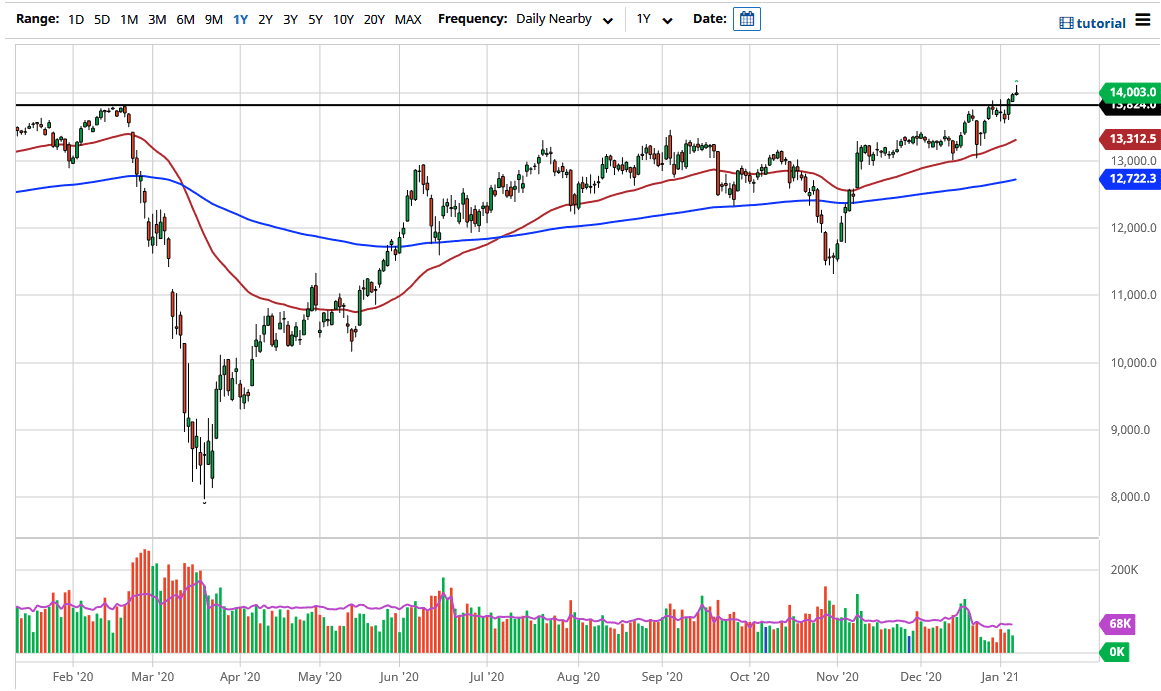

The DAX Index rallied initially during the course of the trading session on Friday, before turning around to form a shooting star. At this point, the market is sitting on top of the 14,000 level, but I think it is likely to see a pullback that looks towards the 14,800 level or so. We would then see a bit of a buying opportunity, as we have recently broken out.

The 50-day EMA is down at the 13,300 level, as it is more than likely going to attract a certain amount of attention as well. The 50-day EMA should be an area where a lot of money would flow into the market because it is in such a strong uptrend. I do not think we will get down to that area, but it is an area worth watching. On the other hand, if we were to break above the top of the shooting star on Friday, that would be a very bullish sign and it would continue to see the market go looking towards the 14,500 level, followed by the 15,000 level which is my longer-term target.

I have no interest in trying to short the DAX anytime soon, because the stimulus out there will continue to drive markets higher in general. This is especially true of the DAX, due to the fact that the German economy is so highly levered to exports, especially when it comes to heavier machinery and the like that will be so highly demanded around the West. German exports should continue to be major drivers of this index to the upside, and every time we pull back it will have people seeing an opportunity to take advantage of what seems to be an eminent breakout. In fact, it has only been a couple of days since we did break out, so this pullback should be simple and technical in its nature and give us an opportunity to play out a much longer-term target. I have a hard time imagining what could get me to start shorting the DAX, but I suppose a break below the 13,000 level might be the first step to changing my mind overall.