For five trading sessions in a row, the EUR/USD pair tried to stabilize above the 1.2300 resistance. However, investors are awaiting the release of the minutes from the Federal Reserve's recent meeting today, as well as the US jobs numbers on Friday, and the results of the US elections in Georgia. This is in addition to the markets carefully monitoring the numbers of coronavirus infections and deaths, as well as vaccinations.

Data released by the German Federal Labor Agency showed that unemployment in Germany fell in December despite the government tightening measures to contain the coronavirus. Other official data revealed that retail sales growth slowed less than expected in November, driven by retail trade in the non-food sector. The number of unemployed in Germany decreased by 37,000 compared to November, which fell below expectations of a 10,000 increase. Unemployment fell by 40,000 in November.

Germany's unemployment rate remained unchanged at 6.1 percent in December, as expected.

Detlev Schell, Chief Executive of the Federal Employment Agency, said: "There has been an increase in job advertisements for short periods of time again - but only to a limited extent...the demand from companies stabilizes at a lower level."

Part-time jobs increased to 666,000 in December due to renewed containment measures. The key figures indicate that the German labor market could go through the crisis unharmed, says Karsten Brzezsky, an economist at ING. However, Brzyski added that the growing number of part-time workers, as well as the long-term impact from the ongoing second lockdown and the high risk of bankruptcy in 2021, are clearly arguing against too much optimism.

Data from the German statistics agency Destatis also showed that in November, the volume of retail sales increased by 5.6% from the previous year, which was higher than the expected growth of 3.9% but below the 8.6% increase recorded in October. Retail sales of food, beverages and tobacco rose only 0.8 percent annually, while non-food retail sales rose 8.5 percent.

On a monthly basis, retail sales grew unexpectedly by 1.9%. Economists had expected a 2% month-on-month decline after a 2.6% rise in October. Compared to February, a month before the COVID-19 outbreak, sales in November were 8.4% higher. The agency said that retail sales for the full year of 2020 are expected to be between 3.9% and 4.3% higher than in 2019.

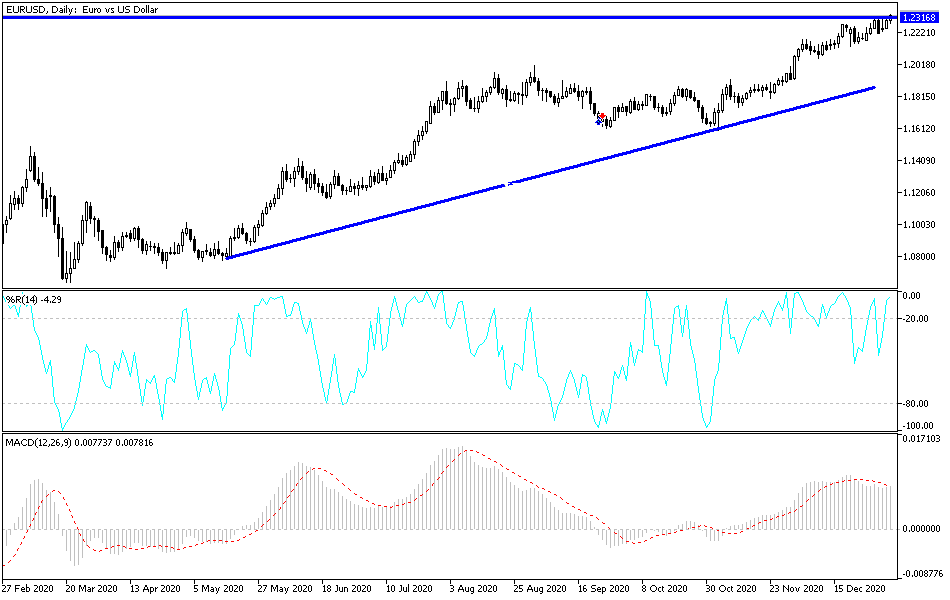

Technical analysis of the pair:

According to the performance on the daily chart, the EUR/USD pair is still within its ascending channel. The events of this week will have a strong effect on the continuation of this trend and on profit-taking selling operations as technical indicators began overbought levels. Therefore, the resistance levels 1.2335, 1.2400 and 1.2425 may be suitable for selling. On the downside, there will be no reversal of the trend without breaching the support level 1.2190 in the same daily period. On the 4-hour chart, the currency pair formed three tops in a unified range, which confirms bullish attempts to break out, and failure in that will lead to a correction to the bottom.

Today's economic calendar:

The German Consumer Price Index and Service PMI reading will be announced for the Eurozone economies. Regarding the USD, the ADP indicator reading will be announced to measure the change in the number of non-farm jobs, factory orders and oil inventories, then the content of the minutes of the last meeting of the Federal Reserve will be released.