The EUR/USD pair had a bearish start to the week, retreating to the 1.2053 support level and stabilizing around 1.2080 as of this writing, ahead of the important German ZEW Index readings. Yesterday's trading was in a narrow range in light of an American holiday, which affected investor sentiment to make strong moves until any new impact on the markets appears. According to recent performance, further declines in the pair are likely in the coming days due to the ECB's concerns about the strength of the currency exchange, as well as vaccination setbacks. Bearish technical signals from all the charts indicate that the euro may head towards its lowest in six weeks around the 1.20 support. During last week's trading, the EUR/USD fell by more than one percent, as high US bond yields led to a recovery in the dollar, while investors’ aversion to risk greatly affected assets such as stocks, commodities, and currencies associated with positive investor sentiment.

Investor sentiment has been negatively affected by the euro amid the Italian government's threat of new elections, as well as a prolonged lockdown in Germany and reports indicating that Pfizer has delayed delivery of its vaccine due to manufacturing problems at a location in Belgium. These factors will be compounded by the European Central Bank's (ECB) speech on currency strength and the tendency of the euro to weaken ahead of the US presidential inauguration in curbing or causing more losses this week as well.

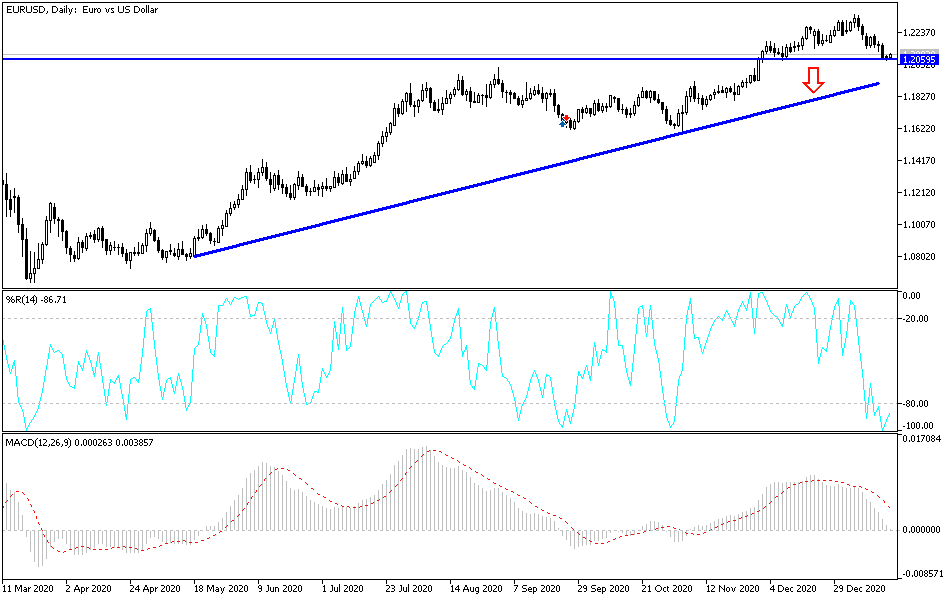

However, technical analysts are also flagging the charts as a continuing source of downside risk as well. Five analysts provide insight and justifications for why they now see the EUR/USD down to 1.20 in the coming days and what will be the lowest level in six weeks, although fortunately for the euro, everyone expects that this is simply a corrective setback within an uptrend. In this regard, Paul Siana, Chief Technical Analyst at BofA Global Research says: “Euro divergences from RSI and MACD warn of a correction, and the channel line has broken since then and there is a downturn underway. Accordingly, we see Fibonacci retracements at 1.2064, 1.1976 and 1.1888 that we should be aware of. However, we are not sure of a price break below 1.20. We believe that the decline in the euro is linked to the rise in oil prices being overbought and the bond market oversold."

The European Central Band may have a chance to comment on the EUR rate on Thursday when the latest policy decision is released at 12:45 AM, during a press conference by Bank Governor Christine Lagarde at 13:30 on the same day. Peter Karbata, Chief Forex Strategist at ING says, “There is little expected from the ECB after the easing measures in December. Nevertheless, we expect Governor Lagarde to say that the European Central Bank is 'watching the exchange rate carefully', warning of the impact of the euro on the already weak inflation rate, and in conclusion, continued Italian political uncertainty and a stable dollar may see the EUR/USD decline for a short period around the 1.1980 support.”

All in all, there isn't much the ECB can do to keep the euro down, but with other central banks now directly intervening to limit their currency appreciation, the risk of tighter rhetoric or some form of action may grow. Therefore, the appointment of the European Central Bank on Thursday may ensure a lackluster performance from the EUR early this week, or simply that any corrective gains accumulated during the first days of this week will be subject to elimination before this event. But the inauguration of the US presidency is also a threat to the euro.

Technical analysis of the pair:

According to the performance on the daily chart, the EUR/USD is in a downward correction stage, and the outlook will be bearish in the event of a move around and below the support level of 1.2000, which will confirm a bearish trend and thus prepare to test support levels more powerful. Those closest are 1.2035, 1.1975 and 1.1900. On the upside, as I mentioned before, the bulls will return to control the performance in case the currency pair returns to stability above the resistance 1.2300. The continuation of the coronavirus, the European lockdowns, and the delay in stimulating the global economy will be an opportunity for the US dollar - a safe haven - to achieve stronger gains.

Today's economic calendar:

Regarding the euro, the German Consumer Price Index reading and current accounts in the Eurozone will be announced. Then, there will be the German ZEW Confidence Index reading. As for the USD, the calendar is empty for the second day in a row.