For four trading sessions in a row, the EUR/USD pair has been in an upward correctional range, which pushed it to the resistance level of 1.2190 before stabilizing around 1.2170. This correction came after the currency pair collapsed to the support level of 1.2053, due to a new political concern from Italy that almost toppled the government there, which has been avoided. Now the euro is interacting with the efforts of European countries to contain the second wave of the coronavirus.

The looser performance of the Eurozone services sector in the January PMI surveys from IHS Markit contributed to the euro holding steady despite the decline in global stock markets ahead of the weekend. Commenting on the performance, Peter Karbata, Chief Analyst at ING said: “Developments in the US capital are likely to push the dollar higher next week. With signs that Biden’s fiscal bill will be tough in the Senate, risk sentiment may chill despite the FOMC message that is likely to remain pessimistic."

The euro ignored reports that delivery of coronavirus vaccines from AstraZeneca will now be delayed, the latest in a series of setbacks to vaccination efforts in Europe after the upgrade to a Belgium-based factory has already delayed delivery of the Pfizer and BioNtech vaccines. The delays came after an earlier European Union decision to wait and keep a portion of the European request in anticipation of full development and approval of a vaccine from Sanofi, France.

Drag Maher, Head of Forex Strategy at HSBC, said: “The euro felt comfortable because the decline in business activity during January was relatively modest and was not worse than expected.” The resilience of the euro means that the DXY does not show the kind of consolidation one might expect alongside the noticeable decline in stocks. And perhaps also, although it can be argued that any deterioration in risk appetite could hurt stocks more if the valuations are viewed as extended, the valuations are less important to the Forex market. Nevertheless, it is clear that much of the “risk” in the Forex market is on the defensive amid concerns over COVID-19 and dampened hopes for any immediate bipartisan financial boost in the US.

The decline in real returns is also widely cited as one of the main drivers of the recent decline in the dollar and the main reason for anticipating further losses in 2021. Declines last week at least could have been a result of expectations for President Joe Biden's newly opened stimulus bill of $1.9 trillion, which might struggle to pass through Congress unless its size is reduced.

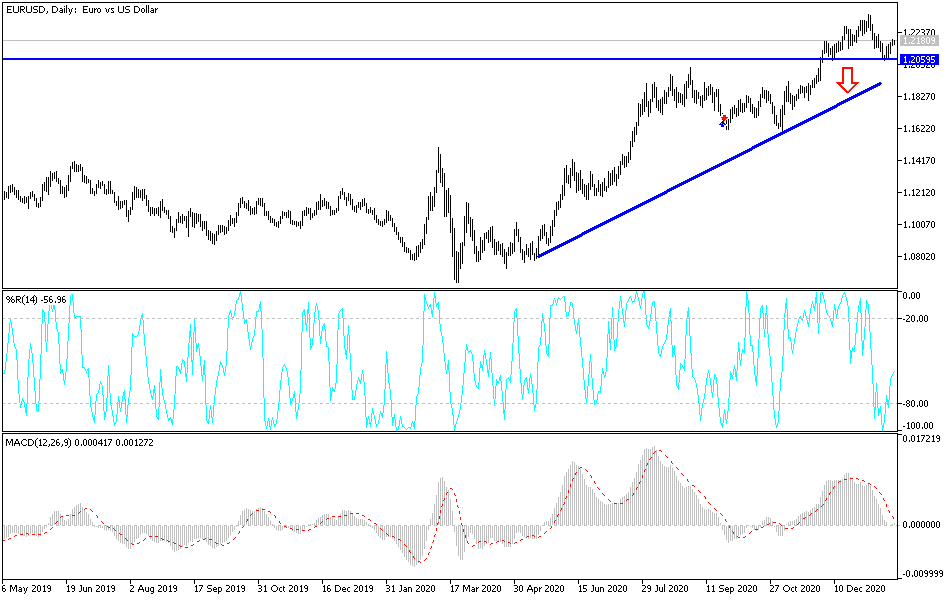

Technical analysis of the pair:

According to the performance on the daily chart, if the EUR/USD currency pair fails to break the 1.2270 resistance level, a head and shoulders pattern will form and bearish sentiment will return. The pair would then be likely top move towards the psychological support level at 1.2000. On the upside, if the 1.2350 resistance is breached, the bulls will gain control to move towards higher resistance levels, including the 1.2500 resistance.

The currency pair will be affected today by the extent of investor risk appetite, as well as the success of European efforts to contain COVID-19, along with statements by European Central Bank Governor Lagarde on two occasions today. Then, there will be the the German IFO Index reading.