The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

It is a good time to be trading markets right now, as there are many strong long-term trends in favor of stocks and riskier assets, although we are seeing some marked counter-trend movements right now.

Big Picture 31st January 2021

In my previous piece last week, I saw the most attractive trade opportunity as long of the NASDAQ 100 Index, and in looking for short-term long trades in the GBP/USD currency pair following a down day right after a new 50-day high daily (New York) closing price was made.

This was not a great call, as the NASDAQ 100 Index fell by 3.60% over the week. However, going long of the GBP/USD currency pair at the end of Wednesday after the first down day following a new 50-day high was made did produce some profit.

Last week’s Forex market saw the strongest rise in the relative value of the New Zealand dollar and the strongest fall in the relative value of the Japanese yen. There is still a valid, long-term, strong trend against the U.S. dollar, meaning it is an attractive time to be trading Forex, as the greenback is the prime driver of the Forex market. However, we are currently seeing a strong counter trend move in favor of the greenback, so it may not be the right time to enter a trade in line with the long-term trend.

Fundamental Analysis & Market Sentiment

The headline takeaway is that we saw an increase in risk-off sentiment at the end of last week and a flow into safe havens such as the U.S. dollar and out of global stock markets. This is mainly because the FOMC are now warning somewhat more aggressively about the fragility of the U.S. economic recovery, suggesting that the speed of the coronavirus vaccination campaign will be crucial, but the U.S. is not slowing an ability to deliver more than one million shots per day, which markets will see as too slow. U.S. Advance GDP data also came in lower than expected, growing at an annualized rate of 4.0% against the 4.2% which analysts had been expecting.

Last week saw the E.U. in combat with AstraZeneca after the company reduced its deliveries of its coronavirus vaccines to the E.U. The E.U. alleged publicly that the contract was not being honored and even obliquely threatened to seize vaccines produced in Europe, or at least a precentage of any, from being exported out of the Eurozone, notably to the U.K. The E.U.’s coronavirus vaccination campaign is meanwhile proceeding relatively slowly.

Global stock markets sold off quite strongly from their recent highs last week.

This week is likely to be dominated by U.S. non-farm payrolls data and the Bank of England’s monthly policy statement, due on Friday and Thursday, respectively.

Last week saw the global number of confirmed coronavirus cases drop and total deaths stabilize. However, numbers remain relatively high, and there are concerns that new mutations of the virus may be spreading, which are more deadly and possibly resistant to the first generation of vaccines which are being rolled out. Many countries have just imposed additional travel restrictions. The U.S. has just made it illegal at the federal level to not wear a face mask on public transport.

The strongest growth in new confirmed cases is happening in Albania, Andorra, Argentina, Bahrain, Bolivia, Brazil, Chile, Costa Rica, Czech Republic, Estonia, Finland, France, Germany, Guatemala, Honduras, Indonesia, Jamaica, Kazakhstan, Kosovo, Kuwait, Latvia, Lithuania, Malaysia, Mexico, Nigeria, Paraguay, Peru, Portugal, Senegal, Slovakia, Slovenia, Spain, Sri Lanka, Sweden, Switzerland, Tunisia, the U.A.E., Uruguay, and Venezuela.

Several countries have begun vaccination programs. Israel has vaccinated over 32% of its population (including 80% of over-60s) with a first dose of the Pfizer vaccine, and over 18% with a second and final dose. The U.A.E. is next with over 30 doses given per 100 people so far.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows that the U.S. Dollar index printed a small, weakly bullish up candlestick last week. The consolidation of the past few weeks suggests that the dollar may not be able to fall much further despite the long-term bearish trend - the pace of this trend has slowed over recent weeks. Overall, next week’s price movement in the U.S. dollar looks unpredictable. For this reason, it will probably be wise to avoid trading the USD directly over the coming week.

S&P 500 Index

After hitting a new all-time high on Tuesday, the U.S.A.’s major stock market index fell sharply, making its strongest daily fall since October. The price chart below shows that this bearish retracement has just begun to penetrate below the 50-day moving average. This area below the moving average can be a great buy zone for this index, if the price makes a firm up day which closes below that moving average. Stocks could be a buy this week, but it makes sense to wait for a further fall followed by a firm bullish reversal before buying.

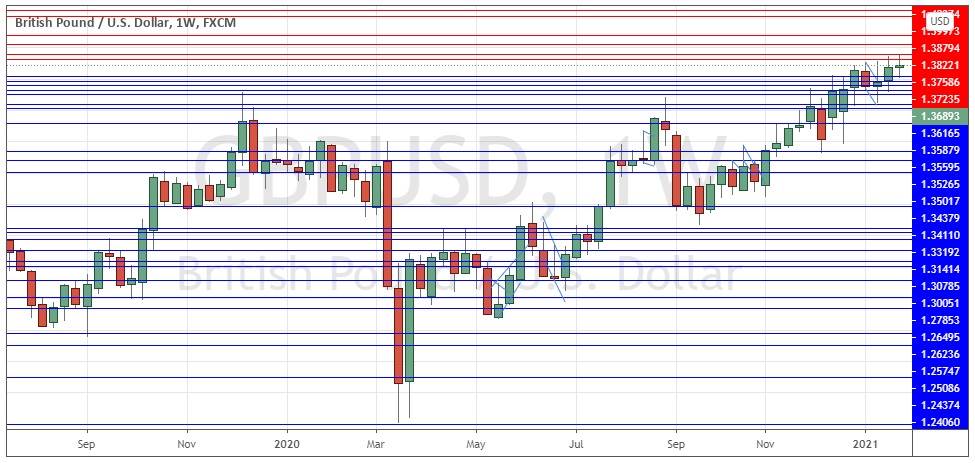

GBP/USD

Although the U.S. dollar has regained some strength, the British pound is also relatively strong as a currency. The price made a new 2.5-year weekly closing high. This long-term bullish trend is probably best traded by waiting for a new 50-day high closing price, and then for a down day the next day, at which point a long trade entry might again be made profitably from the dip. An alternative method would be to identify key support levels and trade bullish reversals at such levels on intraday time frames.

USD/JPY

Last week saw the U.S. dollar regain some strength, and this caused the USD/JPY currency pair to make its first new 50-day high closing price in a long while. This would normally suggest a long trade entry, but it is notable that volatility is very low and that the price has not yet breached the technically significant 105.00 level. If we get a daily close this week above 105.00 this pair could be a buy, especially if it pulls back the next day but still closes above 105.00.

Bottom Line

I see the best likely opportunities in the financial markets this week as looking for selective longs in the S&P 500 Index and the GBP/USD and USD/JPY currency pairs. However, as detailed above, it is important to wait for the right technical developments in each of them before entering any new long trades.