For the second day in a row, the EUR/USD pair is trying to correct to the upside, having stabilized around the 1.2155 resistance level as of this writing. The move comes ahead of the inauguration of the new US President Joe Biden, who markets believe will support more stimulus to support the US and global economy in the face of COVID-19. Due to renewed fears about the pandemic and consequent lockdowns, the EUR/USD had suffered recent losses that extended to the support level at 1.2053, its lowest in a month-and-a-half.

The euro will be more sensitive this week to the impact of the latest monetary policy decision of the European Central Bank and the press conference scheduled to be held at 12:45 and 13:30 on Thursday, which comes immediately after Inauguration Day, and will give ECB Governor Christine Lagarde an opportunity to tackle the EUR/USD's hike to its post-2018 high of 1.2350 and the economic outlook spoiled by new coronavirus restrictions and slowing vaccine rollouts.

Many Spanish regions are tightening restrictions due to the sharp increase in coronavirus infections, pending a government decision to allow a regional curfew at 8 PM. Wednesday's meeting is expected to decide whether to amend the nationwide state of emergency to allow regional governments a more stringent response to the country's third wave. Nearly half of the districts requested that the current curfew limit be presented at 10 PM. On Tuesday, the Ministry of Health recorded 34,291 new cases of COVID-19 during the past 24 hours and 404 new confirmed deaths, bringing the total number since the start of the epidemic to 2.37 million cases and at least 54,000 deaths. Accordingly, central Castilla-La Mancha, eastern Valencia and northern Navarra announced new closures of bars and restaurants, or restrictions to allow only food deliveries or outdoor dining. Western Extremadura, which is currently experiencing the highest infection rate in the country, is delaying in reopening schools for 2021 until January 25.

The European Union is urging member states to accelerate the pace of COVID-19 vaccinations to ensure that at least 80% of the people most at risk of contracting the virus - those over the age of 80 - are vaccinated by March of this year. In non-binding recommendations published on Tuesday, the European Union's Executive Committee also called on the 27 EU member states to accelerate the rollout of vaccination so that 70% of the adult population across the bloc will be vaccinated by summer.

German Chancellor Angela Merkel and the governors of Germany's 16 states agreed on Tuesday to extend the restrictions imposed on the country until mid-February amid fears that new mutations of the coronavirus could lead to a new increase in cases. The infection rate in the country has stabilized in recent days, indicating that current restrictions may be effective in reducing the numbers. On Tuesday, Germany's CDC reported 11,369 newly confirmed infections and 989 deaths, for a total of 47,622 deaths.

However, the increase in infections in Britain and Ireland, which were said to be caused by a more contagious type of virus, made German officials worried that the mutation could spread rapidly also there, if measures were not extended or even tightened, prompting Merkel and the governors to enforce the law. Accordingly, Merkel told reporters in Berlin: "All our efforts to contain the spread of the virus are facing a serious threat," referring to the mutated version of the virus.

In addition to extending the closure of restaurants, stores and schools until February 14, officials have also agreed to require people to wear the more effective FFP2 or KN95 masks on public transport and stores. They also want to ask employers to let employees work from home if possible to avoid office-induced infections.

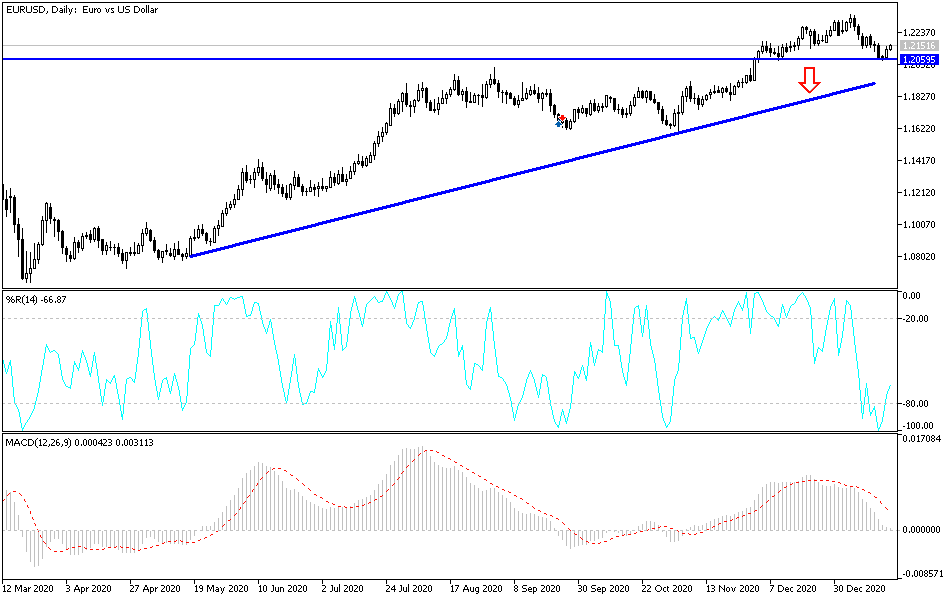

Technical analysis of the pair:

According to the performance on the daily chart, the EUR/USD is attempting to form a new ascending channel opposite to the descending channel that was formed recently amid renewed COVID-19 fears. The outlook will be bullish if the pair moves towards the resistance levels at 1.2220 and 1.2300. On the downside, psychological support at 1.2000 remains a dividing line between bulls and bears controlling the pair's direction, and selling will be strengthened by moving below it. The markets are waiting to hear the new U.S. administration's policies, especially after Trump's policies had been so helpful to the economy, in addition to the European Central’s policy tomorrow.

Today's economic calendar:

Regarding the euro, inflation numbers in the Eurozone will be announced. As for the dollar, the focus will be on Joe Biden's inauguration.