At the beginning of this week's trading, the EUR/USD pair retreated to the support level of 1.2170 as of this writing. The first trading week of 2021 was strongly positive for the pair, as the currency pair jumped to the resistance level of 1.2350, its highest since April of 2018. However, this positivity was impacted by a strong setback for the US labor market and the spread of coronavirus, which led to more restrictions and the crippling of European economies.

Germany has reached a record of 40,343 deaths after 465 new deaths were reported on Sunday. Germany was initially able to keep the death toll low compared to its European neighbors, but since October, new infections and deaths have steadily increased. On Sunday, Germany recorded 16,946 new cases.

The country entered its second strict lockdown last month, which was recently extended until the end of January. Therefore, schools and most stores are closed, hospitals in the country are on alert, and some morgues do not have enough space for the constant flow of corpses.

German Chancellor Angela Merkel has warned that the coming weeks will be the most difficult in the spread of the pandemic. However, the chancellor also said that mass vaccinations, which began in late December, will eventually help. "A few hundred thousand have been vaccinated and it will be more every day," she said. The vaccines have so far been approved by Germany and the European Union by Pfizer-BioNTech and Moderna. More than 530,000 people were vaccinated, most of them elderly and medical personnel.

The non-farm payroll figures showed that the US labor market collapsed around the end of 2020, after a period of efforts to contain the coronavirus were shutting down parts of the world's largest economy again. Accordingly, the Bureau of Labor Statistics announced that US nonfarm payrolls fell by -140K last month, which is surprising, given expectations of an increase of 60K. The net loss for December was the largest since April of last year, which saw the first lockdown for certain parts of the country and economy.

The entertainment and hospitality sectors were the most affected in December, with nearly 500,000 jobs lost, while government salaries fell by 45,000. Employment in the retail trade unexpectedly expanded by 121,000, and there were gains in commodity production sectors, including construction and manufacturing. According to the details of the results, the US unemployment rate in December reached 6.7%, which is the lowest level since the emergence of the coronavirus, unchanged from the previous month.

In a new Forex analysis from Bank of America, the euro has already maximized its bullish potential, just days after the new year. Accordingly, the consensus among the Forex community is that the year 2021 will witness a decrease in the value of the dollar and a rise in the EUR/USD pair, but this step may have already carried out its course. According to Bank of America analysts, the EUR/USD will be within its long-term equilibrium range during the year, from 1.20 to 1.25, ending the year at 1.25. The analysts claim that we're really in the middle of that range.

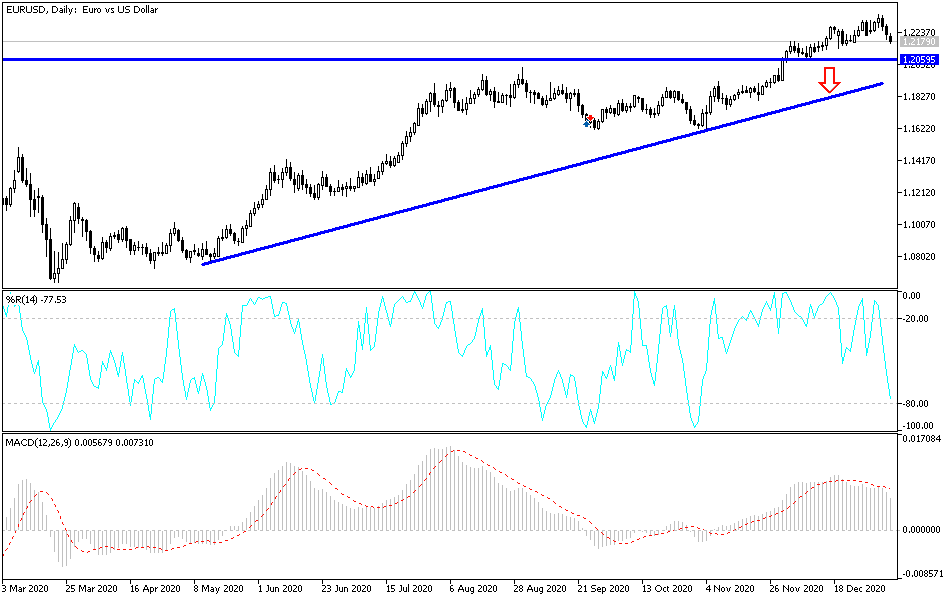

Technical analysis of the pair:

According to the performance on the daily chart, the EUR/USD pair may correct to the upside, but there will be a real break of the current upward trend without the currency pair breaking the support levels of 1.2160, 1.2080 and 1.2000. The future of the currency pair's gains depends on the extent investor risk appetite, which may be stronger if the second wave of the COVID-19 outbreak is contained. Forex traders are anticipating European stimulus plans and the future of the new US administration. So far, stability above the resistance 1.2300 is still a catalyst for the bulls to continue the ascending path.

There are no important US economic data expected today. In Europe, the Sentix Investor Confidence Index will be announced, as well as statements by European Central Bank Governor Lagarde.