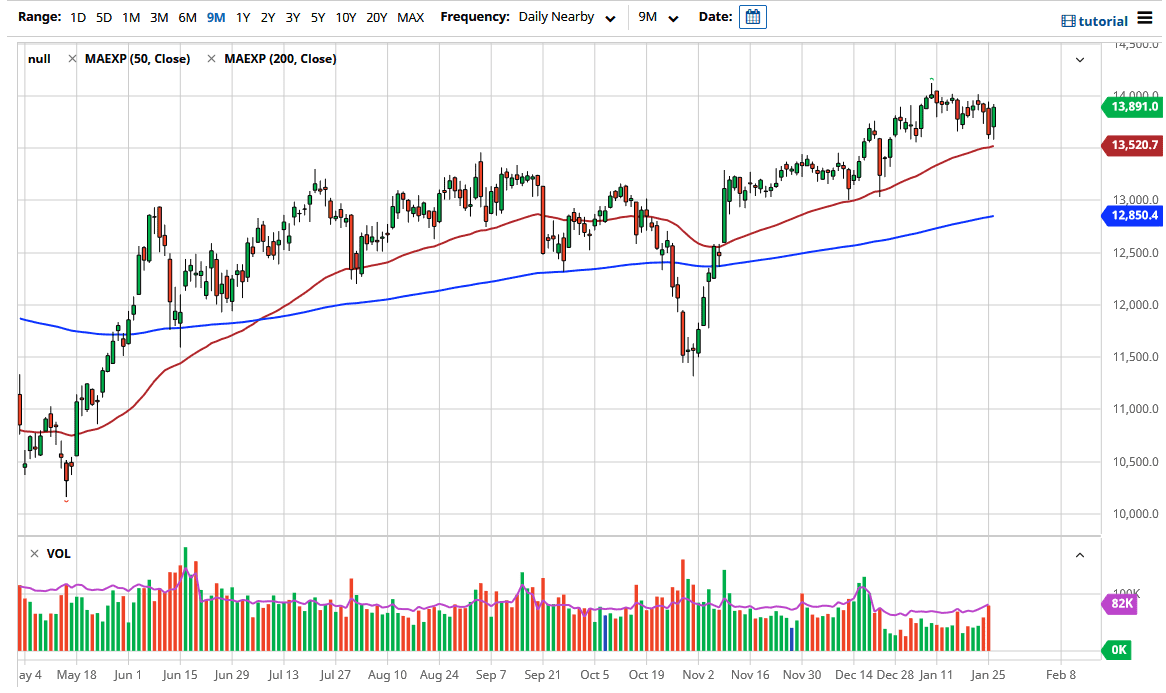

The DAX index initially gapped higher to kick off the trading session on Tuesday only to turn around and fall to fill that gap and reach towards the 50-day EMA underneath. At that point, the DAX rallied rather significantly, closing up well over 1.5% on the session, and looking towards the 14,000 handle above. This is an area that has caused some resistance as of late, but it looks as if it is only a matter of time before the buyers overcome that level. If and when they do, it is very likely that the DAX will then go looking towards the 14,250 level, followed by the 14,500 level.

The DAX is essentially a play on reflation around the world, with perhaps a lot of that circulating around the European Union. After all, Germany is a major industrial exporter, meaning that if we are going to have massive spending by governments around the world and perhaps more specifically the EU, Germany will be sending industrial equipment and the like to various other countries. This is good for exporters and should continue to power the DAX higher. However, one major issue that could come into play sooner or later is the euro and whether or not it starts to get “too strong.” Currently, the trade-weighted euro is not at extreme levels, but it is most certainly starting to creep up against the greenback.

The 50-day EMA underneath offers a certain amount of technical support, but at the end of the day, the trend going higher is really what you should be watching. This gives us an opportunity to buy the DAX when it gets to be a bit “cheap”, ensuring that we will continue to have a buy-on-the-dips mentality. Even if we break below the 50-day EMA, I think that the 200-day EMA rapidly approaching the 13,000 level will be an area that a lot of value hunters will pay close attention to as well. When I look at the DAX, I look at this as a “blue-chip stock index” for the European Union in general. In other words, for those who are more US-centric, it is essentially the “Dow Jones 30” of the EU. I believe that sets up quite nicely on the recovery trade.