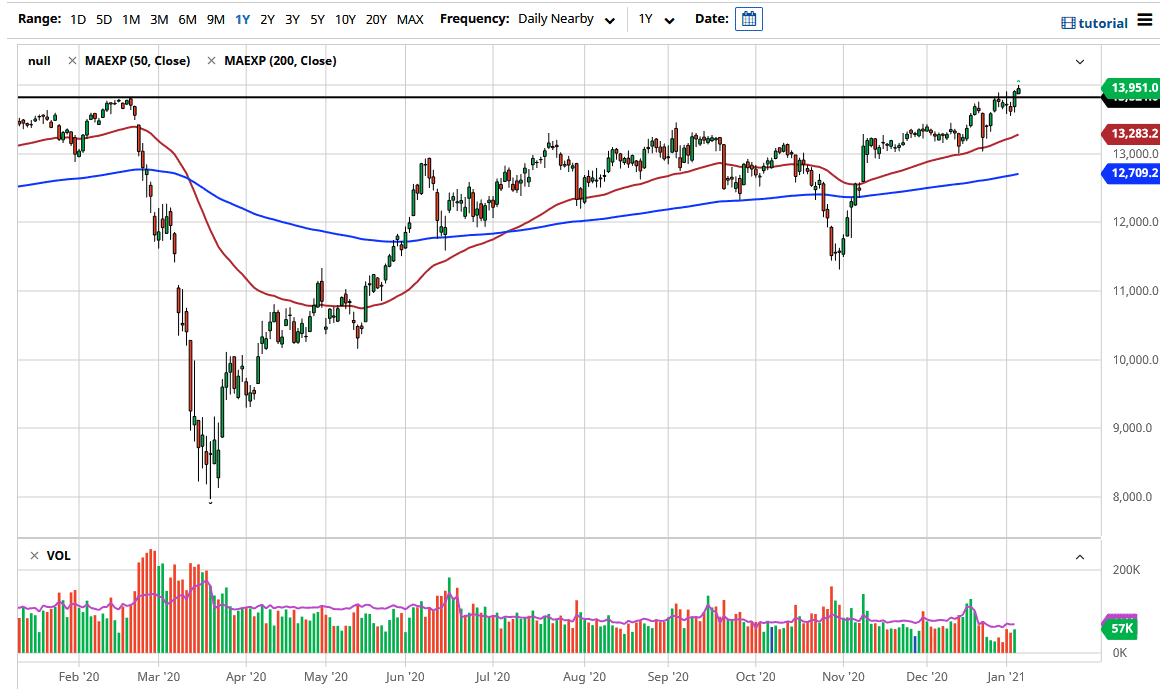

The German index had a strong showing on Thursday as we have broken above the previous highs. At this point, the market looks as if it is threatening the 14,000 level and could open up the door to much higher levels. Breaking 14,000 is of course a certain amount of psychological relief for the buyers, but the most important thing to pay attention to is the fact that the reflation trade seems to be full on, and that should help with various exporters coming out of Germany.

Remember, the DAX is heavily weighted with export laden companies, so this of course comes into play as well. Looking at the Euro, it has risen over the last several months, but it is still not at an extraordinarily high level, so it is likely that we will continue to see the “all clear” when it comes to German equities. Short-term pullbacks at this point in time should continue to offer plenty of buying opportunities as there has been an obvious break to the upside.

The target at this point should be the 15,000 level, as these moves tend to look towards large figures. That being said, the market is going to have the occasional pullback, and of course it might be a little bit quiet heading into the weekend. However, I do think that the market continues to see a lot of people trying to take advantage of value as it occurs, especially with the 50 day EMA underneath offering a buying opportunity. It is obvious that the market has been finding plenty of reasons to go higher, not the least of which of course would be the idea of stimulus globally. As economies around the world trying to wake up from the pandemic, there will be demand for “things”, and therefore German exporters will be one of the first places that people go looking towards in the European Union.

It is not until we break down below the 200 day EMA at 12,700 that I think we could see this market breaking down. The candlestick from the Wednesday session was rather strong, and the fact that we have continued this on Thursday does suggest that there is more momentum there waiting to pick up, and therefore I think it is only a matter of time before we would see acceleration.