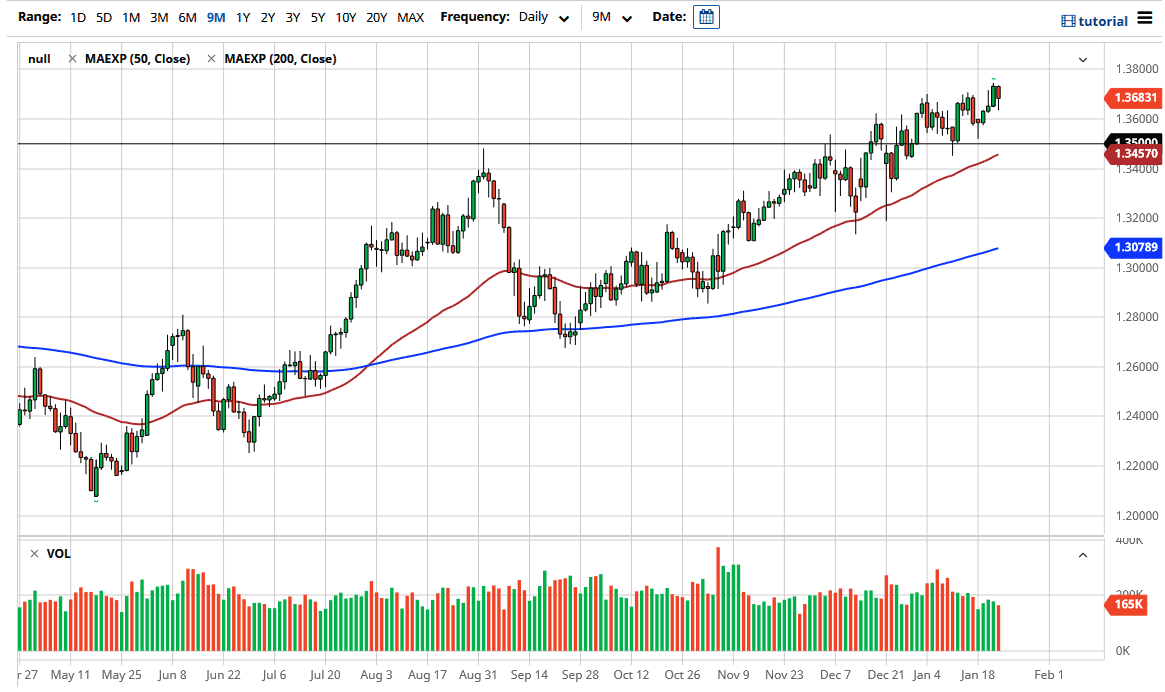

The British pound broke down a bit during the trading session on Friday to reach down towards the 1.3650 level. This is an area that will be interesting, as we have recently seen resistance there. The 1.35 level underneath should offer plenty of support, and the 50-day EMA reaching towards that level does make a certain amount of sense. The round figure will attract a certain amount of attention, and the 50-day EMA will only lead credence to that.

The US dollar is oversold in general, and it has been very choppy over the last several weeks. so it has had an influence on this pair. However, the British pound may be a bit of an outperformer when it comes to currencies in general. This is mainly due to the fact that the Brexit is now behind us, and the British pound is historically cheap at this point. You probably need to go another 15 handles to the upside over the longer term. All we need now is a reason for the pound to rise beyond historical valuations, and perhaps a little help with the US dollar softening.

With stimulus looking less and less massive in the United States, we may have overpriced the idea of the US dollar being flamed. It is likely that we will see the occasional pullback in this pair, but it is almost impossible to short this particular currency pair. If you wish to buy the US dollar against another currency, you may do better in a scenario where commodity currencies get run over. Examples would be something like the AUD/USD pair or even the USD/CAD pair.

If we can break above the 1.3750 level, it is likely that the pound could go looking towards the 1.40 level, followed by the 1.42 level given enough time. I think that the markets will find a reason to go higher, and the pullback to the 1.35 level even falls within the purview of the upward trending channel that you can see if you look at the charts. The candlestick for the trading session on Friday suggests that there are plenty of buyers underneath, so that only means that the analysis of support underneath should continue to be the way forward.