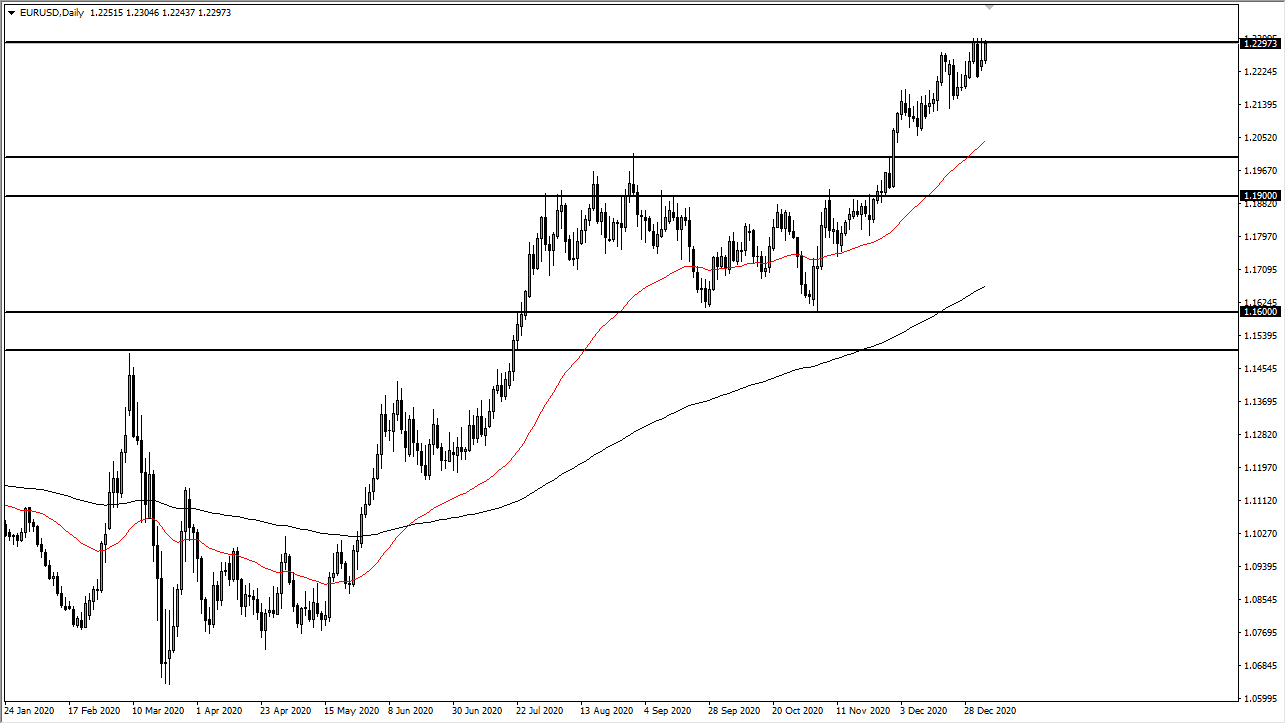

The euro rallied again during the trading session on Tuesday, as the 1.23 level continues to cause a significant amount of pressure. Above there, there is a lot of noise between the 1.23 level and the 1.25 level, so it is going to be a grind higher more than anything else. At this point, it looks like the market continues to buy short-term pullbacks, as the US dollar is getting sold off against almost everything.

The question at this point will be whether or not we can break out to the upside easily, but one thing you can see is that we continue to try to get above it, so it is likely that we will. After all, there can only be so many sellers, and once we get through that liquidity it is likely that we can continue to go higher. Looking at this chart, there are plenty of areas underneath that could offer support, but the most obvious level would be somewhere near the 50-day EMA which is underneath and marked red on the chart. The 1.20 level underneath is also massive support that extends down to the 1.19 handle.

There is a lot of noise between here and the 1.21 handle as well, so it would be difficult to even break down to those support levels on the bottom. It is only a matter of finding short-term pullbacks to show signs of support in order to get long, or to get to a fresh, new high, but you would have to keep an eye on the fact that it is going to be very choppy to the upside. It is probably easier to sell the US dollar against other currencies, specifically the New Zealand dollar and the Australian dollar. It is not that this pair cannot go higher, it is just that it might be a bit slower than many of the other currencies out there. This is a pair that I have no interest in shorting, because the US dollar itself is in so much trouble. Furthermore, pay attention to the US Dollar Index, because if it breaks down below the 88 handle, it is going to be like a rocket fuel for this pair.