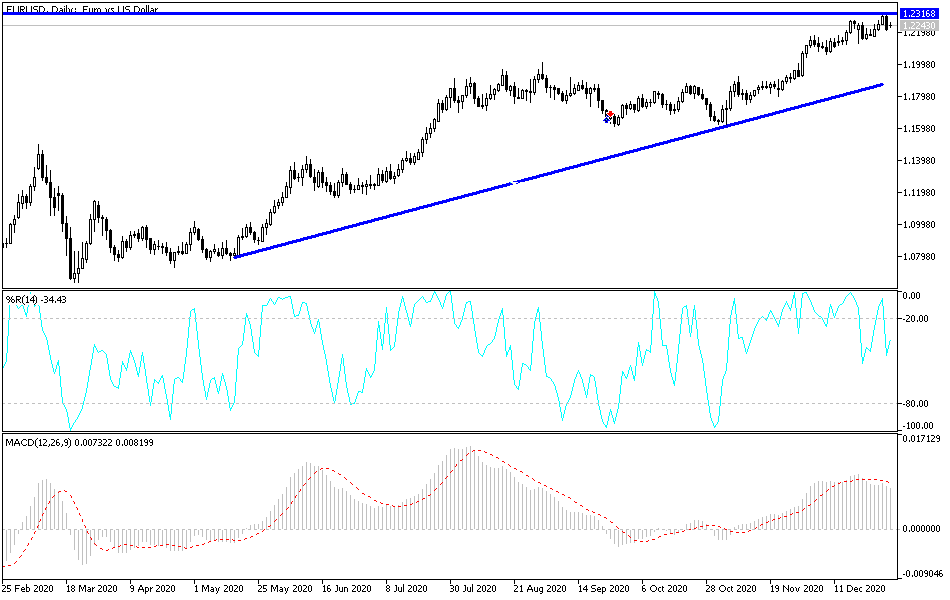

The euro pulled back from major resistance during the trading on Thursday, which would have been a bit thin due to New Year’s Eve. The 1.23 level has been very difficult to imagine simply slicing through, because it is a major resistance barrier that extends all the way to the 1.25 handle. When you look at the longer-term charts - even the monthly chart - you can see that this 200-point area is going to be difficult to overcome. If we do, that opens up a move for the euro that would be measured in months, not weeks.

After forming the candlestick that we did on Thursday, it is possible that we could pull back a bit to try to find support underneath, and that is exactly how I would approach the market, looking for value. I believe that the red 50-day EMA is supportive, and most certainly the 1.20 level is underneath there. I would wait for a supportive daily candlestick, and then start to put money to work. The Federal Reserve will do what it can to bring down the value of the US dollar, which has been obvious for a while.

For what it is worth, the MACD is starting to drift lower while the euro has been drifting higher. This is a little bit of a divergence, but I do not necessarily think that we are looking at the beginning of something major. This is simply a market that has gotten a bit extended and needs to pullback in order to find a bit of momentum. Furthermore, it was the end of the year, which is something that you have to pay attention to as well, because there would have been a lot of position squaring, while there would have also been quite a few traders out there unwilling to put money to work. What we see here is a market that is pulling back in order to build up enough momentum to take on that major resistance barrier above. Pay attention to the US Dollar Index, because if we break below the 88 handle, that means this market will almost have to break out to the upside.