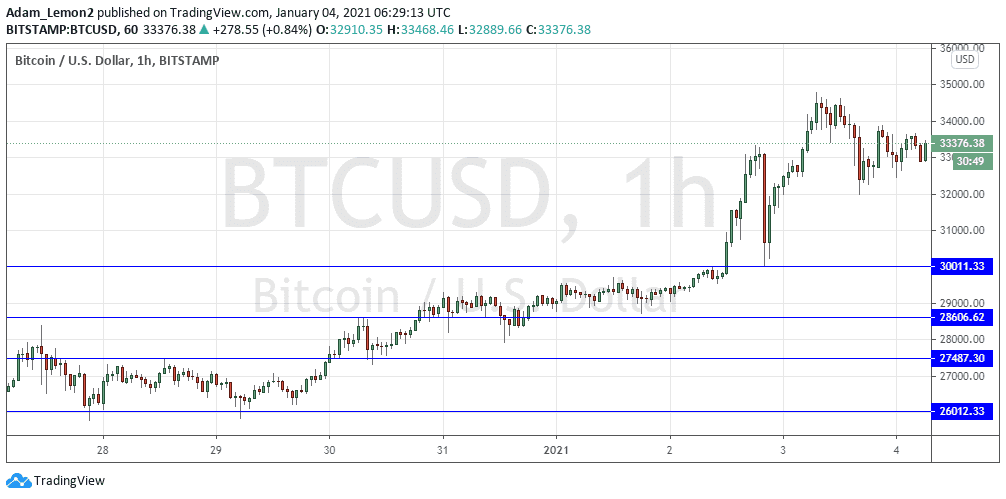

Last Thursday’s signals produced a losing long trade from the first rejection of the support level identified at $28,607.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades may only be entered before 5pm Tokyo time Tuesday.

Long Trade Idea

Long entry after a bullish price action reversal on the H1 time frame following the next touch of $30,011.

Put the stop loss $100 below the local swing low.

Adjust the stop loss to break even once the trade is $100 in profit by price.

Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

Short Trade Idea

Short entry after a bearish price action reversal on the H1 time frame following the next touch of $35,000.

Put the stop loss $100 above the local swing high.

Adjust the stop loss to break even once the trade is $100 in profit by price.

Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote last Thursday that there had been no change at all to the very bullish technical picture with the strong bullish rally into new all-time high prices showing every sign of continuing although there might be year-end profit taking.

This was a good call as the price has risen by almost 20% since then, making a short-term peak yesterday just below $35,000, which may prove to be resistant as a major psychological level and round number.

The bullish advance into new all-time high prices is continuing every day on increasing volatility. The price of Bitcoin has risen by almost 20% over just the past two days, which is an unsustainable rate of increase – nevertheless, it is significant that a new all-time high is being made every day and guessing at a top is only guessing.

We have a strong bullish trend here which is rapidly becoming a speculative bubble, as can be seen by the increasing volatility with a day’s typical price range showing a fluctuation of more than 10%.

The advance is likely to increase over the short term, so there are still long trades to be entered. However, it is increasingly probable that we will see a blow-off top – an exhaustion of the bulls – which will result in a dramatic climax to a new high followed by a fall of something like 15% or 20% of the value of Bitcoin, which could happen very quickly. For this reason, long traders need to be cautious and use tight stops.

I will be happy to enter a new long trade even if do see a sudden sharp decline, as long as the $30K area holds as support and produces a bullish bounce. There is nothing of high importance scheduled today concerning the USD.

There is nothing of high importance scheduled today concerning the USD.