Germany extended its COVID-19 lockdown as it struggles to contain the fast-spreading virus. The largest economy in Europe is the tenth-most infected country globally and has more than 350,000 active cases and above 25,000 new daily ones. Optimism over the rollout of several COVID-19 vaccines pushed the DAX 30 into its resistance zone. It includes the psychological 14,000 level, but the upside is exhausted.

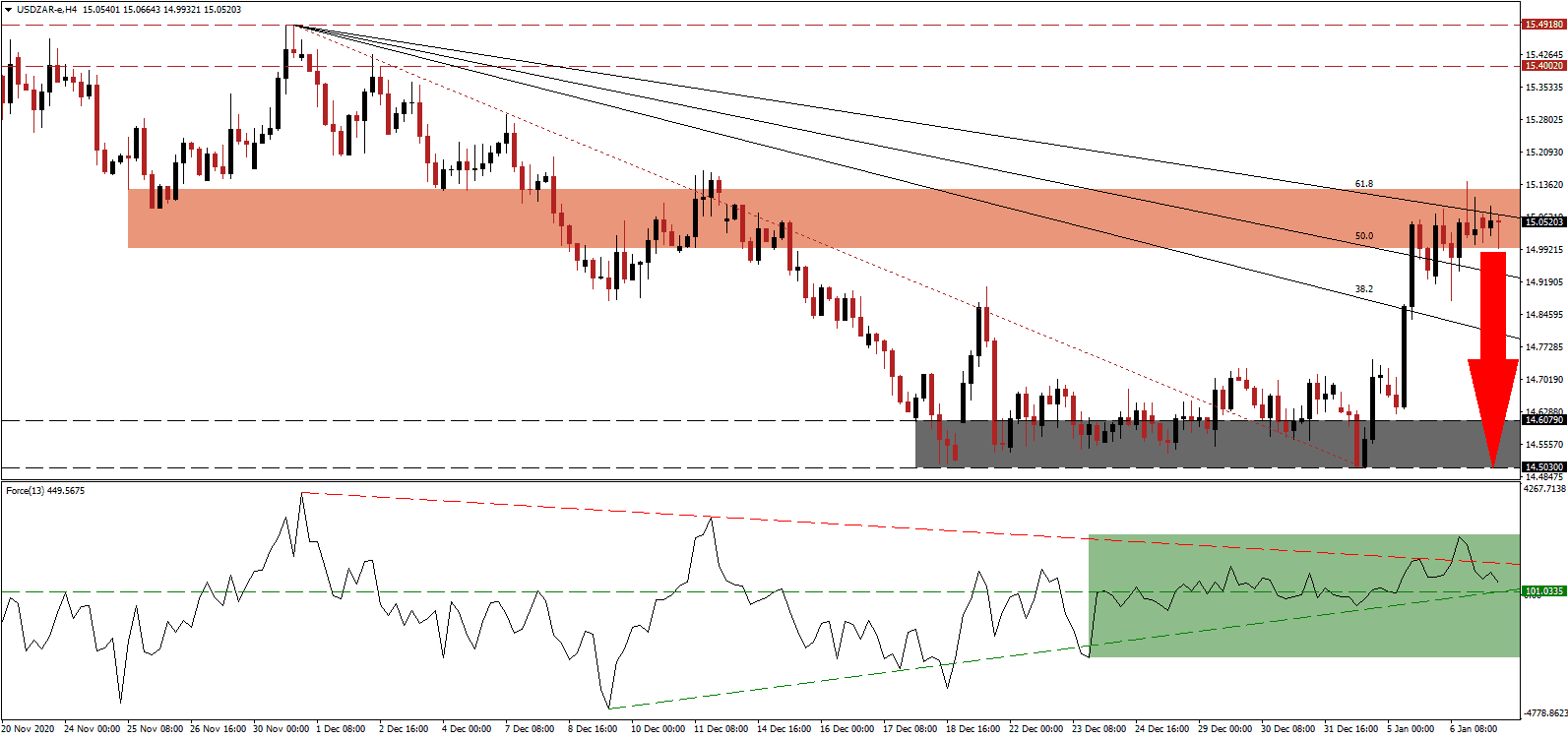

The Force Index, a next-generation technical indicator, is trapped between its ascending support level and its descending resistance level, as marked by the green rectangle. A collapse below its horizontal support level is favored to accelerate into a breakdown below the 0 center-line. It will place bears back in complete control over price action in the DAX 30 and spark a swift pullback.

While German factory orders rose, the data point released this morning covered November, before Germany introduced its second nationwide lockdown and ahead of inventory rebuilding for the holiday shopping season. The DAX 30 started 2021 with a sharp rally amid misplaced economic optimism. It is now challenging its resistance zone between 13,908.7 and 14,002.7, as identified by the red rectangle. A breakdown is expected to follow.

Finance Minister Olaf Scholz tried to reassure financial markets that Germany can manage through a prolonged COVID-19 related lockdown and predicts lower government debt levels than during the 2008 global financial crisis. The DAX 30 remains well-positioned for a correction into its short-term support zone between 13,373.0 and 13,458.1, as marked by the grey rectangle. The ascending 61.8 Fibonacci Retracement Fan Support Level entered this zone.

DAX 30 Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 13,935.0

Take Profit @ 13,375.0

Stop Loss @ 14,050.0

Downside Potential: 5,600 points

Upside Risk: 1,150 points

Risk/Reward Ratio: 4.87

Should the ascending support level pressure the Force Index higher, the DAX 30 could attempt a breakout. The next resistance zone awaits between 14,142.7 and 14,213.4. Forex traders should consider this a selling opportunity amid the worsening global outlook, a mutating COVID-19 virus, and an uncertain relationship with China. Germany will decide if Europe aligns with the US or charts a friendly course with China.

DAX 30 Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 14,125.0

Take Profit @ 14,210.0

Stop Loss @ 14,050.0

Upside Potential: 850 points

Downside Risk: 750 points

Risk/Reward Ratio: 1.13