The British pound rallied during the trading session on Thursday, but it should be noted that this was a reflection of a lack of volume as well due to New Year’s Eve. The market looks as if it is ready to continue going higher, though, so I like the idea of buying short-term pullbacks in order to pick up value. I do not even know that this has anything to do with the British pound itself, but rather possibly the US dollar as it continues to struggle in general. The Federal Reserve pumping out massive amounts of liquidity into the marketplace continues to weigh upon the greenback, so that in and of itself will probably send this market higher.

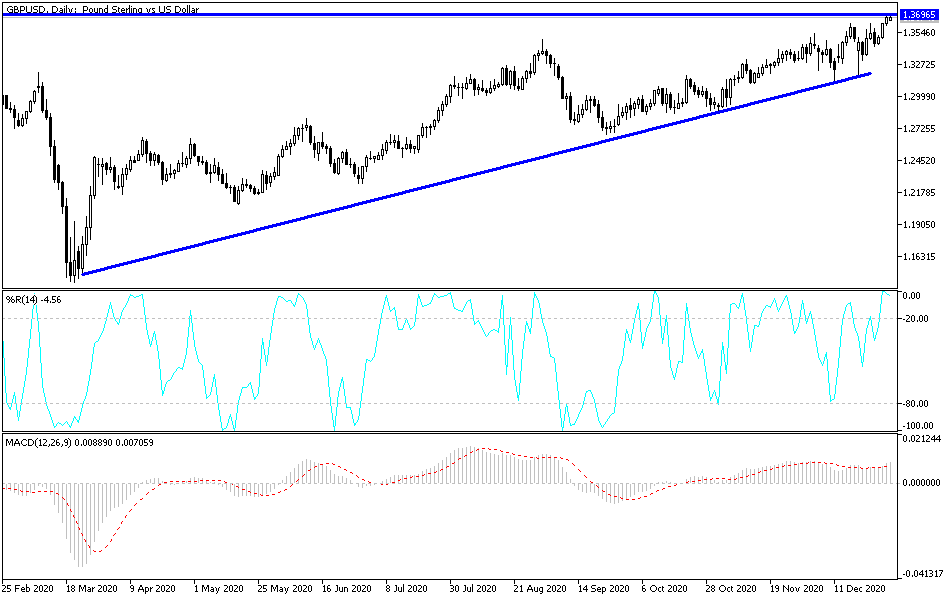

Furthermore, we have the Brexit situation finally coming to an end, although there are still a lot of minor details to work through. That does lift some of the concerns about owning the British pound, which at this point is historically cheap. If that is true, then the market could very well go higher. When you look at the big picture, you can make an argument that we have just formed an inverted head-and-shoulders type of pattern, which could measure as high as 1.50 above. While that does sound like it is a long way from here, the reality is that it is closer to the historical norm for the British pound than where we are now.

To the downside, the 1.35 level offers support, and then again, we will find it at the 50-day EMA. I do not have any interest in trying to get too cute with this market and shorting on the way down there. It is only a matter of time before the value hunters come back in and pick up the British pound, because it has been beaten down so drastically over the last several years. If the central bank in the United States continues to work so feverishly against the currency, the British pound should be a beneficiary. The biggest problem here is that the market may be a bit sluggish when compared to some of its competitors, as the dollar should slide against almost everything at the same time. This is probably more of an investment and less of a trade.