After the EUR/USD pair had fallen to the 1.2132 support level, its lowest level in a month, the pair corrected to the 1.2210 level at the beginning of Wednesday's trading. This move comes ahead of the announcement of US inflation figures by European Central Bank Governor Lagarde, who will also make statements regarding stimulus plans. Currently, the currency pair remains in an upward channel as long as it holds above the 1.2000 resistance.

After disappointing US job numbers were announced for December 2020, it was announced yesterday that layoffs were higher in November compared to the previous month. In addition, the number of available jobs decreased, indicating that the labor market has stopped as the coronavirus has led to a decline in consumer spending.

The US Labor Department said that the number of jobs opened at the end of November decreased by 1.6% to 6.5 million, the first drop since August. However, layoffs rose 17.6% to 1.9 million, mostly driven by job cuts in restaurants, bars and hotels, which more than doubled. Nevertheless, economists expect the US economy to grow at a healthy pace later this year, as vaccines are distributed more widely and recent government incentives provide more money for Americans to spend. Hence, faster growth should boost employment, but most employers now appear to be in a wait-and-see mode.

The US unemployment rate has remained stuck at a high level of 6.7%, the first time it has not declined since April 2020. The lost jobs, according to this report, have also been largely concentrated in areas such as educational services and film production, in addition to the restaurants and hotels that are already struggling.

Tuesday's report, known as the Job Openings and Labor Turnover Survey (JOLTS), adds more details about hiring and firing by companies and government agencies. The data on open jobs provides insights into whether companies expect businesses to improve enough in the coming months to justify additional hiring.

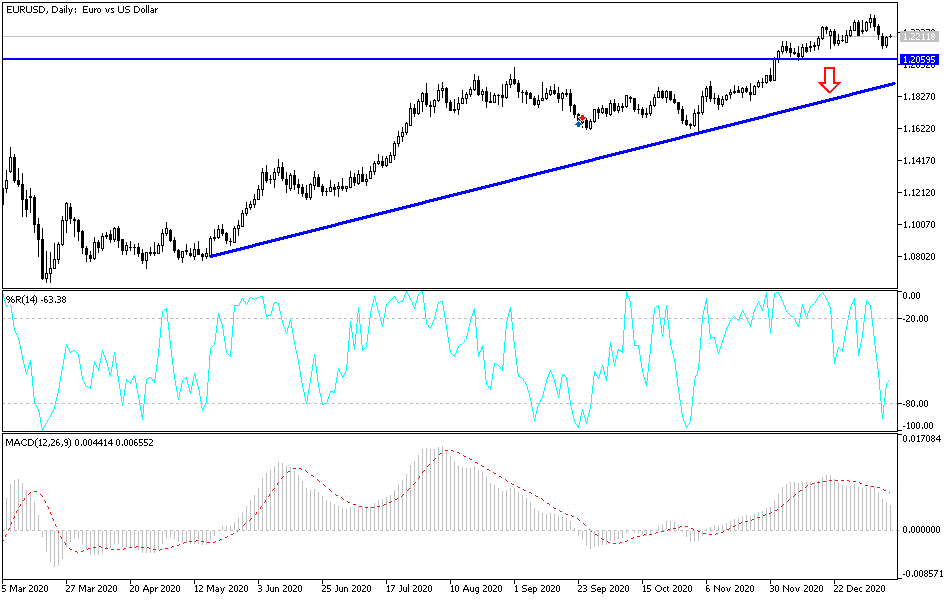

Technical analysis of the pair:

The stability of the EUR/USD pair above the 1.2000 level is still motivating the bulls to control the general trend, which is still upward. Therefore, a break through the resistance 1.2300 will help the pair launch towards stronger bullish areas. On the downside, the support 1.2000 will remain the most important for now for the bears to regain control and for the reversal of the general trend. The continuing global fears regarding the coronavirus and the anticipation of more stimulus will make the pair's upcoming gains an opportunity to sell again.

Today's economic calendar:

Regarding the euro, there will be upcoming statements by European Central Bank Governor Lagarde, and then the announcement of the industrial production rate in the Eurozone. Regarding the US dollar, US inflation figures will be announced through the Consumer Price Index.