The euro got hammered during the trading session again on Friday, just as it did on Thursday. This is probably less of an indictment on the euro itself, and more likely a reaction to the increase in yields when it comes to the 10-year note in America. With the 10-year yield breaking above 1%, that strengthens a currency in this type of environment. Whether or not it continues might be a completely different story, but in the short term, it certainly looks as if we probably have a bit of follow-through.

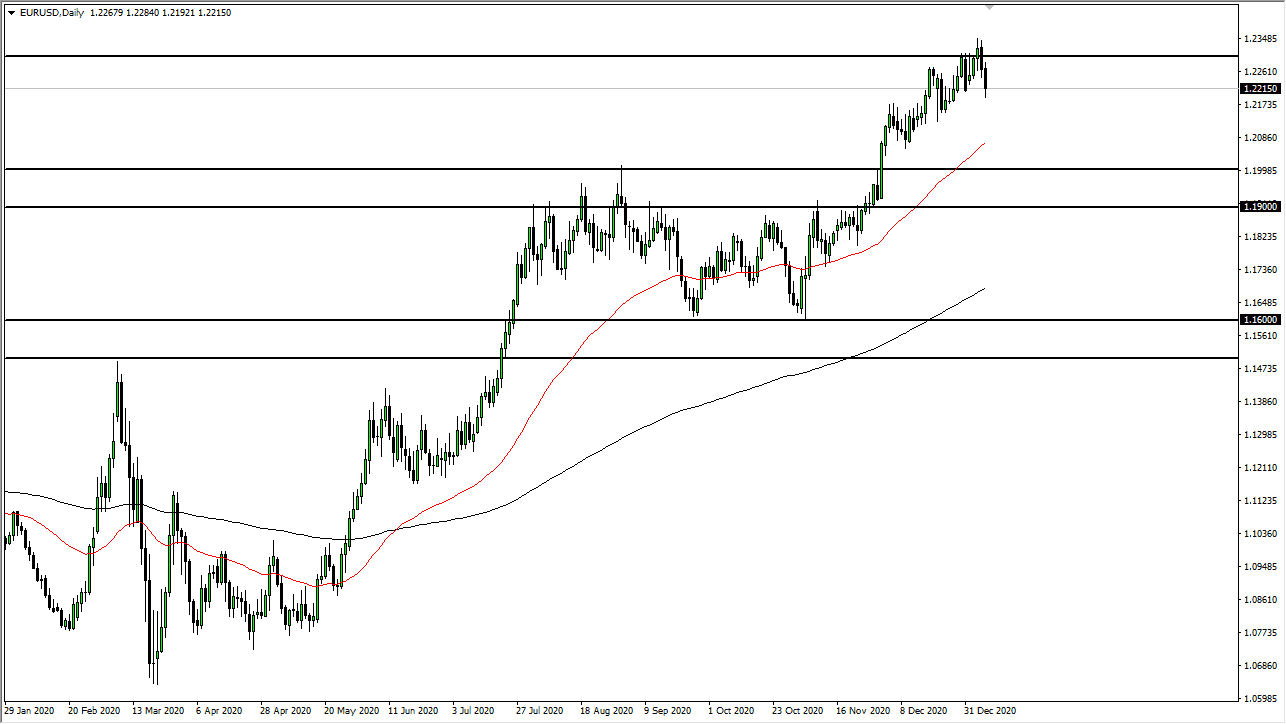

The euro has been very strong for a while, and I do not think that we will break down easily. More likely than not, the market will probably go looking towards the 50-day EMA underneath, which is closer to the 1.21 handle. After that, we have the 1.20 level that is psychologically and structurally important, just as the 1.19 level underneath is important based upon the fact that market memory comes into play based on that previous “zone of resistance.”

You should also pay attention to the candle, because we are closing towards the bottom of it, which suggests that there could be a bit of follow-through. The idea that we could continue to go lower makes sense, because we have been going straight up in the air for some time. Even if we do break down towards the 1.20 level, I do not think that that spells doom for the euro; I think it is just a nice pullback in the short term to justify the overall uptrend that we have been in.

Alternatively, if we were to turn around and break above the 1.23 level, we would have a lot of work to do to get through to go to the 1.25 handle. It is not until we get above the 1.25 level that I think we will get a long-term “buy-and-hold” type of position. At this point, if you are patient enough, you should get an opportunity to start buying again, but in the short term, I think simply standing on the sidelines might be the best way to take advantage of what has been a strong move and should continue to be so. I do not think that the trend has changed completely.