Bull case

Buy Bitcoin because of the strength of bulls.

Have a take-profit at the next psychological milestone of $40,000.

Add a stop loss at $32,450 (Wednesday low).

Bear case

Place a sell stop at $32,450.

Add a take profit at this week’s low at $30,150.

Set a stop loss at $34,000.

Bitcoin's price bounced back in the overnight session as bulls remained resilient amid significant pressure. The BTC/USD rose to $37,800, which is a 25% increase from this week’s low of $30,150.

Bulls Attempt to Reclaim $40,000

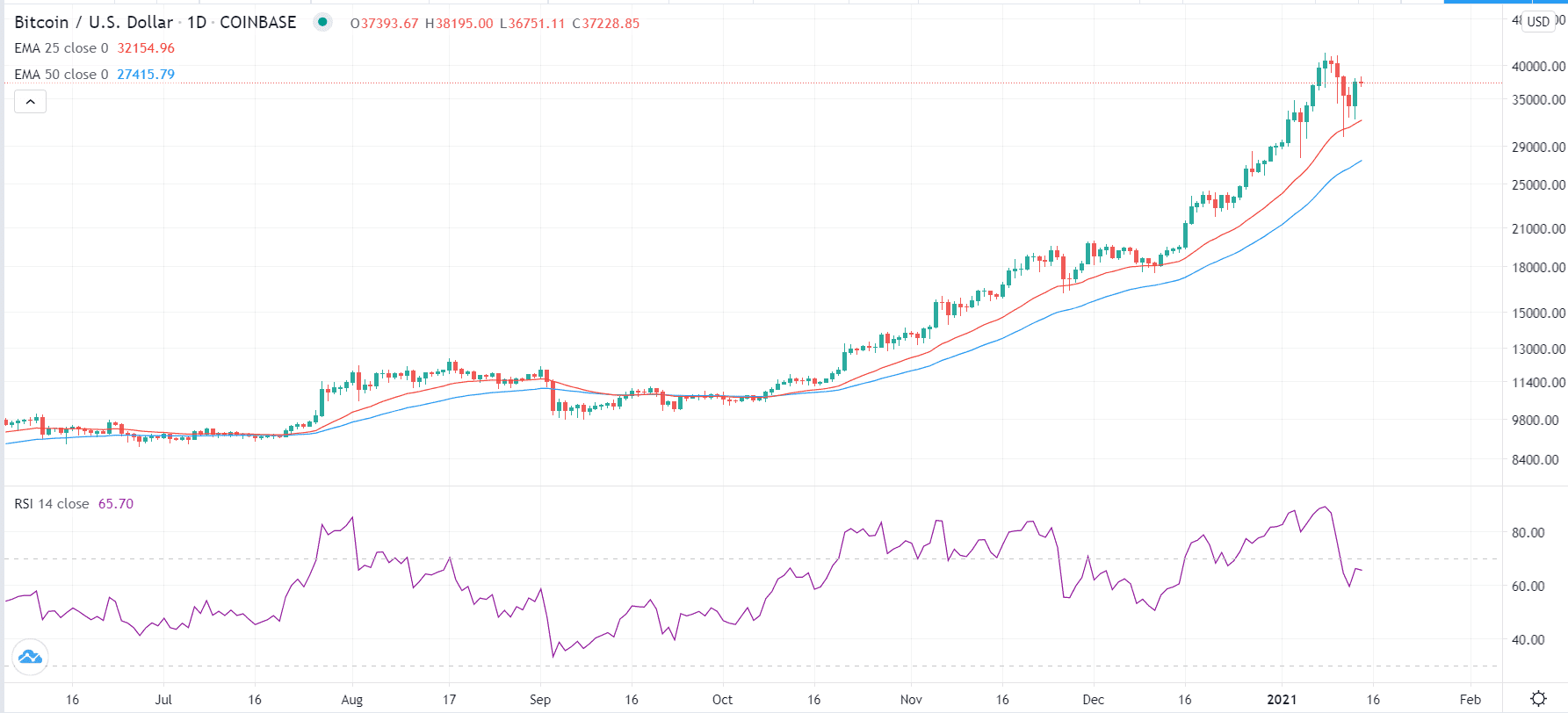

Bitcoin has had a rollercoaster this week. On Monday, the currency declined by more than 26% as some traders rushed to take profit after the currency soared to an all-time high of $42,000. There were also concerns about whether the parabolic rally would be sustainable in the long term. In fact, the currency was at an extreme overbought position based on the Relative Strength Index, MACD, and other oscillators.

In the past few days, however, the price has attempted to rebound. On Tuesday, its attempts to rally found some resistance, which pushed the price back to $32,000. Overnight, bulls got more resilient, pushing the price to $37,800.

This resilience is mostly because of the strong demand among institutional investors. Companies like Mass Mutual, PayPal, MicroStrategy and Square have continued to hold crypto worth billions of dollars. In fact, last week, Morgan Stanley increased its stake in MicroStrategy to 10% in an indirect bet on the digital currency.

Further, inflows into the Grayscale Bitcoin Trust fund have also been strong. The fund’s assets under management have jumped to more than $20.9 billion. Most of these funds are from institutional investors who believe in the currency.

In addition, signs of higher inflation have also supported the comeback. Yesterday, data by the American government showed that consumer prices rose by 1.4% in December. This is slightly below the Fed’s target of 2.0%, but is substantially higher than June’s low of 0.1%. Many traders believe that Bitcoin is a good hedge against inflation.

The BTC/USD will today react to the stimulus speech by Joe Biden. A larger-than-expected price tag could possibly push inflation higher, which will be positive for the BTC.

Bitcoin Price Technical Outlook

Bitcoin price dropped to $30,150 this week, but has made a strong comeback in the past few days. On the daily chart, the price remains above the 25-day and 50-day exponential moving average. It is also just 12% below its highest level on record. The current rally will likely welcome more bulls, which will push the price above $40,000. If this happens, more bulls will come in and push the price above the all-time high of $42,000.