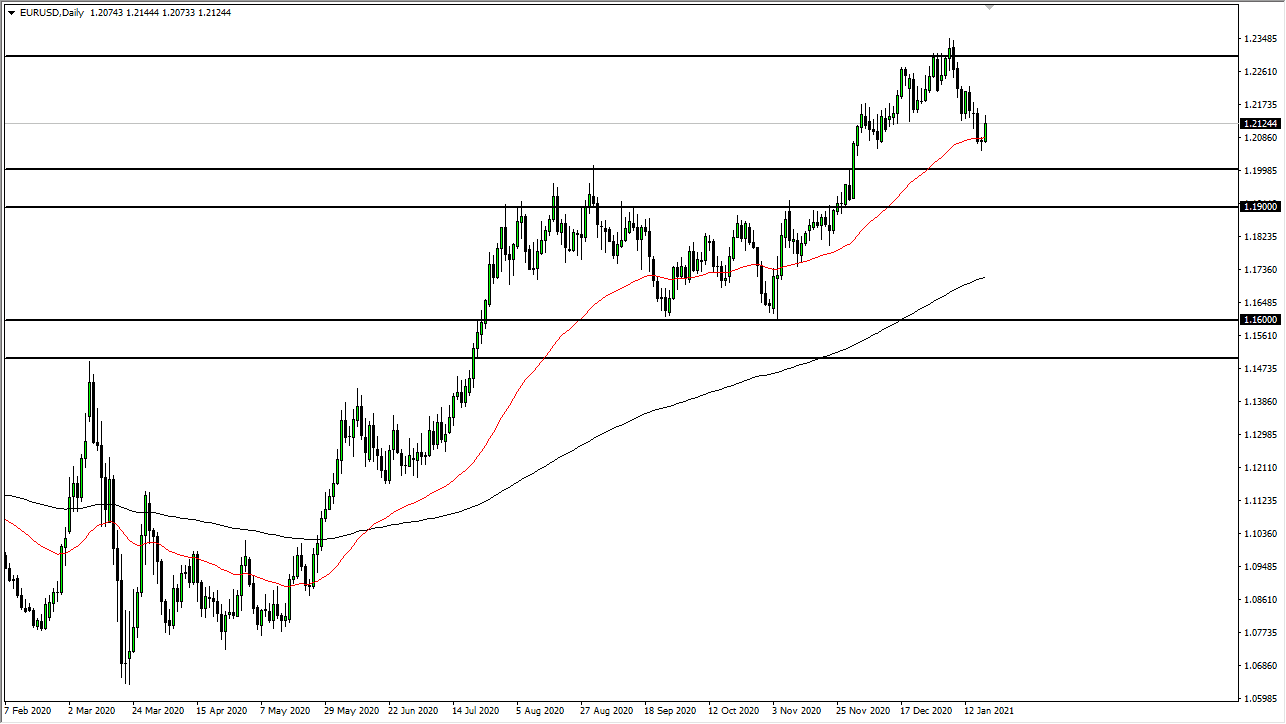

The euro rallied significantly during the trading session on Tuesday as we bounced from the 50-day EMA. Looking at this chart, the market is likely to continue going back and forth, as we have sold off quite drastically but still have an oversold US dollar in general. As long as that is going to be the case, then I think this is a market that will continue to bounce around in this general vicinity, especially as the 50-day EMA is right here. If we break down from here, then we could go looking at the 1.20 level underneath, which is a large, round, psychologically significant figure, and an area that traders have paid attention to more than once.

At this juncture, I believe that the market will continue to bounce around between the 1.20 level on the bottom and the 1.23 level on the top. This is a market that is trying to figure out whether or not we can continue to go higher, which is something to think about due to the fact that we had spiked so much recently. I think the very least we need to do is grind away some of the froth in the market, so I think we are going to continue to bounce around in this 300-point range. The 1.23 level above is significant resistance, and it is going to take quite a bit to break above it. In fact, I believe that resistance extends all the way to the 1.25 handle, and it is going to take a significant amount of effort to get above there.

Pay attention to the US Dollar Index, because if we break down below the 88 handle, it should coincide quite nicely with the breakout in the EUR/USD pair. We have seen a bit of recovery by the greenback recently, but it is still relatively oversold, so we should continue to hear a lot of noisy behavior in this general vicinity. Looking at the size of the candlestick for the trading session on Tuesday, you can see that there is a certain amount of momentum underneath, but I do not think that this is the beginning of a major melt up to the resistance barrier. If we were to turn around and break down below the 1.19 level, that could break down the market rather significantly. I do not see that happening in the short term, though.