pound will be trading on either the coronavirus figures in the UK, or on the prospect of what life is going to be like after the vaccine. You really do not know, but the only thing that seems to be consistent is that the British pound is gaining over the longer term against the greenback. In other words, it is probably best to be bullish of this market from a long-term perspective and perhaps trade with small positions. In the short term, pullbacks to the 1.35 level underneath could be supported, while the 50-day EMA underneath there is sitting at the 1.3350 level, and likely to offer support as well.

The idea of buying the dips continues to be a major theme, and something that I am not willing to go against. From an historical standpoint, the British pound is extraordinarily cheap, by at least a good 15% against the greenback. I think that is what a lot of traders are starting to look at, but the obvious day-to-day noise is going to be something that is difficult to deal with. We have a lot of choppiness ahead of us, but there does seem to be a buyer every time we drop. Essentially put, this is the way the market has been behaving and I just do not see that changing in the short term. Longer-term, I believe that we will go looking towards the 1.40 level, and possibly even further than that. The 1.35 level at this point seems to be a bit of a magnet overall, but I would expect sloppy and upward trading in general.