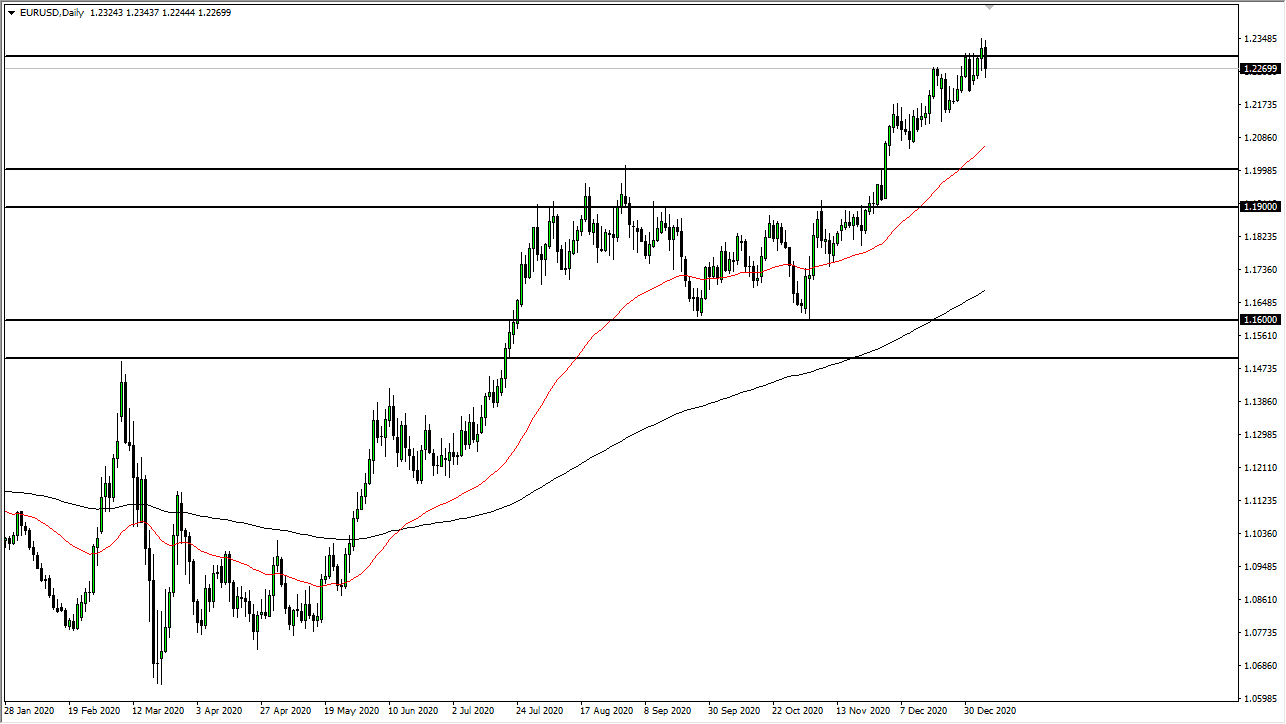

The Euro had initially tried to rally during the trading session on Thursday but has given back the gains as the 1.23 level offers resistance yet again. At this point, it looks as if the Euro is a little overextended so it does make sense that we could get a bit of a pullback. Furthermore, it is difficult to imagine that we simply shoot straight up in the air, especially as the Friday session features the Non-Farm Payrolls announcement. I think that given enough time we will probably see some type of knee-jerk reaction to the downside, but I do believe that buyers will be more than willing to get involved in pick up value if and when it occurs.

The 50 day EMA currently sits at roughly 1.21, and that should offer support. The market sees a lot of choppiness between here and there, meaning that there is not necessarily a ton of conviction between here and there. That does not necessarily mean that we have to break down to that level, just that we could. Furthermore, if there is any day that is going to accelerate that move, it is going to be NFP Friday.

To the upside, there is a lot of noise between the 1.23 level and the 1.25 handle, and I think it is can it take a lot of effort to break through this area. The need to be some type of catalyst to get things going, and although the trend most certainly looks as if it is trying to rise from here, the reality is that there is a lot of order flow to chip through. Yes, we have stimulus coming from the United States, but the question now is whether or not it is going to be big enough to push things through the 1.25 handle?

As for myself, I will be buying dips going forward, although I am not looking for big trades at the moment. I think simple “buying the dips” trading on short-term charts probably continues to be the way that we have to trade this market in the meantime. That being said, if we can finally break above the 1.25 handle down the road, that opens up the floodgates to much higher pricing. The road to that level is paid with a lot of choppiness though and therefore it is something I am looking through the prism of long term trading more than anything else.