The 5100 rallied slightly during the trading session on Thursday, as we have found buyers near the 6650 handle. This is a market that was very much like the British pound itself, trying to break above significant resistance at higher levels. That being said, a lot of what is going on right now is to do with the coronavirus lockdown and of course the infection rate. In other words, do not bother with thinking about the companies in the FTSE 100, as it is trading on more of a macroeconomic point of view.

The 6600 level should be support as it was previous resistance, and we are starting to see buyers defend that area. At this point in time, it looks like we could go looking towards the 6900 level above which was the recent high. I do believe that given enough time we will make that happen but in the short term it might be a little bit choppy. There are a lot of concerns out there when it comes to the various bogeyman problems such as virus, the lock down, whatever happens between the United Kingdom and the European Union, but at this point it looks like people are starting to price and some type of recovery. After all, most things in Great Britain are relatively cheap from a historical perspective, so the stock market of course should be considered in the same light.

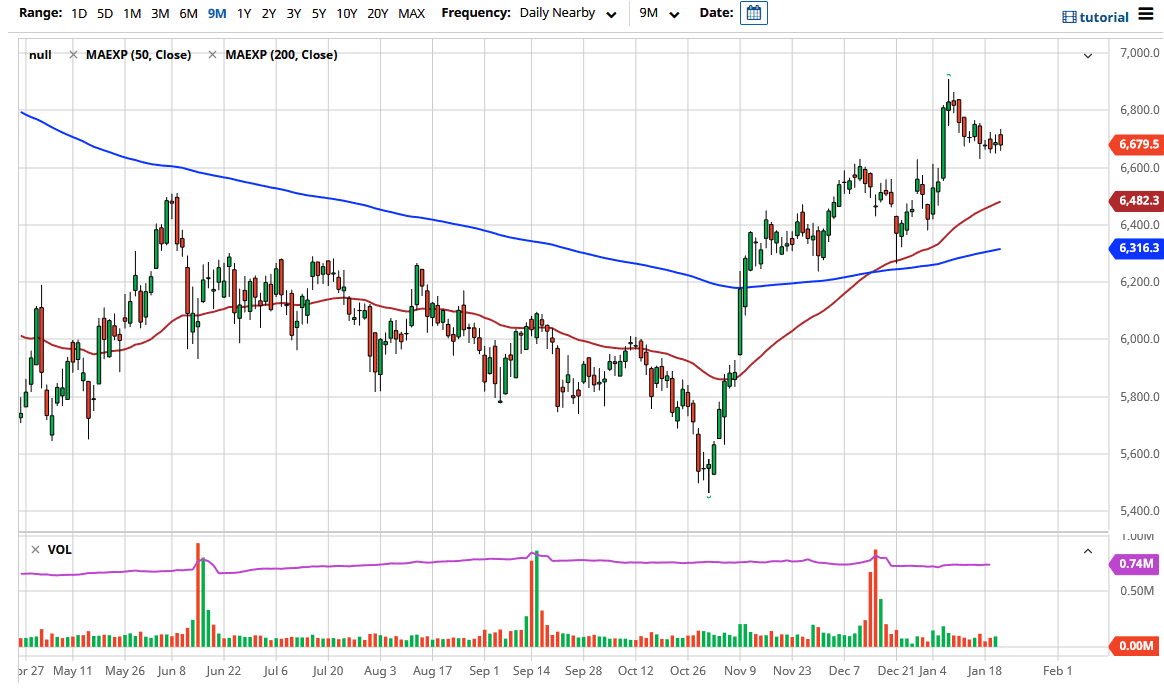

The 50 day EMA is at 6487 and reaching towards the area in which we find ourselves right now. I think at this point we will probably find plenty of buyers if we did pullback towards that area, but I do not see that happening in the short term. That being said, there is always the possibility of a bigger “risk off” type of situation, perhaps if there are even more lockdowns announced or perhaps something goes on with the British pound. The markets are largely algorithmically driven these days, so correlations can also step into the picture at times as well. As the British pound suddenly takes off to the upside against the US dollar, that could be reason enough for people to sell the FTSE 100, at least in the short term. Longer-term, this is a market that looks as if it wants to go right along to the upside with other indices around the world.