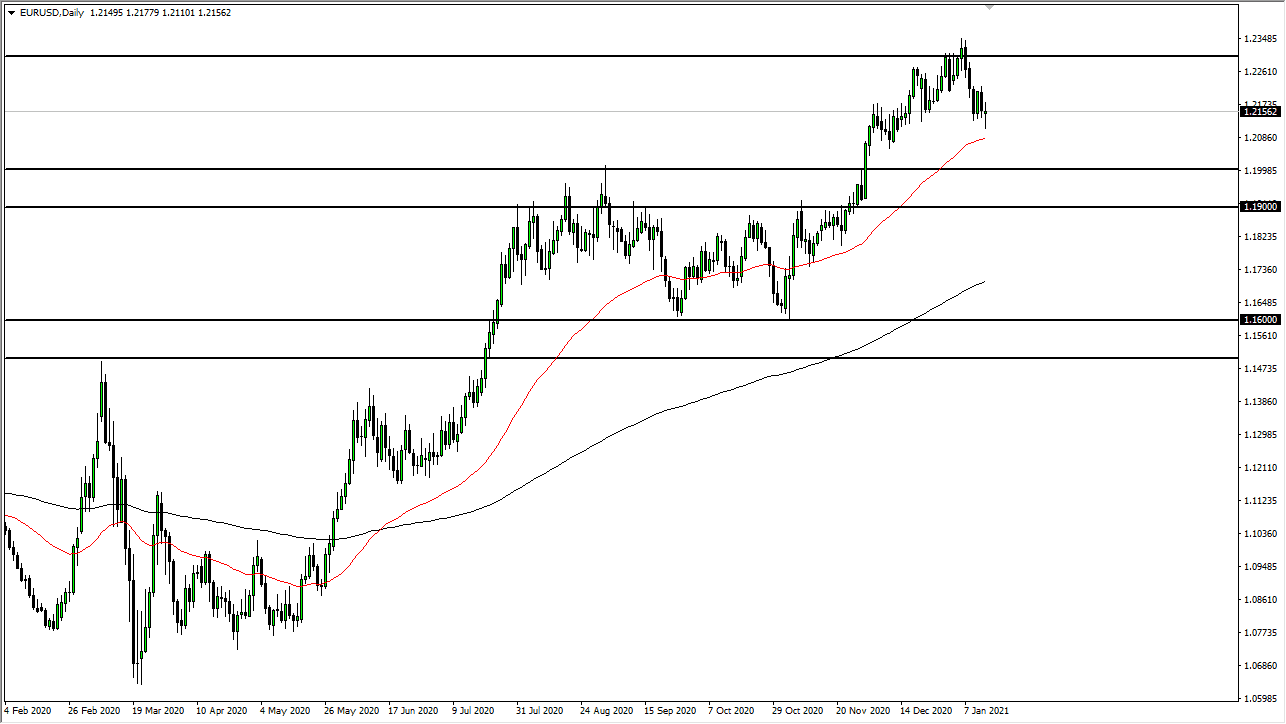

The Euro has gone back and forth during the course of the trading session on Thursday, forming a bit of a neutral candlestick, as it suggests that we are going to see the 1.2150 region offer certain amount of support. Underneath there, I think the 50 day EMA underneath will offer a significant amount of support as well, and that being the case it is likely that we will allot of noisy behavior right around this general vicinity. Furthermore, the interest rates in the 10 year note in the US will continue to have its influence on the markets as well.

The volatility that we have seen over the last 24 hours does suggest that perhaps we are going to continue to see a lot of confusion, but looking at the market, you can see that the trend is still very bullish over the last several months, but at this point you should also pay attention to the fact that the 1.23 level has offered significant resistance, as well as a massive support level in the past. In fact, this general vicinity is important, reaching towards the 1.25 handle as it is a major “zone of importance” when it comes to the markets.

The 1.20 level underneath is massive support that extends down to the 1.19 level, which of course is a 100 point range that people will be paying attention to, where we had seen a lot of noise in the past. I think in the short term, we are basically bouncing between the 1.20 level on the bottom and the 1.23 level on the top. Looking at this chart, we most certainly are running out of momentum if nothing else, and I think that will continue to be the mainstay of this market, as it does tend to be choppy anyway. With this in mind, I think that back-and-forth range bound trading will probably continue to be the way we trade. Eventually, we will break out of the area, and once we do then it gives us a longer-term signal as to which direction to be involved in. Pay attention to the US Dollar Index, and of course the 10 year Treasury Note in the United States, as it will give you a bottle close as to where this pair could go for the bigger move.