The EUR/USD pair has been in a strong bullish momentum since the start of the year, which pushed the currency pair towards the 1.2350 resistance, its highest level since April of 2018. It settled around 1.2320 at the beginning of Thursday's trading. The US currency has been negatively affected by the political chaos happening in the country, which may ultimately lead to risk aversion for investors. Containing the situation quickly would favor further gains for the currency pair.

US ISM Manufacturing PMI reading for December beat expectations of 56.6, with a reading of 60.7. The ISM industrial-driven performance for this period also beat expectations by 65.7, with a reading of 77.6, while the Manufacturing New Orders Index was below expectations of 74.8 with 67.9. The ISM Manufacturing Employment Index also outperformed expectations of 50.7 with 51.5. The ADP survey announced the employment of the lowest number of American jobs in the non-agricultural sector since last April - 123,000 jobs, and expectations indicated that 60,000 jobs would be employed from 304,000 jobs in the past.

After protestors stormed the US Capitol yesterday, President-elect Joe Biden described the protests as an "attack on America's most sacred institution." Biden, who has refused to condemn violent riots by left-wing groups such as Antifa and Black Lives Matter, now called on President Donald Trump to call on his supporters to stop the violence.

President Trump publicly asked his supporters to "remain peaceful" and to "go home peacefully" in a video that was quickly censored by Twitter.

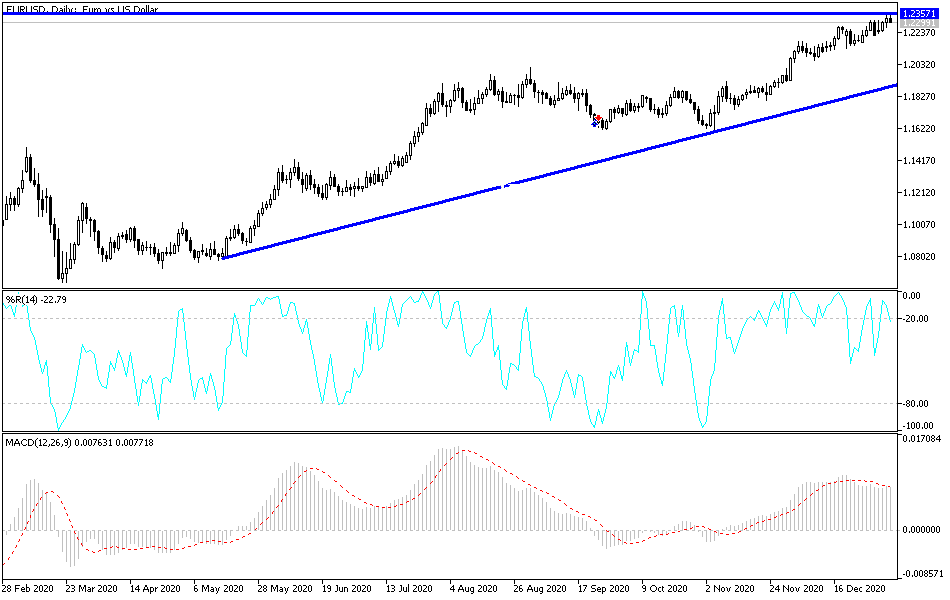

Technical analysis of the pair:

In the near term, and according to the performance on the hourly chart, it appears that the EUR/USD currency pair is trading within an ascending wedge formation, which indicates a significant short-term bullish bias in market sentiment. The pair is now close to crossing into overbought levels in the 14-hour RSI. Therefore, the bulls will look to extend the current short-term gains towards 1.2357 or higher to 1.2390. On the other hand, the bears will be looking to pounce on short-term pullbacks around 1.2302 or below at 1.2266.

In the long term, and according to the performance on the daily chart, it appears that the EUR/USD is trading within the formation of a sharp upward channel, which indicates a strong long-term bullish momentum in market sentiment. The pair continues to trade near the overbought levels of the 14-day RSI. Accordingly, the bulls will look to support the current bullish trend by targeting profits around 1.2413 or higher at 1.2554. On the other hand, bears will be looking to pounce on earnings around 1.2096 or lower at 1.1923.

Today's economic calendar:

The German factory orders, Consumer Price Index reading and retail sales in the Eurozone will be released. Regarding the USD, the trade balance, unemployed claims and the ISM Service PMI will be announced.