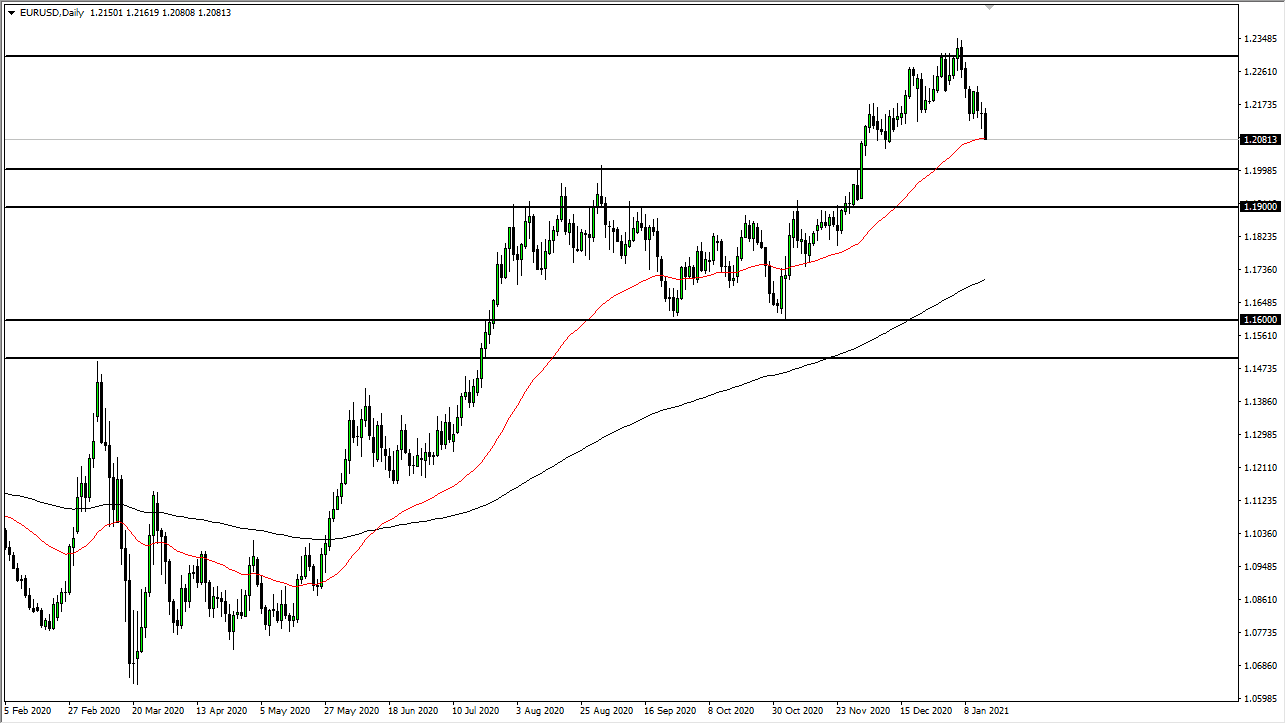

The Euro fell rather hard during the trading session on Friday, as we have broken down towards the 50 day EMA. This is the beginning of significant support, but I think that there is even further to go based upon the fact that we are closing towards the bottom of the candlestick, and of course there is much more important support underneath. The 1.20 level is the beginning of major support that I think it extends down to the 1.19 handle. In other words, we may have up to 200 pips worth of downward pressure before we can continue the overall upward trend.

During the week, we have seen interest rates in the United States rise as people are demanding more yield to let the US government borrow money. This makes sense, because they are doing everything, they can stimulate the economy and are likely to spend insane amounts of money. Joe Biden initially asked for a $1.9 trillion stimulus package, but the reality is probably closer to the $1.1 trillion level. That being said, it is likely that stimulus will continue to weigh upon the US dollar over the longer term. With this being the case, I would anticipate that somewhere between the 1.20 and the 1.19 levels we will see buyers jumping in. I have no interest in buying it now, and to be honest I do not even necessarily think that you can be a seller for anything other than a short-term scalp type of trade.

I do believe that ultimately this is a market that probably try to get back to the 1.23 level, an area that offers resistance all the way to the 1.25 level. If we can break above there, then we can kick off the next big leg higher, but I think that is a story for later this year, and not anytime soon. I assume that we are simply going to bounce around in this roughly 300 point range as the Euro typically does anyways. Choppiness is the norm, not the exception and I do not see this being any different this time around. With all that being said, I am simply looking for short-term buying opportunity but will base its upon some type of daily close that suggests the buyers have returned to try to pick things back up.