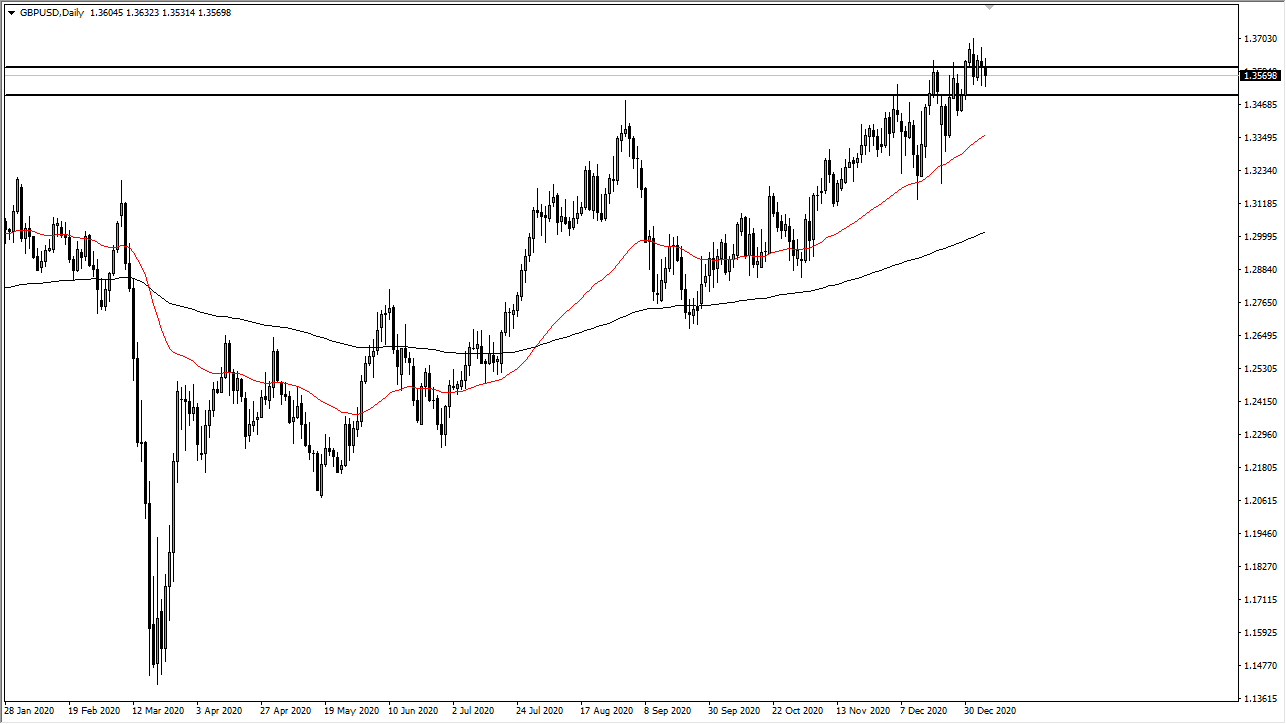

The British pound has gone back and forth during the trading session on Thursday, as we continue to hang around the 1.36 region. This is an area that had previously been resistance, extending down to the 1.35 handle. It now offer support as one would expect, and at this point in time it is likely that the value hunters would come back into the market on any type of dip. Even if we break down below there, I think that the 50 day EMA comes into play as well, thereby offering a bit of value the people would be willing to look into.

I do believe that the upside is probably somewhat limited in the short term though, but if we break above the 1.37 level could open up the possibility of a move towards 1.40 level. Keep in mind that the British pound of course has a lot of things to worry about, not the least of which would be the coronavirus lockdown and of course the effects of Brexit. That being said, there is starting to be a certain amount of rumbling out there that perhaps negative interest rates are coming to the Bank of England, although that has not been confirmed yet. If that is the case, then it will certainly do damage to the Pound.

The big driver right now is probably going to be stimulus in the United States, and therefore it is likely that we would see more upward bias given enough time anyway. I do not have any interest in shorting this market, although I am not necessarily overly keen or fond of the British pound. I think it is a simple matter of momentum, and we continue to have momentum to the upside in this market. That is unless of course we get some type of major meltdown in the financial markets. Right now, it does not look like that is going to be the case, but it is hard to tell where we go from here on any given headline. All one can do is support follow with the market is telling them, and right now it is saying that it likes the idea of going higher. The jobs number will have a certain amount of volatility introduced into the pair, but at the end of the day things will probably sort themselves out.