Euro traders went back and forth during the session on Wednesday trying to figure out what will happen to the US economy and monetary policy now that Democrats control all three branches of government. Initially, we had seen a lot of US dollar selling, but that turned around as Wall Street started to think about the reality that a lot of the moderates in the Democratic Party would have much more power than initially thought, and that there would be profligate spending. The market is likely to hear a lot more noise than anything else going forward.

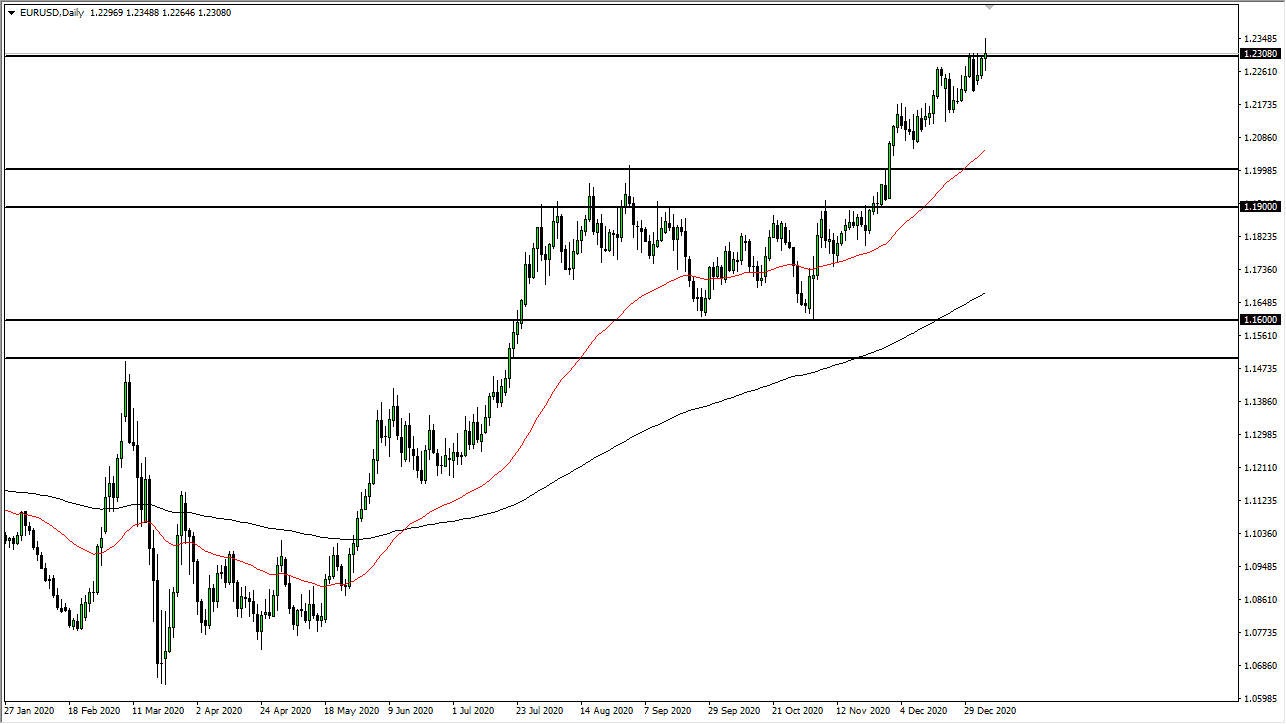

I believe the US dollar will probably continue to lose value over the longer term, but for me it is obvious that there is resistance at the 1.23 level that extends to the 1.25 handle. The candlestick from the trading session on Wednesday does suggest a little bit of confusion, so a pullback could be coming. That pullback should end up being a nice buying opportunity, though, because this is a market that has been in an uptrend for some time. The 50-day EMA sits just above the 1.20 level, which also offers a significant amount of support.

In order to break above the 1.25 level, we probably need to see a certain amount of momentum building, so this pullback should make sense. The market almost certainly will try to get there, but the question is more about the momentum. I do not have any interest in shorting this pair, because as long as both the Federal Reserve and the US government are intent on bringing down the value of the greenback, it will eventually happen. The US Dollar Index is still in a massive support zone, so it will be interesting to see whether or not it can truly break down. If it does break down below the 88 handle, it is likely that the market could see the euro not only get to the 1.25 handle, but perhaps even break through it. In the meantime, simply buying the occasional pullback or dip probably makes the most sense in this particular situation. Longer term, we could have much further to go, but obviously there are a lot of moving pieces right now with the coronavirus spreading throughout the world.