Bull case

Buy the BTC/USD and have a take-profit at the upper side of the triangle at 39,000.

Have a stop loss at $35,000.

Bear case

Sell the BTC/USD at 36,600 and have a take-profit at 35,000.

Have a stop loss at 38,000.

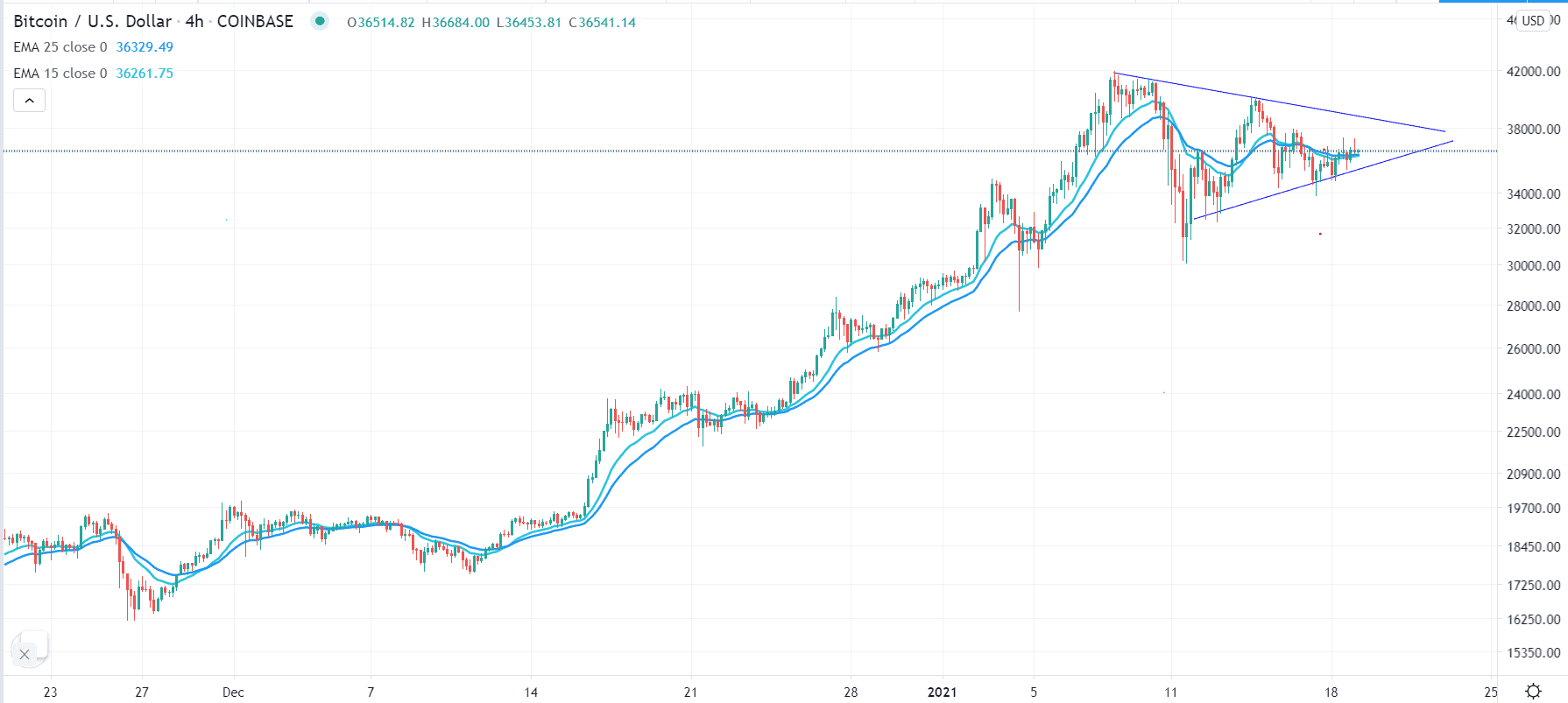

The Bitcoin price is in consolidation as traders focus on the next move after the currency reached an all-time high last week. The BTC/USD is trading at 36,545, which is 12% below the all-time high of $41,295 and 21% above last week’s low of $30,000.

Bitcoin in Consolidation

Bitcoin price has had a strong rally, making it one of the best-performing major asset this year. It has risen by more than 320% in the past 12 months and by 35% this year alone. This has brought its total market cap to more than $681 billion. In contrast, gold has dropped by more than 1% this year.

The BTC/USD has risen mostly because of the large institutional demand for the digital currency. In the past few months, several prominent companies have invested in it. For example, MicroStrategy has invested millions of dollars in the currency. At the same time, Morgan Stanley has increased its stake in the company to about 10%, making it an indirect bet on the currency.

Retail investors have also increased their bets on the currency as evidenced by the rising transactions in Cash App, the company owned by Square. Therefore, as Joe Biden becomes president, this demand could continue rising. For one, he has pledged to provide more than $1.9 trillion in stimulus. Individuals will receive about $1,400, meaning that many families will get more than $3,000. Some of these funds will go back to Bitcoin.

Similarly, more companies will likely move their treasuries to Bitcoin after the success of MicroStrategy and Square. In fact, recent data shows that inflows to the Grayscale Bitcoin Trust have continued to rise, which is a sign of more demand.

BTC/USD Technical Outlook

The four-hour chart shows that the BTC/USD is struggling for direction. It is on the same level as the 25-period and 15-period exponential moving averages. Also, the pair has formed a symmetrical triangle pattern, which is a sign of indecision in the market.

Therefore, with the confluence zone approaching, the pair will probably experience a breakout. In my view, the overall trend remains bullish, meaning that the pair will possibly bounce back higher. If this happens, bulls will attempt to test the all-time high at $41,295.

The alternate scenario is where the pair reverses and moves below the lower line of the triangle. This is possible because of the small rising wedge pattern.