In Q1 of 2020, the EUR/USD pair had collapsed to the 1.0637 support, its lowest level since April of 2017, during the height of the COVID-19 crisis. Since then, the performance of the EUR/USD has been subject to fluctuation, sometimes positive, with global central banks pumping trillions of dollars into the global financial and banking system to instill confidence among investors. Each time, the US dollar prevailed, as it remained the ideal safe haven for investors, but everything changed in November, as shown on the daily chart below. The currency pair began its upward journey immediately after the announcement of vaccines that would eliminate the coronavirus and the results of the US presidential election.

The EUR/USD broke out of the support level at 1.1601, reaching the resistance level at 1.2309, its highest since April of 2018. 2020 trading closed by stabilizing around the 1.2215 level. The currency pair began trading in 2021 with a positive attitude, but is still cautious as the pandemic rages on. Despite vaccination campaigns, the final elimination of the epidemic will still take more time.

During the past week, it was announced that the initial US unemployment claims for the week ending December 25th were lower than expectations of 833,000, at 787,000. The performance of continuing claims for the previous week were also lower than expectations, with 5.219 million versus 5.39 million. Prior to that, it was announced that the Chicago PMI for December beat expectations of 57, with a reading of 59.5. November pending home sales missed the expected change of 0.0% (month-on-month), with a change of -2.6%.

Spain's preliminary CPI for December missed expectations (monthly) of 0.3% with a change of 0.2%. Annualized, it outperformed the estimated change of -0.7% with a change of -0.5%.

The euro is still widely seen as a potential beneficiary of a further expected depreciation of the US dollar in 2021. The single European currency has weakened against all of the major currencies during the last hours of 2020 trading, although its annual gains were still higher than its competitors.

The rate of the euro against the US dollar was higher by 9.55% for the year 2020 and was recorded at 1.2309, a level unprecedented since the first days of 2018. The largest single contribution to the euro's strength was the decline and collapse of the US dollar at the hands of the Federal Reserve and the United States Treasury.

Europe’s economies, like many other countries in the developed world, have long been unable to generate the inflationary pressures that the European Central Bank (ECB) has mandated to bolster its monetary policies. But with interest rates in the Eurozone reaching new depths in September 2019, the euro now offers investors a fixed, inflation-adjusted return or "real interest rate". Accordingly, “real interest rates” are still negative in the Eurozone - as they are elsewhere - but they are no longer falling like those in the US and certainly not with the momentum of inflation-adjusted returns in America. This is why many analysts expect the EUR/USD pair to rise to 1.25 by the end of 2021.

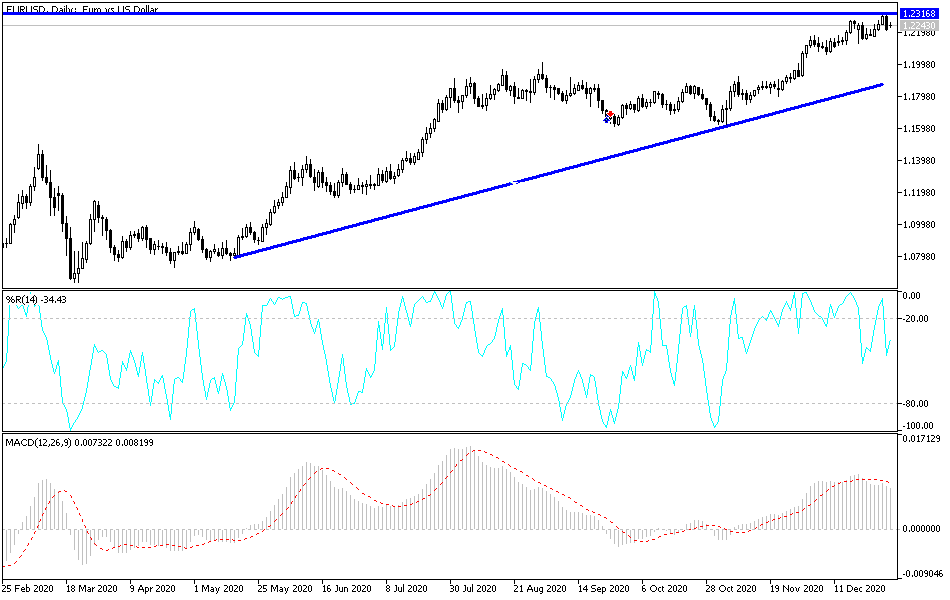

Technical analysis of the pair:

In the near term, and according to the performance on the hourly chart, it appears that the EUR/USD is trading within the formation of an ascending channel, which indicates a significant short-term bullish bias in market sentiment. The pair has recently retreated to approach the oversold levels of the 14-hour RSI. Accordingly, the the bulls will target short-term profits around 1.2267, or higher at 1.2300. The bears will look to pounce on the current pullback by targeting gains around 1.2188 or below at 1.2151.

In the long term, and according to the performance on the daily chart, it appears that the EUR/USD is trading within a sharp, ascending wedge formation. This indicates a strong long-term bullish bias in market sentiment. Accordingly, the bulls will look to extend this rally towards 1.2388 or higher to 1.2529. On the other hand, bears will be looking to pounce on profits down around 1.2066, or lower at 1.1914.

Today's economic calendar:

In the Eurozone, the Industrial Purchasing Managers' Index (PMI) reading for the Eurozone economies will be announced. From the United States, the rate of construction spending will be announced.