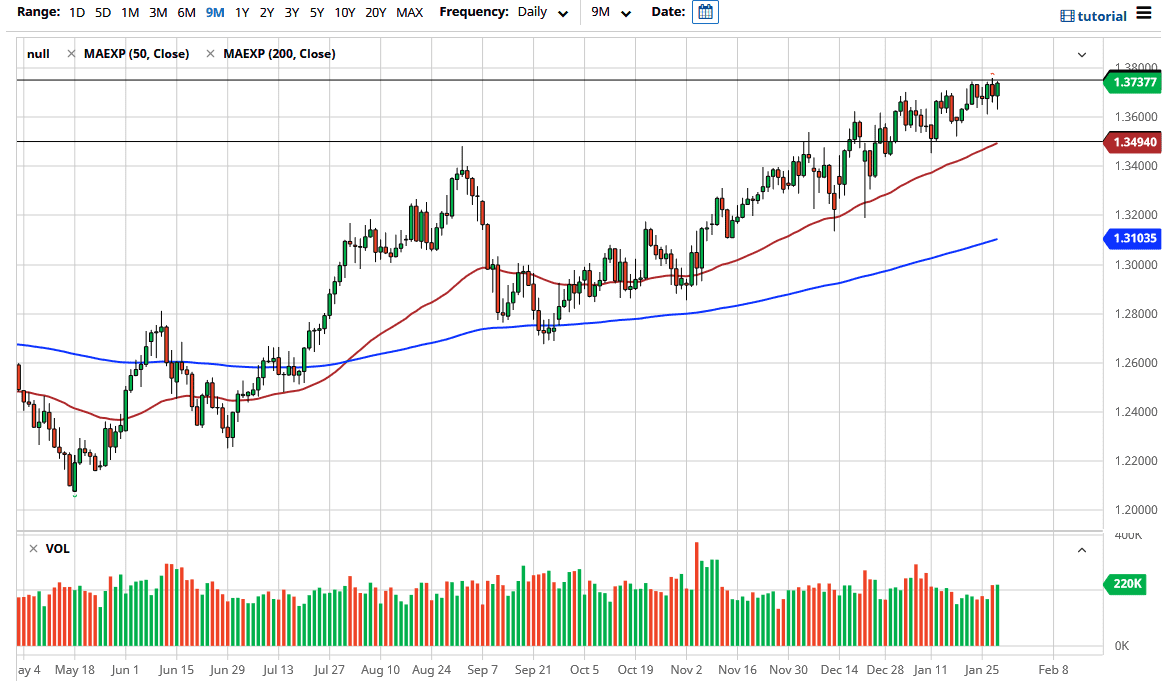

The British pound initially fell during the trading session on Thursday, reaching down towards the 1.36 level before turning around and rallying significantly. That being said, we ended up forming a hammer yet again and it looks like the 1.3750 level is going to continue to be threatened. If we can break above there, then it is likely that the market could go higher. Ultimately, the market has been knocking on the door breaking out for a while and it seems like more of the same continues.

To the downside, the 1.36 level continues offer support and most certainly the 1.35 level will also, due to the fact that not only has it in the past, but we have also seen the 50 day EMA approach that same level. In other words, there are plenty of technical reasons to think that the market does eventually go higher. With that in mind, I like the idea of buying dips and I do think that once we do get that cleaned breakout above the 1.3750 level, it is likely that the British pound will go looking towards 1.40 level longer-term due to the fact that it is the next large, round, psychologically significant figure.

At this point in time, it is obvious that every time we sell off value hunters are coming back in and I think that will continue to be what happens over the next several weeks. After all, the British pound has been historically cheap for a while and now that we are beyond Brexit, traders are starting to focus on the future. If that is the case, then they are looking beyond the lock down and everything else at the same time. They are anticipating that the British economy will pick up in strength and efficacy, going back to a more normal type of situation.

If we do get some type of major risk off type of situation, then you could see money flowing back into the greenback, but I think at the end of the day that will probably be a short-term situation. The 200 day EMA is all the way down at the 1.31 handle, so we do have plenty of room below here that could offer technical support. Whether or not we can break above the 1.40 level is a different question, one that I will take a look at once we get there.