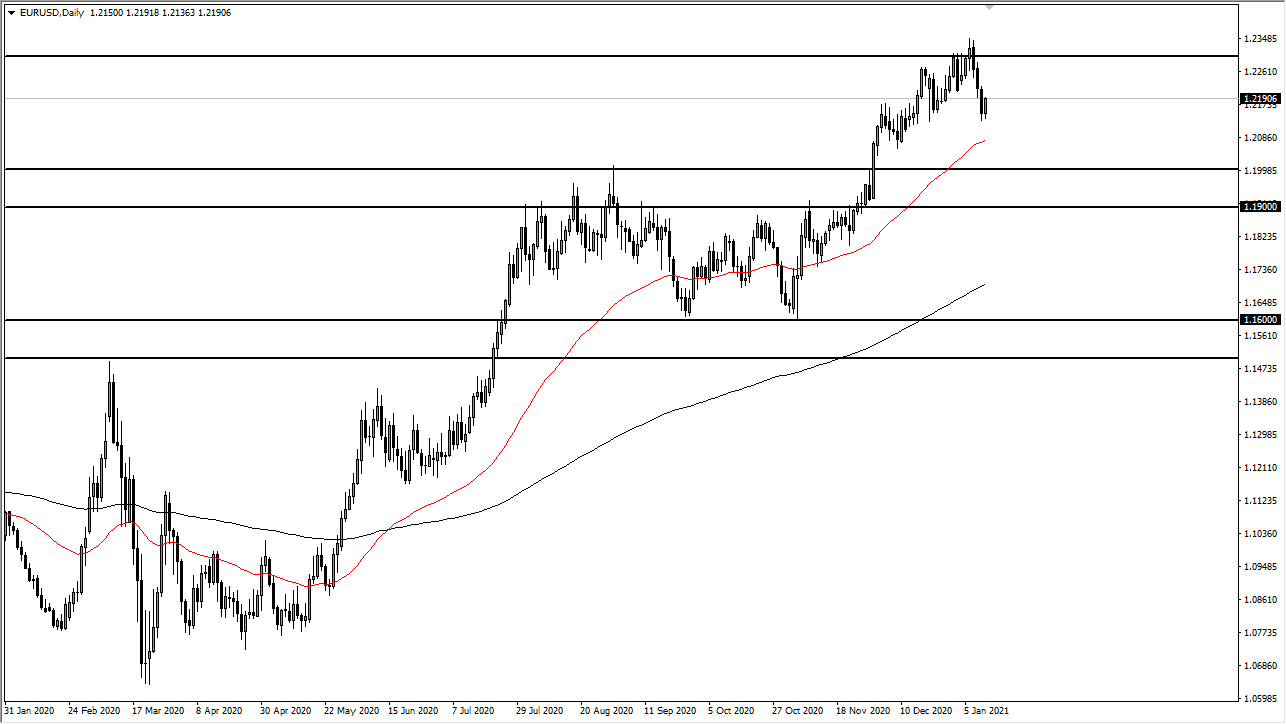

The euro bounced quite a bit during the trading session on Tuesday, as the 1.2150 level underneath has offered a bit of support before. We had recently just fallen three days in a row and we are in an uptrend, so one has to wonder exactly how much we could be selling off in the short term. Value hunters return to the market eventually, which is exactly what we are starting to see now. The 1.23 level above recently caused quite a bit of resistance, and I think it will take quite a few attempts to finally get above there.

To the downside, the 50-day EMA sits underneath near the 1.21 handle, and after that we have the 1.20 level underneath which is also supportive as well. The area between 1.20 and 1.19 has been important in the past, so that is another area where we may see support. In fact, it is not until we break down below the 1.19 level that I could imagine thinking about selling the market. At this point, the market continues to offer value on dips, and with stimulus on the horizon, it makes sense that we would continue to see anti-US dollar sentiment. After all, the more US dollars that are printed by the Federal Reserve, the more likely we are to see the greenback lose value. By simply waiting for some type of dip, value hunters are more than likely going to look at this as another opportunity to perhaps pick up enough momentum to finally break above the 1.23 level, as there is a lot of noise all the way to the 1.25 handle.

At this juncture, the market will probably continue to be very choppy to say the least. We had gotten a bit ahead of ourselves before, so this pullback will be looked at through the prism of being healthy for a long-term move, in my best estimation. This does not necessarily mean that we will just slice right through the 1.23 level; rather, that the market is just getting more comfortable with trying to build up the necessary move to get above it.