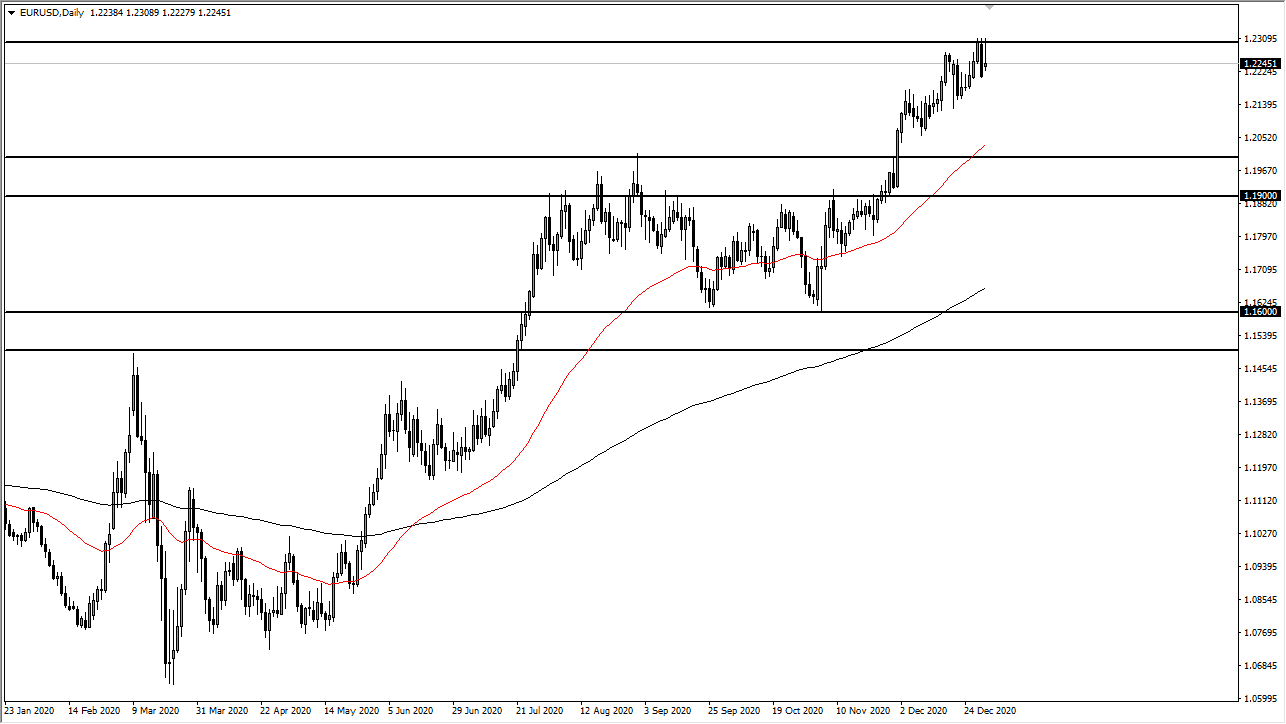

The euro gapped higher to kick off the year, showing signs of strength, and then took right off to slam into the 1.23 level by midday. That is an area that has been resistance more than once, and the fact that we sold off from there is a bit telling as we have formed a very ugly candlestick for the day. I do not necessarily think that you should be selling this pair, but I do recognize that breaking above the 1.23 level is about to become a serious problem. The last three sessions have seen the market crack just above that level, only to be rejected each time.

In order to break above the 1.23 level, you need to have either a major catalyst or a bit of momentum building, which means pulling back from here. In the scenario of the catalyst, the quickest one could be if the Democrats take control of the Senate after the Tuesday night runoff. If that happens, it would be very negative for the US dollar and the euro would be one of the major beneficiaries. However, if that does not happen, then we need to start paying attention to exactly what happens with stimulus. This market probably needs to pull back to entice more traders to get long again, perhaps even as low as the red 50-day EMA on the chart. This is mainly because I see the 1.23 level as the beginning of significant resistance that extends to the 1.25 handle. It is going to take a lot of work to chew through a “thick zone of 200 pips.”

The red 50-day EMA is now above the 1.20 level, so I think that level may not even be attempted again. Short-term pullbacks will continue to attract people wanting to get long of this currency, as the US dollar has far too many things working against it currently. The euro is unfortunately tied to the European Union, but right now most economists are expecting that the EU outpaced growth in the United States for the year, and that should continue to put a little bit of upward pressure on the euro itself.