Bearish case

Short the EUR/USD since the dollar seems to be prevailing.

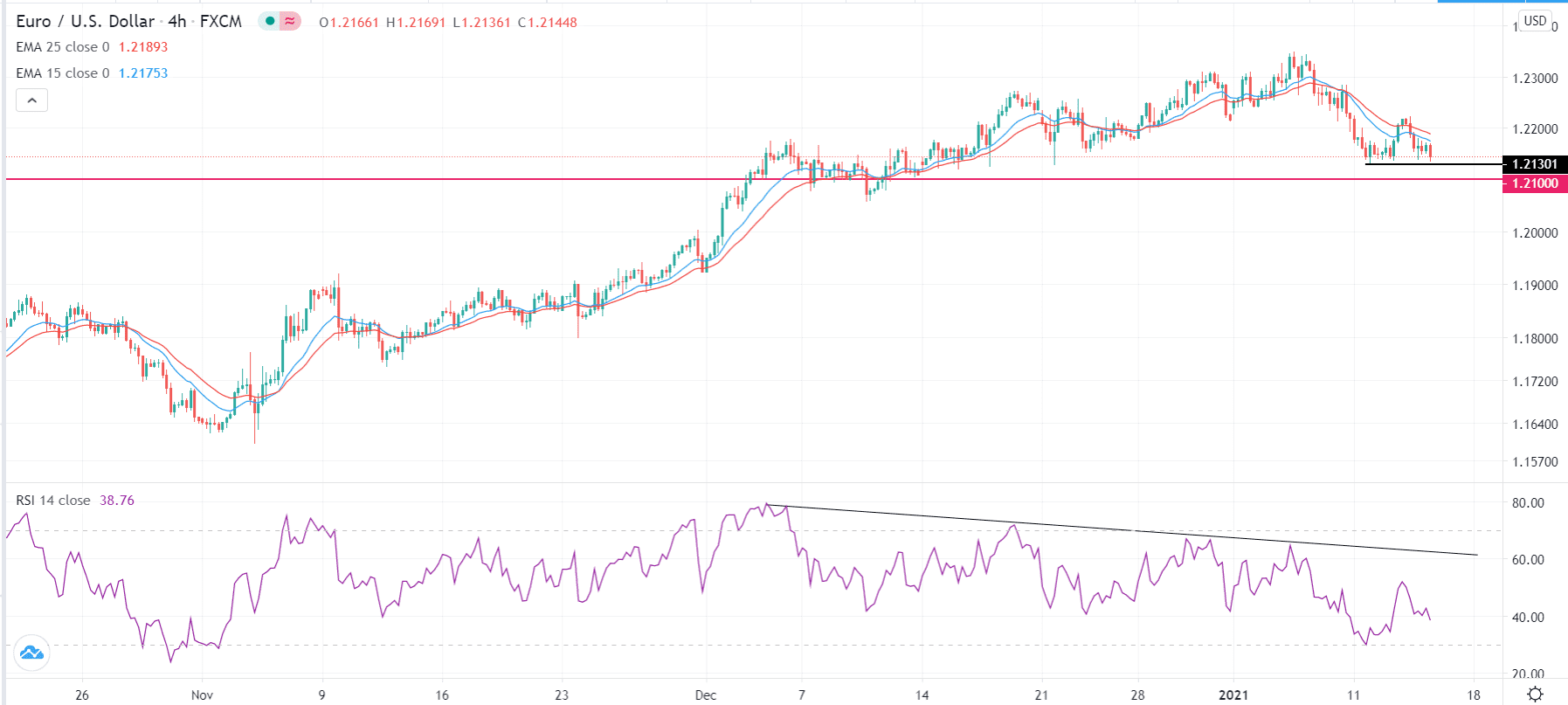

Have a take-profit at the psychological level at 1.2100.

Add a stop-loss at Tuesday’s high at 1.2225.

Bullish case

Set a buy stop trade at 1.2225.

Add a take profit at 1.2300.

Set a stop loss at 1.2145.

The EUR/USD is under pressure as some investors and analysts start betting on a rebound of the US dollar. It is trading at 1.2145, which is 1.70% below this year’s high of 1.2345.

Fed Officials Turn Hawkish

The dollar is falling as some members of the Federal Open Market Committee (FOMC) sounded hawkish in their statements this week. In a statement, Esther George of Kansas City Fed said that inflation could move faster than expected. This in turn will push the Fed to change its current policy faster than expected.

The same sentiment was repeated by other members, including Eric Rosengren, Loretta Mester, Richard Kaplan and Raphael Bostic. Later today, the EUR/USD will react to a statement by Jerome Powell, the Fed chair.

Financial analysts have also started changing their views about the dollar. In a report this week, analysts at Danske Bank said they expect the EUR/USD to fall by about 5% this year. They argued that the US unemployment rate will likely drop to below 4% this year while the inflation will rise above 2%.

The latter point is possible as evidenced by the US inflation numbers released yesterday. The data showed that the headline consumer prices rose by 1.4% while the core prices rose by 1.6%.

Later today, the pair will also react to a speech by Joe Biden, who will talk about his stimulus plans. The speech will possibly include more funds for individuals, state and local governments, schools, and vaccine distribution, among others. The price tag for this funding could add up to more than $3 trillion. This is substantial considering that the US has more than $27 trillion in debt. The pair will also react to the ECB monetary policy statement.

EUR/USD Technical Outlook

The EUR/USD price has been in a downward trend this week. On Monday, it fell to a low of 1.2130, which was the lowest level since December 31st. It attempted to rebound but found resistance at 1.2225. On the four-hour chart, the pair is now attempting to move below Monday’s low of 1.2130.

The 15-period and 25-period moving averages have made a bearish crossover while the bearish divergence pattern has continued to form on the Relative Strength Index (RSI).

Therefore, the pair will likely break-out lower as bears target the next psychological support at 1.2100. On the flip side, a rise above 1.2225 will invalidate this trend.