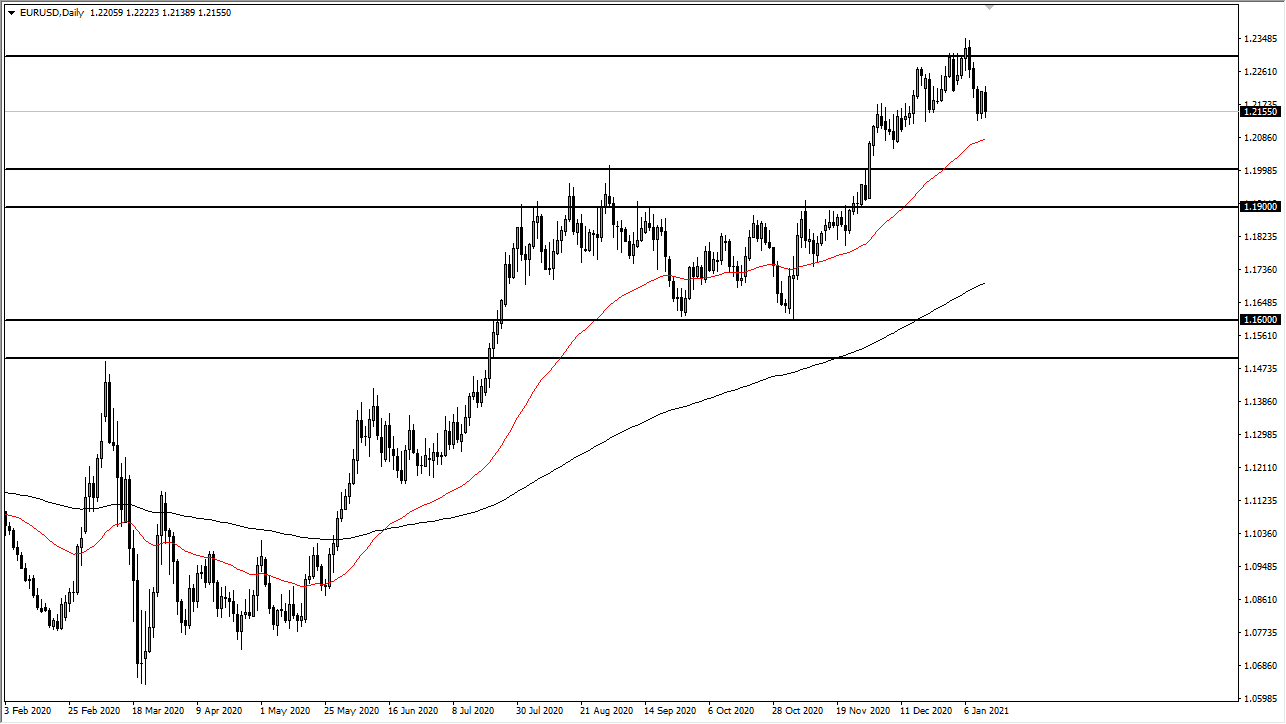

The euro initially tried to rally during the trading session on Wednesday, but gave back the gains to show signs of exhaustion yet again. This is a market that should continue to be very noisy, but at this point, we are trying to figure out what to do with the 1.2150 level. This is an area that has a significant amount of previous structure movement out of it, so I think that we could see a little bit of choppiness in this area, and perhaps even more importantly, we could see a bit of stabilization going forward.

The euro had gotten a bit overextended, as it reached towards the 1.23 level. When you look at the weekly chart, you can see that there is a lot of noise between the 1.23 level and the 1.25 level, so this should not be a huge surprise. When you look at the US Dollar Index, we are also sitting on a significant amount of support, and that also suggests that perhaps the US dollar had gotten a bit oversold. Keep in mind that the two charts tend to move in opposite directions, so that is worth paying attention to.

The 50-day EMA sits just below, sitting around the 1.21 handle. I think that could also be a target for buyers to get involved “on the cheap” when it comes to this market, which still looks very bullish. As long as we have massive amounts of stimulus coming out the United States, eventually you will see this pair rally. A pullback from here will not only see support at the 50-day EMA, but we also see a significant amount of support at the 1.20 level as well. This chart it is very likely to see a lot of sideways action, which is good for the longer-term trend. In fact, it is not until we get below the 1.19 level that I would be concerned about the overall uptrend. The market is probably one you need to be seeing as a “buy the dips” type of scenario. I have no interest in shorting this pair in the short term.